Etsy: The power of special

Share price: 210USD ($ETSY)

Market Capitalization: $26B

“The beauty is creating structure in a world that is highly unstructured”

Josh Silverman, Etsy CEO 2020

1. Elevator pitch

Etsy believes that creativity cannot be automated and has built a two-sided online marketplace with a vibrant community of artisans and buyers seeking special items. The self-proclaimed antidote to commoditized commerce is set to benefit from the second wave of e-commerce which will be built around curation and discovery.

2. E-commerce and marketplaces 101

"The great businesses are habits in the mind of the consumers "

Josh Silverman

Covid-19 has had a profound impact on the e-commerce industry by shifting global consumer shopping behavior towards online purchases in many retail categories. Millions of buyers were forced to shop online for the first time in their lifes and given that most of our purchases are habit-driven, the pandemic was an unusual event where some habits were reformed and the e-commerce transition was pulled forward by several years.

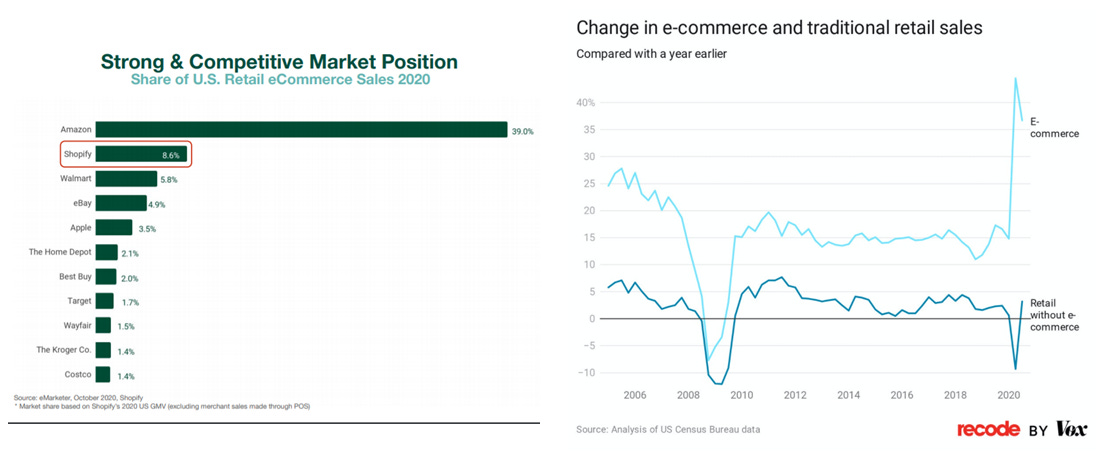

In 2020 and based on the US department of commerce data, the e-commerce industry reached $791B (+32%) while e-commerce sales accounted for 14% of total sales (vs 11% in 2019); despite retail closures, it is still day one for the e-commerce industry. While consumers got used to the "out of stock" message when looking for home gym equipment, nimble marketplaces such as Etsy, which do not suffer from logistical chain issues benefited from this event.

The pandemic also benefited e-commerce platforms that are trying to democratize the industry by offering best in class tools and services to online retailers and entrepreneurs. Companies like Shopify($SHOP) or Wix($WIX) more than tripled from the March lows, given that a new influx of merchants started using these types of solutions(Shopify +64% merchants yoy).

The rise of these platforms is based on the assumption of decentralized e-commerce where in the future people will buy from a plethora of brands that will be powered by these type of solutions.

"So when I look forward 10 years from now, I think it's really unlikely that there's going to be 2 million places to buy things online. I think there's going to be very, very few places to buy things online. If you're going to buy something that comes with a barcode, you're going to buy it from most likely Amazon, and maybe there will be 1 or 2 other people who survive and are able to compete somehow in that category. And then, there's going to be room for a few other people that do something really different. And I think Etsy is very well positioned to be one of those other places, and I think that's a huge opportunity"

Josh Silverman

I think Silverman is spot on "consumer´s mindshare" is not limited, and it takes cognitive effort to remember any given brand so we only remember a few brands in each category (where we tend to shop frequently), so to reach the consumer emerging brands will be promoted in platforms such as Pinterest or Instagram and marketplaces like Amazon or Etsy that will help with curation, trust, and convenience.

Amazon has proven that becoming a defacto destination can be hugely powerful. Unlike the early days of e-commerce where we used to shop around Amazon has now become the default destination for most of our purchases, which are habit-driven. Sometimes we don´t know if Amazon is the cheapest option because we do not even bother comparing prices. This behavioral change has propelled the hugely profitable Amazon´s ad business which is on a $20B+ run-rate.

However, other marketplaces like the OTAs (Booking or Expedia) have not been able to replicate this "blind trust" that consumers have placed into Amazon. Given that travel is an expensive and relatively infrequent purchase, consumers tend to shop around ( Expedia studies) and Google is extracting rents from the OTAs who are forced to pay billions in performance marketing every year.

"How are you different and why are you better , and are you good enough and is that relevant often enough that you can earn one of the precious spaces in someones brain that they are gonna remember you ?"

Josh Silverman

In order to become an organic destination, a marketplace needs to provide a substantially better experience, because if you do not manage to become a "defacto destination" in any given category it is difficult to build a profitable and defensive business at scale. Otherwise, if most of your traffic comes from Google or Facebook you don´t own the customer nor the majority of the economics. As Etsy management tends to say you have to earn your "right to exist" in the consumer´s mind.

For this reason, the most successful marketplaces group various categories, since it is easier to earn "consumer mind-share" if the frequency of your purchases is higher. ( For example, if you buy a new pair of shoes every 2 years and you shop for shirts every few months, a clothing marketplace like Zalando would have a better chance of achieving organic traffic than a marketplace built around shoes).

Very few brands will succeed by going D2C, SEO and performance marketing expenses are the new rent for these companies who will fight for a precious spot on the consumer´s mind. The reason behind the success of shopping centers (or supermarkets given that Heinz is a Shopify client) was that brands sought access to demand, and nowadays aggregators and marketplaces are the entities who hold the relationship with the consumer. As James Currier explains "In the late 1600s, for instance, all the violin makers moved to work and sell their violins on the same street in Venice. Although the proximity of the competing violin vendors drove down prices, it was worth it for the suppliers as a group because it was more important for them that people in the market for violins would take their business to that particular street, not some other street in some other city".

Marketplaces 101

A marketplace is a platform that connects buyers and sellers and facilitates transactions of products and services. (Examples include Amazon, Uber, or Airbnb). This type of business model benefits from strong network effects given that the addition of a new seller increases the value of the whole ecosystem. As the number of sellers increases, the products or services offered are more diverse and of higher quality, which increments the number of buyers improving the "flywheel" and generating outsized returns.

Different types of marketplaces can be ranked depending on their scalability and defensibility. Global marketplaces(e.g Amazon or Etsy) with differentiated supply (where each unit of supply is unique e.g Airbnb) are among the greatest business models, unlike marketplaces with commoditized supply (e.g Uber) and local network effects(e.g Takeaway) that tend to be lower quality businesses.

Etsy has built a marketplace with differentiated supply, (unlike Uber where the customer seeks transport, and once the wait times are low enough the addition of supply does not meaningfully improve the customer experience) where every listed item is unique and where value proposition improves as the marketplace scales. Moreover, Etsy benefits from global network effects, (unlike Takeaway where the restaurant supply can only be accessed by nearby customers) as products can be theoretically purchased from any given customer, independently of their origin. Amazon, eBay, and Farfetch among others exhibit similar characteristics(e.g Spanish customers can purchase clothing from an Indian seller). Shipping costs create friction in the marketplace by hindering transactions in some categories (heavy items like furniture) and have given birth to the creation of local marketplaces(Wayfair).

Source: Dan Hocken

The nature of transactions will dictate the type of improvements that the supply of the marketplace will experiment as the business scales. Commodities like batteries or home appliances will experiment deflation as more efficient supply enters the marketplace. Conversely, marketplaces like Etsy where every single product is unique will obtain more creative supply as they scale.

Moreover, the are some relevant factors to consider when assessing marketplace quality like fragmentation(every side has to fragmented) or the grade of involvement in the marketplace( if the marketplace is involved in more aspects of the transaction it will be able to monetize a higher percentage of the total purchase given that it provides more services to the sellers e.g Amazon is heavily involved in the transactions by providing FBA services to the sellers and is, therefore, able to monetize a higher percentage of every purchase, while Etsy doest not offer shipping services). Comparing the take rate among different marketplaces without taking into account its degree of involvement in the marketplace is a futile exercise, given that some companies may provide advertising or shipping services to their selles which gives them the right to recognize a higher percentage of every transaction as revenue since they act as "big suppliers" instead of mere intermediaries.

Frequency is another important factor to take into account, because as I previously said the goal of any given marketplace should be to become a habit instead of relying on advertising to get customers. If the transactions are not frequent enough the marketplace may depend on marketing in order to obtain traffic, which will hinder the economics; not only the business will need to expend higher sums of money to grow but "onsite ads" on the marketplace (which are a hugely profitable revenue line) may not get traction ( if most of the traffic is not organic and the customer does not perform any type of search ). Aside from marketing, marketplaces do not require incremental capital to grow which makes them hugely profitable businesses at scale if they manage to obtain sufficient organic traffic (which may improve with scale due to word of mouth). Once a marketplace has achieved dominance, it becomes a very defensive business given that an upstart would hold a much inferior value proposition that will not attract buyers or sellers.

Becoming a "Cognitive Reference" should be the priority of every marketplace. As most of our transactions are habit-driven the marketplace associated with any given category will benefit from word of mouth and higher organic traffic. Amazon is the perfect example of these type of dynamics

I think marketplaces are a great tool for both buyers and sellers because they help with both curation and discovery, reduce friction, allow comparisons that promote competitiveness, and expand the TAM(Total addressable market) by reducing the barriers of entrepreneurship( 1,8M Shopify merchants vs 4,4M Etsy sellers), given that the sellers do not need to become marketing experts and they can instead focus on providing a good product for their customers.

Some marketplaces feature unknown brands or individual sellers that have not earned consumer´s trust. The marketplace facilitates the transaction by protecting consumers against fraud, providing a payments platform, allowing refunds, and filtering supply based on reviews. By aggregating a great number of sellers into the platform the marketplace facilitates curation and discovery and on top of that, marketplace policies ensure that every listed item stays true to the essence of the business (you will not find mass-produced items on Etsy). Akin to what Substack has done to blogs, marketplaces homogenize buying experience, therefore, improving conversion.

Marketplaces that feature supply from many different categories can establish a relationship with the consumer who might not want to contact every single provider because some of its purchases will be very infrequent. In a conclusion, I think marketplaces are a great business model that will be relevant over the next decade and will prevail over D2C for the majority of our purchases.

3. ETSY

Etsy is a global marketplace for handmade or vintage items and craft supplies that connects 82M buyers and 4,4M sellers. With a mission of keeping commerce human, Etsy believes that "in a world of increasing automation and commoditization, creativity can not be automated" and features a collection of more than 85M listings over 50 retail categories(including jewelry, clothing, home&living or wedding items).

More than 80% of both sellers and buyers are women and the GMS( dollar value of items sold in the marketplace) increased 100% organically in 2020, reaching $9,5B and becoming the 4th most visited e-commerce website in the USA. Etsy is a top-tier marketplace with great barriers of entry( Amazon handmade miserably failed) whose value proposition increases at scale ( more sellers attract more buyers and vice-versa).

Etsy was founded in 2005 by a group of friends, one of them was Robert Kalin who at the time was an amateur furniture maker who was looking for a better way to sell his goods online. In 2011 Chad Dickerson was appointed as the CEO of the company, and in 2015 Etsy filed for an IPO at 16$ per share while reaching $2.4B in GMS.

In May 2017 Etsy was underperforming and with takeover rumors surrounding it, the company's board replaced Dickerson with Josh Silverman who is the current CEO and Rachel Glaser was appointed as the CFO. The new management led a fast turnaround that resulted in the acceleration of the GMS, workforce reductions, and increased levels of profitability.

Right to exist

"If I'm there every day buying all of the commodities of life, it can't be special. We live in an era of incredible convenience, matched with an equally incredible price and selection. Any commodity item can be purchased with one click, packed by a robot, and land at your door virtually the next day. But when the world develops a default, it also craves the antidote. We believe Etsy is the antidote to commoditized commerce when you want something to feel special, when you want it to feel meaningful, when you want it to be fun, when you want it to express yourself -- your sense of identity, show that you care for someone else or when you want it to feel human or personal"

Josh Silverman

As I previously explained to build a profitable and defensive marketplace you need to become an organic destination that stands for something in the consumer´s mind. E-commerce is a fierce industry and building another marketplace based on price and selection for your everyday purchases is a losing strategy, Amazon is the undisputed leader in those areas and to compete in e-commerce, you must avoid playing by Amazon´s rules. eBay is the poster child of a great marketplace with network effects that has barely grown over the last few years.

Etsy is not competing on price or convenience in fact, given that Etsy does not own logistic assets and relies on external partners( such as FedEx or UPS) some items take weeks to arrive, and since 97% of Etsy sellers run their business from their home Etsy´s items are not the cheapest.

In a world where customers complete 28% of purchases on Amazon in 3 minutes or less Etsy is positioned as an antidote to commoditization. Etsy wants to own "special" and by requiring items to be either handmade(production partners are allowed) or vintage Etsy ensures that every single item on its marketplace is unique, allowing millions of sellers to showcase what is so special about their items( production process, materials, etc.). Etsy defines special as 3 particular purchase occasions, celebrations, gifting, and style. "Those are the 3 times in your life when you really want the thing you're buying to express your unique identity or to express the fact that you cared enough to spend a little bit more time".

Amazon has built an incredible business based on price, selection, and convenience that does a great job by fulfilling most of the commodity items that we need to buy. Whenever we go to Amazon we expect to buy quality items at the lowest price possible. On the other hand, when the consumer wants to buy something special or get inspiration from thousands of unique items, Etsy is the place to go. By not displaying mass-produced items Etsy is able to provide its customers a bazaar-like experience.

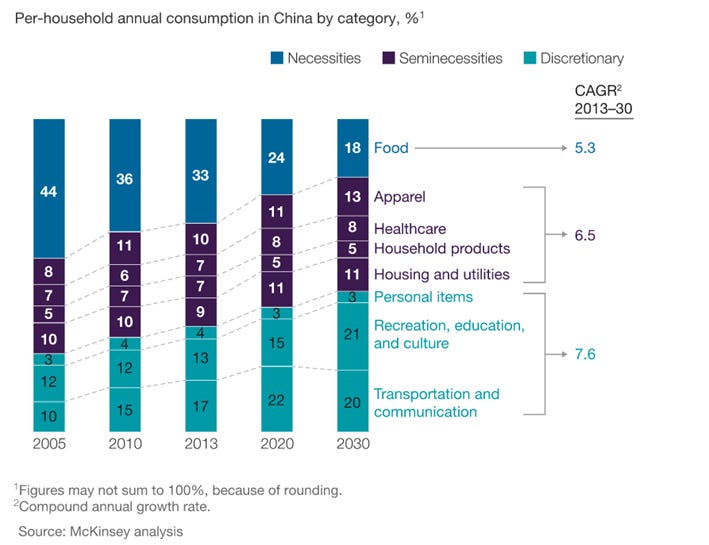

As income increases, we rise in Maslow´s hierarchy of needs and most of our expenses become discretionary; moreover, commoditization has become commonplace and it will unleash some portion of our budgets. While most e-tailers are selling items that you need Etsy displays a unique collection of items that you want and whose consumption is set to increase over time. The first wave of e-commerce allowed convenience and comparison but the second wave will be marked by curation, discovery, and self-expression.

Inspiration has not been replicated by any other e-tailer and Etsy is set to capture an important part of retail that has always been difficult to replicate by traditional e-commerce as more people will eventually demand unique goods from all over the world. Etsy is therefore seeking to be a marketplace for most of your special purchases and does not want to own your daily shopping( which includes things like diapers or batteries). Sellers can explain the uniqueness of their products by uploading videos to the platform during the production process and allowing customized orders.

As the majority of sellers are small artisans that work from their homes, a marketplace like Etsy is fundamental in order to ensure trust (unknown sellers) and improve the discovery of millions of sellers that otherwise would not be able to sell their products.

Acquisitions

Over the years, Etsy has made several small acquisitions to grow its core marketplace:

In June 2014, Etsy purchased A Little Market, a French e-commerce site for handmade goods, foods, and wine that was integrated into the Etsy core marketplace.

In September 2016, Etsy announced the acquisition of artificial intelligence startup Blackbird Technologies to augment the ability to surface the most relevant and personalized search results going forward.

In 2018, they announced an agreement with DaWanda, a privately held marketplace for gifts and handmade goods based in Germany, migrating the whole community to the Etsy platform to bolster its international expansion. Germany is now the second-largest international market for the company.

In July 2019, Etsy acquired the music-based marketplace Reverb for $275 million, becoming the largest acquisition of the company. In 2019 revenue exceeded $45M and in 2020 Reverb achieved over $800M in GMS which makes it a compelling bolt-on acquisition for the company. Reverb is a two-sided marketplace of new, used, and vintage musical gear from all over the world. The founder directly contacted Etsy who was not looking to make an acquisition and in 2020 Etsy appointed David Mandelbrot as Chief Executive Officer. The article will be focused on the core Etsy marketplace given that it represents the majority of the GMS of the group.

Marketplace policies

"Handmade is a differentiator. It's why you should prefer Etsy over something else. So we need to communicate to people when they're on that journey and they're about to go buy at one of the mass e-tailers, what should trigger them to say, aha, I need to go check Etsy for that. And I think the answer is special. Do I want this purchase to feel special? Nope, it's batteries. Nope, it's diapers. Nope, it's socks"

Josh Silverman

Marketplace policies are one of the most important aspects of the company and I think it is worthwhile to explain its intricate details. Given that Etsy´s value proposition depends on its uniqueness and products that can not be found anywhere else, marketplace policies are fundamental to maintain its reputation in the long run.

Etsy is a marketplace for handmade, vintage, and craft supplies. The handmade definition is quite complex and has evolved over the years. In 2013 Etsy announced that they would now permit factory-made goods and drop shipping, provided the seller either designed or hired designers of the items, disclosed "taking ownership of the process". Etsy sellers were now able to hire as many employees as needed. By allowing sellers to use production assistance to make their goods Etsy allowed shops to grow and succeed in the marketplace. Manufacturers must be reviewed and approved by Etsy to ensure they adhere to certain criteria, although Etsy will not conduct visits or in-person inspections.

Etsy sellers must have a meaningful role in the creation or design of the items they are selling, know who is making their goods and how is the production process carried out. This information will be required by the marketplace when any given seller discloses they are working with a "production partner". Reselling is strictly forbidden under the handmade category and the articles announced at Etsy would not exist if it wasn’t for their creators. "Production partners" are external entities that do not belong to the seller´s shops and help them produce their articles. For example, if you create greeting card designs, you can get them printed or produced at a company that you hire or pay to have those things produced.

As the management has stated "Items need to be either sold by the person who made it or the person who is selling it and designed it has a direct and personal relationship with the manufacturer. So if you design the wooden furniture and then you work with a group of craftsmen two towns over who can make it and you can inspect it, that's fine. Or you might work with a group that is not in the same country as you, but you have a personal relationship, you can make and inspect it, that works. What doesn't work is this is mass-produced in a factory".

This is tremendously important; any given marketplace works because the consumer trusts that they are buying goods that adhere to marketplace policies ( in Etsy´s case special goods), that is why Etsy has an integrity team that removes items that do not fit with their brand.

There is a catch though, as Etsy sellers flourish and externalize their production, they risk eventually losing their uniqueness as bigger manufacturing capabilities. Etsy has strict policies but at the same time, they have a tremendous number of individual sellers ( more than 4 million due to the nature of the marketplace ) which makes the reviewing process very complicated. This leads to reselling and nonspecial items sold by Chinese sellers featured on the platform which puts authentic sellers that craft their own items in great danger (picture below) because their items are not competitive. Although Etsy tries to correct these issues, the guidelines are fuzzy and policies leave a lot of room for interpretation.

These issues harm Etsy´s reputation in the long term and even though they are commonplace amongst marketplaces (eBay, Amazon, etc) Etsy has to be the most restrictive over a fragmented supply which can be a difficult task. These are not issues faced by big e-tailers where sellers are more professional (Etsy GMS per active seller around 2.400USD) and guidelines are more defined and easier to implement. (Example Etsy vs another Etsy seller vs Alibaba).

Some sellers raise the sheep, shear and darn the wool and knit it into a sweater

Strategy and shopping experience

In order to "own special" Etsy is focused on three kinds of purchase occasions: celebrations, gifting, and style in more than 80 countries all over the world. Etsy is a dynamic and nimble marketplace that adapts to the cultural zeitgeist($1,9M Bernie Sanders related merchandise sold in the days following the inauguration) and unlike other e-tailers can quickly adapt to a changing landscape (due to the absence of a centralized supply chain). April 2020, Etsy issued a call to all sellers on the site to start making facemasks to combat COVID-19, and in 2020 Etsy sold $747M worth of face masks.

In 2017 the new management team defined 4 core areas of focus to further grow the company "Etsy needs to achieve really world-class at search and discovery, be great at trust and reliability, have world-class seller tools and great marketing capabilities"

Curation: at the end of 2020 Etsy announced that there were more than 85M listings on the platform. Every single item on Etsy is meant to be unique which makes best-in-class search and discovery one of the most fundamental aspects of the business(for example if you search for coasters you will get more than 250k results at Etsy vs 70k at Amazon). Almost 60% of search results at Etsy yield more than 800 results and unlike Amazon where cheaper items at any given quality will be featured to improve customer´s experience and save them money ( Amazon mantra) Etsy´s customer is not looking for cheap items but relevant and unique goods that appeal to them. The migration to Gooogle Cloud that was completed at the end of 2019 has been fundamental in the improvement of this area

Ecommerce is often depicted as a business with infinite self space but the case is that the majority of consumers do not go past the first page of results(86% in Etsy´s case, this metric along with the reformulation of queries remark the progress that Etsy has made in this area); that is why Etsy is focused on building a great search engine that curates results based on your preferences (Etsy surveys note that 78% of buyers say they come to Etsy for items they can´t find anywhere else). Half of the visitors come without a specific item in mind( this is a huge number that remarks that Etsy competes more against Pinterest instead of eBay or Amazon, who are often depicted as competitors).

“Amazon really solved buying, but it killed shopping in the process.”

Glossier CEO, Emily Weiss

Ecommerce has been focused on convenience and it has neglected the shopping experience to the point where platforms like Pinterest emerged in order to solve "the inspiration problem". Etsy now has a customized shopping experience depending on the occasion( Mother´s Day or Christmas) and in Q3 2020 launched personalized search, where the same keyword will yield a different set of results for every customer and items displayed are ranked based on their potential to convert into a purchase ( depends on consumer´s taste and preferences, location, etc).

Etsy's curation capabilities will evolve towards Netflix and Spotify instead of Amazon or eBay). There is still a long way to go and given that more than half of the purchases in any given country are domestic, local events and geographical trends should be considered in order to further improve the customer´s experience.

Akin to Pinterest, Etsy introduced favorites and lists, which have been fundamental to curate the shopping experience, customers can favorite items, create lists and follow shops.

Marketplace trust: given that Etsy is built around unbranded goods from unknown sellers, trust is fundamental in order to increase consumer´s purchases. This is why a marketplace reduces friction over an individual web store, Etsy brand, reviews, and refunds policy help consumers overcome the trust hurdle required to buy unbranded or unknown goods on the internet.

Connection between sellers and buyers: over 8% of transactions start with a conversation between sellers and buyers and those inquiries are worth 200% of the typical AOV(average order value). Etsy allows artisans from all over the world to tell a story about their products and in Q2 2020 launched the ability to upload videos(where sellers can feature their items or production process). The number of videos uploaded to the platform has grown from 700k in Q2 to 3M at the end of 2020.

Unlike Amazon or Alibaba who own logistic assets (warehouses, fulfillment centers, and last-mile delivery) Etsy is a 3P (third-party) marketplace that relies on logistic companies (like FedEx or UPS) to deliver their goods. Shipping has always been a pain point in the purchase process (shipping price and timing are key factors for many shoppers and create a lot of friction in the marketplace, given that some items take weeks to arrive or are too expensive to ship).

Many e-commerce sites present shipping as another cost of goods sold but Etsy used to broke out shipping costs separately which led to carts getting abandoned at the end of the purchase process when the customer discovered shipping costs. It was common to find $5 items with $7 shipping costs which damaged the marketplace and resulted in a terrible buying experience(the shipping price was not featured up front and it was revealed at the last stage of the purchasing process)

As of December 31, 2020, more than 70% of item views on Etsy and more than 80% of GMS now have no additional shipping cost Given that shipping is not free this is a mere gimmick that has radically improved customer´s buying experience (customers prefer a $12 item than a $5 item with $7 shipping costs). Etsy has now given tools to the sellers in order to include shipping costs as part of the price of the items sold (these tools allow sellers to price domestic customers differently than international customers depending on shipping prices) and the marketplace now displays expected delivery dates for most of the items listed.

Despite the great improvements, Etsy is not a managed marketplace and does not own logistic assets. Etsy may get away without integrating into logistics because the nature of the goods sold on the marketplace( not commodities) allows for higher delivery times( customers know they are buying something special that may be customized or made to order). However, shipping costs create friction on international transactions( a USA customer may not buy from an Indian seller), and return policies can discourage customers to buy items in some categories.

TAM

Before 2020 Etsy was depicted as a niche marketplace for handmade goods, but the business was organically growing GMS at a 20% rate and COVID has only boosted structural latent tailwinds.

Management used to define the total addressable market as the online sales on their top 6 categories at just their core geographies(U.S., the U.K., Canada, Germany, France, and Australia) and that market size was $155 billion. Then in the 2019 investor´s day, the management team included all their relevant categories( including beauty, personal care, or collectibles) which led them to a $249B online market that got trimmed down to $100B based on a 3,500 people market research (40% of the people interviewed were expressive or seekers who love shopping or want to express themselves through the items they bought).In 2023 that smaller number would grow to $170B.

I think that this research may be useful for assessing the size of the markets where Etsy is selling its goods but it is not super relevant; e-commerce is stealing share from offline retailing, Etsy operates in more than 6 countries (83) and 3,500 people survey is unlike to measure “special”.

As I previously wrote when our income increases, we rise in Maslow´s hierarchy of needs and most of our expenses become discretionary. TAM is therefore too dynamic for me to even try to accurately measure which will result in false precision.

Etsy´s biggest constraints are consumer preferences and execution as most of the items under this gigantic $1,7T or $250B (online) market could be eventually sold by the marketplace. Discretionary spending will rise and Etsy operates in multibillion categories like jewelry, apparel, or home furnishings. To the extent that customers decide to expend a few extra bucks on Etsy instead of going to IKEA, TAM will increase and given that selection, personalization and discovery are better at the former I do no think that TAM will be a constraint any moment over the next decade (execution could be).

For example, Michaels is the largest arts and crafts retail chain in North America and provides arts, crafts, framing, floral, home décor, and seasonal merchandise to hobbyists and do-it-yourself home decorators. Michales was recently taken private by Apollo and used to size their TAM at $100B. The Hobby Lobby is another American retailer depicted as an arts-and-crafts store that sells hobbies, picture framing, jewelry making, fabrics, floral and wedding supplies, cards and party ware, baskets, wearable art, home decor, and holiday merchandise. Both Michaels and Hobby Lobby sold more than $10B worth of goods and even they sell some categories that will not be available at Etsy, the sheer scale of these companies exemplifies that Etsy is not constrained by its TAM.

Quantitative metrics

Over the last couple of years, Etsy has grown its GMS at a healthy clip, and in 2017 when the business was decelerating a new management team led by Josh Silverman propelled the business performance. 2020 has been an extraordinary year for the company that will probably not be repeated, Etsy grew 100% organically while ending the year with 4,4M sellers and 82M buyers. Given that Reverb is a small part of the business, I will focus my efforts on Etsy's core marketplace and will make references to organic growth ( which excludes Reverb).

Cash generation is great and beautifully tracks EBITDA, (Etsy has a negative WC that generates cash as the business grows), the new management is disciplined and they have bought back some stock since 2017 to offset dilution (from stock options and debt convertibles), the company is debt-free, profitable and the majority of its balance sheet is cash.

Approximately 61% of the GMS came from purchases made on a mobile device and in 2020 the top six retail categories on the Etsy marketplace were homewares and home furnishings, jewelry and personal accessories, craft supplies, apparel, beauty, and personal care, paper, and party supplies.

43% of Etsy sellers were located outside the United States, and due to its rapid growth, UK revenue was disclosed for the first time ever at $196M. 36% of the GMS was generated between an Etsy seller, Etsy buyer, or both, located outside of the United States. ( Etsy´s definition of international GMS). Local commerce is very important and in both U.K. and Germany more than 50% of sales were domestic.

Etsy is focused on improving repeat purchases which represent the percentage of active buyers who have shopped on Etsy two or more days over the last 12 months( this number jumped to 48% of total buyers in 2020). Habitual shoppers are very important for the company and these are buyers who have spent $200 or more and made purchases on six or more days in the previous 12 months and are the most profitable customers because they obviously expend more on the platform and buying on Etsy is a habit on their mind( most of the habitual shoppers browse the site every single month). Habituals represent 8% of active buyers and its growth has accelerated over the last quarter.

80% of Etsy GMS is organic (defined as GMS not attributed to performance marketing ) and unlike eBay who spends around 25% of its revenues on a stagnated top line, Etsy has been able to grow at a 20% (excluding 2020) while improving its margins.

In 2015 Etsy was the 10th most visited retail site in the USA, and in 2020 was the 4th largest e-commerce site by monthly visits. Even though COVID growth will not likely be repeated in the future, the business has permanently benefited from the pandemic due to retail lockdowns and a nimble supply chain; and its growth excluding mask sales has accelerated every single quarter (masks sales represented 4% of Q4 GMS down from 14% in Q2 while organic growth excluding masks has spiked from 93% in Q1 to 118% in Q4) the business has beautifully outgrown e-commerce in the USA (even outgrowing Shopify 94% vs 118% ex maks for Etsy in Q4) while building tremendous awareness. (out of the 3 million mask-only buyers in Q3, approximately 50% returned in Q4 for a non-mask purchase).

During 2020 the company has heavily invested into upper-funnel marketing channels like TV to build brand awareness and product development to further bolster the marketplace growth, it is therefore not unreasonable to think that habitual buyers will increase, representing a higher percentage out of the total number of active buyers. In 2018 Etsy ran their first TV advertising campaign in the USA and top-funnel marketing expenses have increased to 156M in 2020 (31% of marketing expenses) from barely 46M in 2018; these investments in brand awareness are not directly translated to GMS and can hinder marketing efficiency metrics(I included a burd metric to assess how effective are marketing expenses at driving GM's growth) but will be key in order to increase the number of habitual buyers in the platform which will eventually be reflected in cohorts average GMS.

Like every other marketplace, Etsy taxes the transactions in its platform and has two sources of revenue :

Marketplace revenue (75%): marketplace revenues are comprised of listing an item for sale fees (0.2$ per item), transaction fees that were increased from 3,5% in 2018 (5% of GMS for each completed transaction), and fees for Etsy payments which is a in-house payment processing product( fees range from 3 to 4% and 92% of GMS is currently processed by Etsy payments). Etsy payments revenue is the lowest margin revenue.

On top of this during the second quarter of 2020 Etsy began charging for "offsite ads" a 12 to 15% fee on the seller´s volume of sales if that sale was generated from an advertisement placed and paid by Etsy on a third party site. Under this program, Etsy pays the upfront marketing expenses to promote seller´s listings on third-party sites like Pinterest or Instagram and the seller will only pay an additional advertising fee if they make a sale( sellers over 10.000$ in revenue can not opt-out from the program and are subject to a 12% fee). The recent spike in gross margins in 2020 is due to the shift to "offsite ads" where expenses are now recognized in marketing and were previously included as a cost of revenue.

º Service revenue (25%): service revenue mainly consists of "onsite advertising" that allows Etsy sellers to pay for prominent placement of their listings in search results ( similar to Amazon ads) and shipping label revenue which allow sellers in USA, Canada, UK, and Australia to purchase discounted shipping labels( revenue is recognized net of label costs).

Etsy's "onsite ads" is a very profitable source of revenue and its success will rely upon the organic traffic. If Etsy is able to become a de facto destination for special purchases, its ads business will thrive due to the increase of searches being made by new customers. (Amazon ad business is thriving because most people look for unbranded products and the purchasing process begins with a search on Amazon).

Etsy´s take rate (revenue divided by total GMS) has rapidly increased to 17% due to the Etsy payments rollout, the introduction of onsite ads, and an increase in the transaction fees. Excluding additional services (service revenue) take rates are very competitive at 13%.

Etsy operates a high margin marketplace that blasts near 70% gross margins (COGS mainly consists of payments costs which are lower margin than other revenue streams, refunds, cloud expenses) and has achieved +30% adjusted EBITDA margins while growing at a +20% clip ( unlike other companies adjusted EBITDA mainly includes DA and stock-based comp expenses). This is mainly a fixed costs business (excluding marketing) and its margin profile will depend on its capability to become a "top of mind destination" for consumers.

It is important to highlight that Etsy retains less than 50% of buyers in any given year but the active customers that remain expend more than 50% in the platform than the prior year, and this figure increased to 70-90% in the following periods. So despite losing quite a lot of customers over the first years the customers that remain are much more valuable to the company given that they are loyal (they stick throughout the years) and tend to expend more. In 2020 more than 84% of the GMS was due to existing buyers ( buyers who had shopped at Etsy at some point in their lifes).

Successful sellers vastly increase their GMS over time while a great number of artisans leave the platform in the first year. Based on Etsy 2021 seller survey only 30% of the sellers run their business as their sole occupation, 97% run their shops from their homes and 55% of the sellers are multichannel but Etsy is their primary source of sales( in 2019 the second-largest channel were craft fairs but in 2020 many sellers focused their efforts online).

Etsy has gained meaningful awareness and e-commerce share and has been one of the clear winners of the pandemic. During the pandemic, consumer behavior shifted towards online purchases in a period where habits were "up for grabs" Etsy was able to capture millions of new buyers that are shopping amongst a great number of categories(Etsy biggest problem was awareness, some buyers thought Etsy was a wedding, or gifts e-commerce site and only came to the marketplace once a year). In the long term, I think Etsy will not only retain the new Covid cohorts but will keep outgrowing e-commerce for the years to come.

Management

"Trying to maximize shareholder value is ridiculous, I couldn't run a company where you had to use that as an excuse for why it was doing things"

Rob Kalin, Etsy co-founder

A few years have gone by and Josh Silverman has proven to the world that you can build a profitable growing business for shareholders while benefitting other stakeholders.

After serving as the CTO of the company, Chad Dickerson was appointed CEO of Etsy in 2011 by Rob Kalin (Etsy co-founder and former CEO), but in 2017 after meaningful losses and several quarters of deceleration, board member Josh Silverman was appointed as CEO replacing Chad Dickerson.

As this NY Times article explains, shareholders were calling for the sale of the company and activists began buying shares. Under fears of an imminent takeover, the board fired Chad in May of 2017 in an abrupt transition. Before 2017 Etsy did not look like a listed company, "employees shared their emotions freely, often crying at the office". In just a few weeks, Silverman shut down several projects(including Etsy studio who had just been launched after 18 months) and laid off 22% of the company. Even though marketplaces are great and defensive business models, this management transition points out that execution is everything and Etsy wouldn´t probably be a public company if it wasn´t for Silverman.

Josh Silverman(52) began his career on the staff of U.S. Senator Bill Bradley, served as Senior Consultant at Booz Allen & Hamilton, and in 1998, he launched Evite, the first website of organization of social events allowing to manage and send invitations online; at the bust of the 2000 bubble the site was bought by IAC (Barry Diller). In 2003, Josh Silverman joined eBay and was in charge of eBay Netherlands where he launched the classified division. In 2008 he becomes CEO of Skype where he doubled revenues and tripled profits and in 2011 he becomes president of consumer products in American Express.

Silverman was named CEO of Etsy in 2017, a few months after becoming a board member. During his first weeks at Etsy, he decided to stop 60% of the company projects while laying off more than 1/5 of the employees, while introducing an obsession with GMS growth. Josh created 26 projects that were called “ambulances”( because when an ambulance gets in your way you move away) that had a meaningful chance of increasing GMS in the short term, these projects were a priority and were fully staffed within days. After changing the company´s mission ( simplifying it to "keep commerce human") Josh decided that Etsy had to own special and oriented the whole marketplace towards this goal.

Josh used to say that Etsy was a "boiling frog" that required drastic changes and oriented the company towards a few core aspects to grow the marketplace (search and discovery, seller tools, marketing, and platform trust). In Q3 2017 just months after joining the company he stabilized GMS which grew at (13.2% GMS growth, a 140 basis point acceleration compared to Q2) and in Q2 2018 GMS growth was around 20% while profitability and customer experience were improving. In just 2 years Etsy doubled GMS growth while improving profitability (23% EBITDA margins in 2019). Even it might be underappreciated this was a beautiful "turnaround" in just a few years.

"In network effects businesses you are either winning or you lost "

Josh Silverman

Silverman is super long-term oriented and every time he has been on one of those CNBC interviews where he was asked about the stock price movements, he dismissed the questions or said he didn’t care about short-term stock movements and instead focus on the business. He still thinks it’s early days on Etsy and he has a clear vision that is masterfully executing. Josh has a tremendous understanding of network effects and marketplaces(I have quoted him several times throughout the article for you to further understand its way of thinking about business)

The management team is quite disciplined and is focused on profitable growth, they always stress the importance of obtaining great returns on marketing spent (remarking that they could grow faster but they want to maintain minimum hurdle rates) and they showcase long term thinking ( for example despite impacting short-term revenues, they recently decided to reduce ad load on Etsy ads in order to show more relevant advertisements and improve customer experience). 48% of employees are women and the management team is very diverse.

Rachel Glaser(59) has served as CFO since 2017 joining the company at the same time as Silverman and has been instrumental in its success. Ryan Scott who was recently hired as CMO in 2019 will bolster the marketing efforts of a marketplace that has never had a CMO in its whole history.

Besides creating value for stakeholders, Silverman has made a fortune himself. In 2017 he received a front-loaded equity grant(options to buy 3,87M shares for 10,62$ each with a 2027 expiration date) to induce him to join Etsy and provide him with a meaningful equity stake in the company that would align his interests with stockholders. Josh still holds around 3,1M options that are currently worth 631M$ (during the recent surge in the stock price he has sold some while still holding a fortune on Etsy’s options). Management compensation bonus is determined on Revenue, GMS and Adjusted Ebitda margins and directors hold around 3,5% of the company shares.

4. Competition

Etsy displays a unique inventory and provides artisans a place where they can sell their goods. While marketplaces policies restrict Etsy´s inventory they are vital in order to feature "special items" and some sellers would not be able to make a living without these. By closely restricting the type of inventory available on the marketplace Etsy ensures that their seller´s remain competitive; while any given business can advertise on aggregators such as Pinterest or Instagram, Etsy allows sellers( for example who raise the sheep, shear the wool, darn the wool and knit it into a sweater) to be competitive and tell their story given that the competition is playing by the same rules. ( The seller featured below crafts map artworks by using local atlas).

We must separate the chaff from the wheat, whereas Etsy has a clear mission and a unique business model or "right to exist"( as Silverman claims) other marketplaces have dubious value propositions, for example, eBay (185M buyers and $100B in GMS) marketing expenses have been hovering around 25-30% of revenues while GMS has stagnated and averaged 2% growth for the last 13 quarters(excluding 2020 where eBay only grew its GMS 20%, losing e-commerce share). Wish, a marketplace built around price and focused on Chinese merchants is burning shareholder´s money on marketing expenses (67% of revenues in marketing expenses in 2020 in order to grow 34%).

Although offline retail is the biggest competitor that Etsy will face over the next decade, I will briefly talk about some industry participants :

Amazon

Amazon is the everything store and the convenience undisputed leader, but you can not "own" special purchases while simultaneously being the place where you buy a phone charger or a new fridge. I think Amazon is poised to win a big portion of our budget driven by quality and price and in its relentless quest towards low prices, Amazon will do well in commodities and items that you need ( a desk for remote work, groceries, or a new phone charger) while freeing up budget that will be spent in discretionary categories (where Etsy shines).

"Most shoppers, 57%, are looking for something specific when they shop on Amazon, and 63% know what they want beforehand, according to a report from SmarterHQ". Josh Silverman often describes Amazon as a vortex that is commoditizing everything but Amazon plays a fundamental role in e-commerce by allowing deflation ( comparisons and brutal competition that foster price competition, supply is professionalizing and in 2020 more than $1B was spent to buy Amazon sellers by companies consolidating the industry such as $MWK or Thrasio).

The company was built around convenience and cheap prices and that premise goes against Etsy´s mission. Amazon is creating a tremendous amount of deflation and is vastly positive for the consumer but it is not the place to go if you want to buy other types of goods or seek inspiration.

Nonetheless Amazon Handmade ( hand-crafted products) launched in 2015 as Etsy´s competitor. A quick search on both sites on the"necklaces" category barely yields any results on Handmade (on the thousands) while Etsy displays millions of items. Moreover, Amazon has a much narrower number of categories and options.

On Etsy you can follow shops, favorite items contact the sellers and the whole platform has been built around discovery and "special" purchases.

Even so, on National Handloom Day Amazon announced the launch of Amazon Karigar in India. "Amazon Karigar showcases over 55,000 products, including more than 270 arts and crafts from 20 states. Amazon Karigar will give prominence to India’s handicrafts heritage by enabling weavers and artisans to showcase ‘Made in India’ products to customers". One would have thought that given the fact that Amazon has a huge presence in India and their recent campaign video got a lot of traction Karigar would stand a chance to succeed in the country.

Karigar launched with close to 55k items and in January 2021 Amazon disclosed that the site had more than 90k listings while Etsy India showcases more than 3M listings and launched just one year earlier (2018).

Social e-commerce

Jose Neves (Farfetch founder) recently remarked that some marketplaces like Amazon are tailored for convenience while neglecting, discovery, inspiration, and curation. There are two types of shopping: one more suited for commodity-like goods where we prioritize price and convenience and other type, more oriented towards special purchases or categories like clothing, gifts, and presents where we seek inspiration. Etsy falls in the latter form of shopping and competes more with Instagram and Pinterest (besides offline retailing) rather than Amazon and eBay. As I previously wrote half of Etsy buyers come to the platform without a specific item in mind, that´s why platforms that drive top-of-the-funnel awareness ( who are also integrating down the funnel by allowing in-app purchases) are worth a closer look.

Source

Social e-commerce( defined by eMarketer as "products or services ordered by buying directly on a social platform or through clicking links on the social network") is in its early innings and new features like live-streaming shopping and shoppable ad formats, as well as in-app purchases, will increase conversion and drive sales. By allowing users to purchase items without leaving the app these aggregators reduce friction ( consumers can see a product, add it to a chart and instantly check out in a seamless experience). China is leading social commerce in the world, that drives around 13% of its total retail commerce sales (Wechat has a 90% share) and eMarketer estimates that will reach $363 billion in 2021(up 35.5% year over year and more than triple what they were in 2018) representing 13.1% of total e-commerce sales) while US social commerce is forecasted to grow 35% to $36B representing a 4,3% share of e-commerce (1/10 of the Chinese sales).

This second wave of e-commerce will fill the inspiration void, better recreating the "shopping" experience

Pinterest

While the first wave of e-commerce has ignored inspiration and curation, Pinterest built its business by capturing inspiration and is now integrating down the funnel displaying shoppable items. Given that Pinterest is the biggest social media channel for Etsy´s traffic and half of Etsy buyers go to the site in search of inspiration I think Pinterest deserves a closer look. Moreover, the majority of its users are women and therefore there is a great audicence overlap with Etsy.

"At Pinterest, we believe there’s a difference between shopping and buying: inspiration. A more inspired online shopping experience takes the best of shopping everywhere and makes it possible anywhere”.

Source

Pinterest reached 459 million monthly active users, about two-thirds of whom are female. What makes Pinterest such a special platform is that commercial content from brands and retailers is central to the business. Ads on Pinterest do not compete with native content, unlike other platforms where ads are distracting from the overall experience. Pinterest users come to the platform in search of inspiration for their lives (sports routines, cooking recipes, remodeling a house, clothing, and fashion, travel destinations, or weddings among others). Pinterest displays visual recommendations in the form of images and recently added videos ( these are called pins) and users can then save and organize these pins into groups called boards ( publicly shared with every user on Pinterest, allowing for human curation) pins can be created either by businesses or by individuals when any given user finds the content they like on the web ( images, articles or videos).

Pinterest has become a "curation leader" and as of December 31, 2020, Pinners saved nearly 300 billion Pins across more than six billion boards. Pinterest is an incredible marketing tool for brands because every pin links back to a useful source(product to buy, ingredients for a recipe, or instructions to complete a project, in the future, they could lead to an Airbnb reservation or in-app buying and I think the opportunities ahead are quite large.

" Users can create sections in a board to better organize Pins. For example, a Quick Weekday Meals board could have sections like breakfast, lunch, dinner, and desserts, they can invite others on Pinterest to a shared group board or follow another person on Pinterest, while choosing to follow a select board or their entire account". Given that Etsy powers its recommendations based on previous activity and favorites there is quite a bit of overlap among platforms.

As users come to the site looking for inspiration about what to wear or what to buy ("Pinterest says 97% of its users’ searches are unbranded meaning people are looking for ideas using general terms or browsing visually but don’t yet have a specific brand in mind" Pinterest owns the most precious part of the purchase funnel and its ads succeed because people do not know what they want, seek to be inspired and discover new brands). In 2019 Pinterest took a logical step by integrating down the funnel and they launched Pinteres Shop, a place for a curate buying experience. The company has made several improvements to their shopping capabilities like showing shoppable items ( some pins are mere images and Pinterest is now showing similar shoppable items, story pins, augmented reality tools like eyeshadow try on, and in 2020 they launched an integration with Shopify.

There is no in-app checkout yet but I’m sure that it won’t take much longer allowing Pinterest to capture the whole purchase funnel in a business model where ads not only do not disturb the experience but also fuel the platform´s content.

Facebook shops

Facebook is also pursuing social e-commerce, in early 2020 they launched the shop interface that businesses could use to build their brand and drive product discovery and announced in-app checkout for USA vendors. At the brand´s shop, people can now browse products, explore collections, and purchase without leaving the app in a seamless experience that will likely drive conversion. Your shipping and card information can be saved for convenience and customers will receive notifications about shipment and delivery inside enabling them to keep track of their purchase.

With shops, businesses are now able to customize the shopping experience, and curate products into themes. Mark and Tobi Luke did a webcast together featuring the new product (because FB partnered with Shopify for the launch). I think given that there are more than 10M business advertising on FB, shops is a gamechanger that would propel western social e-commerce expansion.

In November 2020 along with Reels, Facebook introduced Instagram shop, an aggregation-like tool that allows users to discover new brands and creators, browse and buy products and get personalized recommendations based on their tastes and preferences. Over the following months, Facebook has included live shopping(IGTV and reels) features, messaging, and guides. Instagram already had collections ( similar to Pins and boards ) and both are trying to capture and a meaningful share of social e-commerce and in 2021 Shopify Pay was added to Facebook. (Shopify claims its Shop Pay checkout is 70% faster than a typical checkout and it seems like FB is more concerned with expanding the TAM rather than extracting value from the ecosystem).

In 2021 Mark Zuckerberg joined a ClubHouse conversation with Daniel Ek and Tobi Luke where they talked about the creator economy and Mark revealed that FB had more than 1 million active shops and more than 250M people actively interacting with shops every month in less than a year and said that the next 5 years were going to be really explosive when it comes to social e-commerce.

I think curation and discovery capabilities are going to radically evolve over the next decade and the platform that holds the relationship with the consumers would be in a great spot to capture most of the economics from this new wave of e-commerce.

Aggregators represent a threat to Etsy but these platforms are suited towards brands with thousands of units in stock whereas Etsy sellers may have just a few units of every product ( which makes products special) Etsy's limited supply is what makes the site unique given the long tail of special items featured. Aggregators will feature branded items from established shops along with unknown brands while Etsy will fight to maintain its "special" brand by only featuring items in line with their policies. I still think there is a fair overlap among Pinterest and Etsy users, and even though Etsy may still be the default place to go if you have a specific purchase in mind, the mere fact that users seek inspiration on these platforms where they spent several hours per week can limit Etsy´s growth ( Amazon is more insulated from these dynamics given logistics infrastructure that would take years to replicate and given the fact that you do not go to Amazon seeking inspiration as I previously wrote most users already know what they want beforehand).

5. Risks and opportunities

Opportunities

Covid has proven to be beneficial for the company and management has used the opportunity for investing in top-of-the-funnel awareness. Etsy´s biggest opportunity in the near future lies in converting a bigger percentage of users into habituals and building marketplace awareness to increase cross-category purchases(given that a lot of its customers are not aware of the depth of Etsy´s inventory). Habitual users growth has been accelerating for the last couple of quarters and I think the company will hold the earned awareness in a post covid world as more users think about Etsy with the idea of special in mind ( instead of being a weddings or a gifts site in the mind of the users).

International growth is a huge opportunity, the company barely has any presence in International markets (besides Uk and Germany) and localization, curation, and depth of inventory have a long way to go in these markets. Out of the 93M items listed (April 2021), 63M belong to USA sellers and 75% of listed items are from either American or UK sellers. Local density is of crucial importance given that in the UK and Germany more than 70% of trade is local and UK GMS grew at 189% last year.

India is a huge market where Etsy is focused on increasing seller density and that was recently included in the select list of core geographies. In August 2018 Himanshu Wardhan(Etsy India) disclosed that Etsy had around 650k listings, this figure is now closer to 3M. Etsy is employing guerrilla marketing in India by literally going door by door, village-to-village educating sellers and craftsmen, and teaching them how to get up and running on Etsy.

Etsy is reducing the barriers of entrepreneurship (4M sellers vs 1,8M merchants in Shopify) by aggregating a long tail of unique supply and filtering the chaos through curation and discovery and it is positioned to unleash a new wave of sellers who can focus on product creation instead of marketing ( you don’t have to get traffic to your website or become an SEO expert).

Risks

Key-person risk: as you may have already figured out, Josh Silverman is an important part of the Etsy thesis given that the marketplace is in its early stages and requires direction from the top. Etsy would not be a +$10B GMS marketplace if it wasn´t for Silverman and its departure from the company would be an awful event. Josh has a fortune on Etsy share options and the company recently announced an equity compensation program to retain him over the next years, so his departure does not seem likely.

Shipping costs could hinder Etsy´s expansion by introducing friction given that the marketplace is not truly global in some categories(cross-border network effects, not global) and is limited by its shipping costs. Some categories will struggle with international orders (such as clothing or shoes ) as an adequate refund policy is necessary in order to ensure customer´s confidence, while others like jewelry (costs less to ship and there are barely any sizing issues) are more prone for international orders. Unlike big brands, Etsy has millions of unique SKUs from a long tail of sellers that make logistics more complicated.

Shipping should not be overlooked given that logistics and convenience have been decisive in Amazon´s success, Etsy customers are willing to wait longer, and even though Etsy is trying to differentiate from commoditized e-tailers by allowing sellers to communicate with buyers during the waiting process( by uploading videos about the creation process) customer experience is set to be worse than when ordering from Amazon and its hassle-free return policy.

Aggregators: given that Etsy is a place to seek inspiration for a big part of their users, Pinterest whose sole mission is focused around "owning inspiration" or Instagram, where users spend several hours per week are scary competitors. Pinterest seems more problematic given its sole focus, execution, and audience overlap and I will be paying attention to its e-commerce ambitions.

History has taught us that controlling distribution is crucial and these platforms hold the most precious asset of the "new economy", consumer attention. Its share of consumer´s time will propel curation and discovery capabilities (Etsy will have a hard time catching up in this area due to time spent in-app but focus could mitigate this). I still think Etsy will likely remain an important destination on the consumer´s mind as they aggregate a long tail of unique goods, along with personalization and the ability to interact with sellers( while these platforms feature other types of inventory).

Marketplace policies: Even though Etsy would never be price competitive with big brands( given the low amount of units that every item has) the company´s moat lies in its unique collection of items protected by its "handmade" policies.

As merchants scale and decide to externalize more of their production the platform risks losing its identity( as Silverman claims, if it has a barcode it does not belong to Etsy) but on the other hand successful merchants would need to manufacture a bigger number of items as they scale, losing its exclusivity and its "specialness". Moreover controlling such a wide and fragmented inventory in a manner that sticks to Etsy´s policies can be a difficult task (fuzzy guidelines do no help).

6. Valuation

I think the next few years may be bumpy as the COVID pandemic abates. Nevertheless, I believe Etsy will be able to achieve meaningful growth over the next decade. This is an asset-light business and excluding marketing expenses, most of the costs of the business are fixed.

Long-term margins are tied to organic traffic, if the majority of Etsy´s GMS is organic in the following years, profitability will trend higher ( as Etsy would expend less as a percentage of revenue in marketing and its "onsite ads" revenue would be higher). The company obtained a 32% adjusted EBITDA margin in 2020 (23% in 2019) and 40% EBITDA margins are not unreasonable as margins would trend towards contribution profits and Etsy is able to sustain great organic traffic.

If Etsy manages to grow GMS to $50B over the next decade (16% CAGR) and slightly improves its take rate (including ads) up to 20% while achieving 30% FCF margins at a 25-30 multiple I can get to 14% returns ( including cash build), which can be insufficient. Valuation is a bit demanding at 2020 15x EV/REV but an optically rich multiple can yield great returns if GMS grows faster to $100B (25% CAGR) which would lead to +20% returns over the period.

Given the company is not TAM constrained, execution will be the most important factor in the near future( that is why Silverman is essential); aggregators will not likely be a meaningful threat over the next few years but they could hinder Etsy´s growth prospects at some point in the next decade. Despite the challenges, I think Etsy is an extraordinary and unique marketplace that will flourish over the next years as more sellers embrace the creator economy and curation capabilities improve.