Share price: 513USD ($NFLX)

Market Capitalization: $227B

Is Netflix a threat?

"It’s a little bit like, is the Albanian army going to take over the world?” "I don’t think so."

Jeffery Bewkes, CEO Time Warner 2010

1. Elevator pitch

Netflix is the leading streaming service in the world, run by a talented management team in an industry with multidecade tailwinds on the ongoing shift towards OTT video consumption. Its unprecedented scale, untapped pricing power, innovative culture, and local presence make the Albanian army a compelling opportunity for the next decade.

2. Industry general introduction

The global TV market is huge with around 1,4B TV households ex-China and 750M+ pay-tv subscriptions (pay-tv refers to subscription-based television; services that provide premium entertainment like original TV shows, films, and live sports).

The number of pay-tv subscribers has steadily grown over the last decade despite representing a dramatically inferior value proposition than OTT video consumption (cost, convenience, and selection).

Due to the proliferation of streaming service companies, pay-tv households have already declined in some countries like the USA where subscriptions peaked around 2013 and have steadily decreased towards 80M in 2020.

Based on Nielsen data, U.S. adults are spending an increasing amount of time per day interacting with media across many devices, including 4 hours of daily TV consumption. Out of total TV time, linear TV still accounts for 75%, while streaming represents 25% ( in Q2 2020 up from 19% in 2019) and the trend towards OTT video consumption is a multidecade opportunity for streaming service companies.

Most of the streaming time is concentrated among a few providers and Netflix represents 34%, closely followed by Youtube. This implies that Netflix is still below 10% of screen TV time in the USA. Netflix´s lead in the USA where incumbents own streaming services can give a hint on the huge monopoly that the company holds on international streaming.

3. Netflix

Netflix is currently the biggest streaming service company in the world, and it was founded in 1997 by Reed Hastings and Marc Randolph as a DVD rental business. In 2007 they flawlessly transitioned towards licensing content from other companies and eventually creating its own content in 2012 (House of Cards).

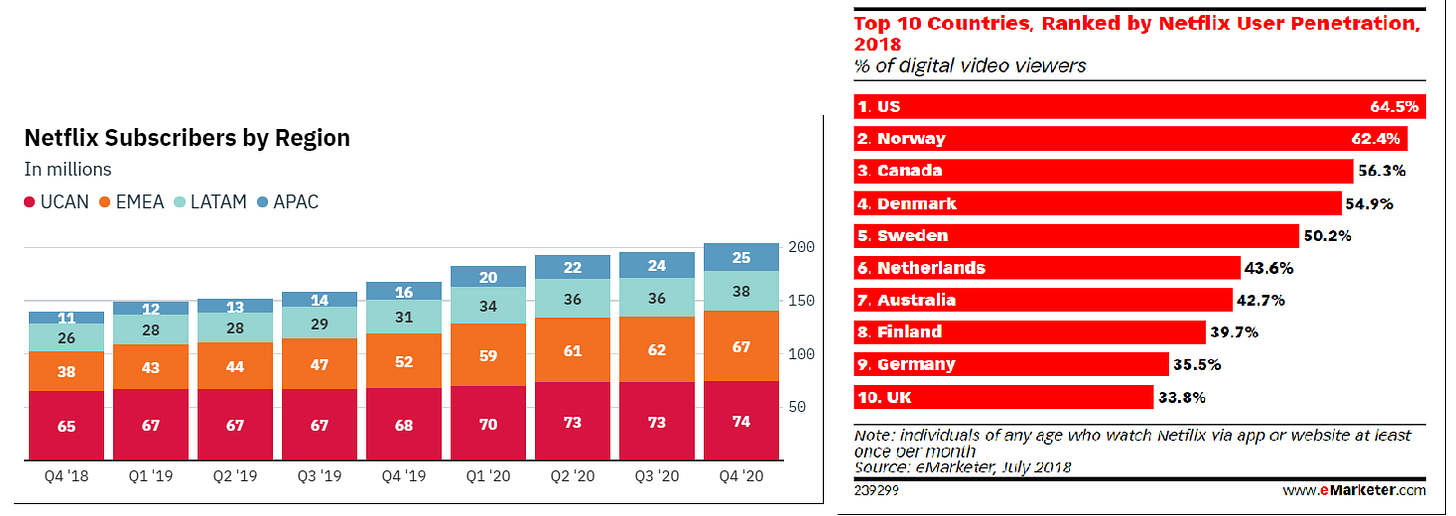

The company began its international expansion in 2010 and now commands 204 million subscribers all over the world excluding China, Crimea, North Korea, and Syria. Netflix has a higher penetration in the UCAN region, but the international value proposition is even better given the lack of competition and worse incumbent content.

Netflix has various attributes and capabilities that build an evolving moat around its business model:

I. Focus and flexibility

I think focus is a superpower and unlike most of its "competitors" Netflix's business model relies solely on subscriptions; Netflix has no alternative revenue streams to subsidize its SVOD business, so it lives and dies by its programming. Moreover, the culture is dynamic and flexible, and they have changed its business model twice in the last decade, firstly from DVD rental to streaming and a couple of years ago from licensing to creating its own pipeline of original content.

Netflix's mission statement is to entertain the world and they fulfill this vision by providing the best content to every member of the platform. This has translated into a rapid rate of change and a drastic improvement in their content slate in a short time span.

It still amazes me how fast the has service improved since they started producing its first original content in 2012 and this rate of improvement is a by-product of a clear focus on their SVOD service.

II. Scale

To understand the SVOD (subscription video on demand) business model we must comprehend that tastes around the world are super diverse and any given customer may be interested in a great number of topics or genres and is used to watch millions of dollars worth of content per week. Streaming services like Netflix benefit from scale advantages given that content spending can be amortized over a huge subscriber base, allowing them to produce niche content in a cost-effective manner. On top of that scale improves customer´s value proposition who have access to a huge library of global content.

The more relevant content Netflix makes for its subscribers, the more engagement is going to produce further compounding its scale and pricing power advantages. Netflix is running its business for the long term and content expense has drastically increased over the years. By increasing its content investments Netflix wants to ensure that is able to provide something to watch for every single individual on the platform from children to the elderly, attracting even more subscribers that allow for higher content expenses.

Broad availability and scale have given birth to the proliferation of multiple niches and have improved the value proposition for the consumer who is now being served with content specifically targeted towards their interests. Regardless of your preferences, Netflix has relevant content for you to watch and this unprecedented scale has allowed the company to become the default entertainment option for many people who turn to Netflix in search of something to watch.

When most of the people in any given country are talking about the same shows, that creates an incentive to subscribe to be part of the conversation (Top 10). Netflix is the only service that consistently creates content that taps into the cultural zeitgeist (Emily in Paris created a 340+% increase in searches for Kangol bucket hats, Lupin made an impact on Nike´s Air Jordan sneaker sales, after Queen's Gambit release searches for how to play chess hit a nine-year peak, and The Last Wish, one of the books on which the first season of Netflix‘s "The Witcher" was directly based has landed on The New York Times Best-Seller list 27 years after it was first released)

Netflix's global distribution capabilities have translated into several videogame companies announcing upcoming titles on the platform, seeking global impact that may increase the popularity of their franchises. Other streaming companies have announced similar partnerships but Netflix is by far the leader with several videogame adaptations currently in the making ( Resident Evil, Assasins Creed, Cyberpunk, Splintercell, etc.)

Due to its global audience, Netlfix can pick up dying or obscure series and bump its popularity obtaining huge viewership numbers. Riverdale increased its audience by 400% from season 1 to season 2 because the show was available on Netflix, Money Heist became the most-watched show on Netflix after its audience was sinking on a Spanish TV channel, and we have seen similar cases with Lucifer, You or Cobra Kai. This translates into lower costs for licensing titles since Netflix offers local studios lucrative deals and enables local content to reach a global audience. Low-budget Spanish films like "Bellow Zero", can achieve top 1 in 55 different countries and reach more than 46M households. This type of global distribution was unheard of and allows talented actors to achieve "Hollywood status".

These factors have transformed Netflix into a platform where upcoming talent seeks to achieve global exposure, and some of the actors who starred in Netflix shows achieve huge social media presence and start doing other projects in the industry.

With more than 500 upcoming movies or TV shows, the dependence on an individual title is vastly reduced allowing unprecedented risk-taking that can eventually lead to some of the greatest productions of the next decade. Filmmakers are now relieved from the pressure of the networks and this allows them to create higher-quality content and to embark on bigger and riskier projects with the backing of a 200M subscribers behemoth that can spread the cost of failure among its customer base. This has translated to awards and nominations across several categories.

III. Local champion

One of the biggest mistakes we can make is extrapolating U.S. entertainment tastes to the rest of the world, given that the most viewed content in each country was a function of prior distribution technology, rather than consumer preferences. Most people want to watch high-quality local content and have their community reflected in those stories and on top of that, they seek meaningful stories based on their taste and preferences regardless of their origins. Netflix is therefore enabling an explosion in both volume and quality of foreign content allowing incredible storytellers and producers around the world to reach a global audience.

In order to create the best stories around the world, Netflix works like a "well-oiled" decentralized machine, signing local talent at an unprecedented scale. To bolster its local presence Netflix is building or leasing production hubs around the world like in Albuquerque where it bought one of the largest production hubs in North America or Madrid where Netflix has built the second-largest production hub of Europe in order to increase its local content production capabilities from 2 shows in 2016 to close to 20 in the last year.

63% of upcoming Netflix original TV shows are international titles (according to Ampere Analysis). Netflix local productions are not watering down the local aspect of the show to make it travel, these are creators telling stories for local audiences that are so good that eventually travel globally. Lupin, an adrenalin-filled French language heist series released in early January reached more than 70m households, becoming the first French series to land on the streamer’s U.S. Top 10 list, Money Heist: Part 4 (Spain) hit the Top 10 in 92 countries, Barbarians (Germany) in 91, #Alive (Korea) in 90, Ragnarok (Norway) in 89 and Lost Bullet (France) in 89 countries.

It had been 10 years since the Spanish cinema received an Oscar nomination in the animation category but an animated Netflix movie has changed this dynamic, pointing out that talent is global and there were many projects around the globe waiting to be greenlighted. In India, all the Emmys nominations were for shows created by Netflix or Amazon, streaming is therefore reshaping the local creative landscape.

By heavily investing in local productions that were previously financially unfeasible, Netflix increases the customer surplus providing a vast array of high-quality titles based on your preferences for the mere cost of a 10-15 USD per month subscription, expanding the TAM for long-form video content. This will have profound effects on the media landscape facilitating the creation of global franchises around the world.

Netflix is the absolute leader in the international streaming landscape and it is years ahead in terms of both quality and volume of new local content. Moreover, some titles take years to develop, and it is necessary to build local teams around the world that can greenlight shows in a decentralized manner to build a great pipeline of titles across different genres. This requires a level of commitment and focus that competitors are unlikely to achieve. As Netflix keeps producing original local content and signing talent, its competitive position in the industry will continue to improve.

Due to the global nature of content, building a local presence in any given country reinforces your position in the global landscape, so in order to attract Indian customers local Indian content is necessary but having a deep pipeline of Spanish, Korean or german content is also valuable. Consumers’ tastes are becoming more global and Netflix international scale ( e.g investing more than $500M in countries like South Korea where other streaming services barely have any presence) will be essential to capture the next 200M subscribers around the globe.

IV. Best in class user experience

Curation becomes more important when the number of alternatives increases. Content curation and user experience are often underestimated but we live in an era of content abundance and it is vital to target and curate content to satisfy any given member. Customers used to search for the content they wanted to watch, but nowadays more than 80% of Netflix viewing comes from the first page of recommendations and research suggests that a typical Netflix member loses interest after perhaps 1 to 2 minutes of choosing, having reviewed 10 to 20 titles. “Either the user finds something of interest or the risk of abandoning increases substantially.” A good recommendation engine and UX is therefore crucial, vastly reducing friction and improving the overall quality of the service.

Management has repeatedly stated that " the end goal of the system are moments of truth, when a member starts a session and we help that member find something engaging within a few seconds, preventing abandonment of our service for an alternative entertainment option". Netflix has been able to excel user expectations, helping them discover new and relevant content which turns into more engagement and more viewing that has enabled Netflix to become the default option for watching high-quality entertainment.

Netflix was the first OTT video service to rollout user accounts and recommendations that tap into 80,000 tagged genre sub-categories; interactive/dynamic storytelling, daily Top 10 lists (enabling members to be part of the cultural zeitgeist in their country) of most-viewed titles in individual countries and in October 2020, Netflix introduced the “New & Popular” tab in its TV user interface, which includes a new “Worth the Wait” section listing titles scheduled to come to the service in the next year and letting subscribers set reminders for when they become available.

Embarked on a never-ending quest to reduce customer friction Netflix is releasing “shuffle play” as a permanent feature to worldwide customers, letting subscribers turn over the decision of what to watch next to the streamer’s algorithms and it is on track to release the "Fast Laughs" feature that consists on a news feed of short-form clips drawn from its full catalog, easing the discovery process for its members.

Netflix is the undisputed "UX king" and while much of Netflix’s tech can and will be replicated, they will continue making technological and experiential gains as its competitors replicate their older achievements. We have seen this dynamic play out in the music streaming industry where curation and user experience have proven to be crucial factors for success.

Netflix groups its user base into taste clusters that help executives analyze how subscribers interact with programming." Instead of grouping members by age or race or even what country they live in, Netflix has tracked viewing habits and identified almost 2,000 microclusters that each Netflix user falls into". Akin to add- supported networks, Netflix used to rely on age and gender to recommend shows, but nowadays micro clusters govern the recommendation decisions or as Sarandos puts it, “It’s just as likely that a 75-year-old man in Denmark likes Riverdale as my teenage kids.” As I previously explained, consumer tastes are a function of previous availability and therefore need to be educated through curation

As this interview lays out "the Netflix algorithm figures out which taste communities a member is in and then pushes the shows it thinks those members will enjoy to the top of their home screen. “We have a saying: Your Netflix is not my Netflix,” De Carlo says, noting that taste communities aren’t some static construct, either. “Most people are usually members of several different communities,” she says. “We’re complex beings, we’re in different moods at different times.”

“For all the thousands of titles in the company’s catalog, the average member only sees 40 to 50 options in a typical visit. Clusters, which can comprise anywhere from tens of thousands to millions of subscribers, are what help ensure that those members see the right 40 to 50. You also aren’t limited strictly to your cluster assignments---maybe you’d love Peaky Blinders, given the chance---as the algorithm occasionally offers glimpses outside your silo”

Given that the recommendations are based on viewing habits and consumer tastes, the algorithm is global, and scale is measured in the number of users that belong to any given cluster. That´s why I previously argued that you´ll have an edge in any given country if you have already built a pipeline of international content (a terror Indian fan will probably be interested in German terror movies). This outlines why the global scale is incredibly powerful in the industry.

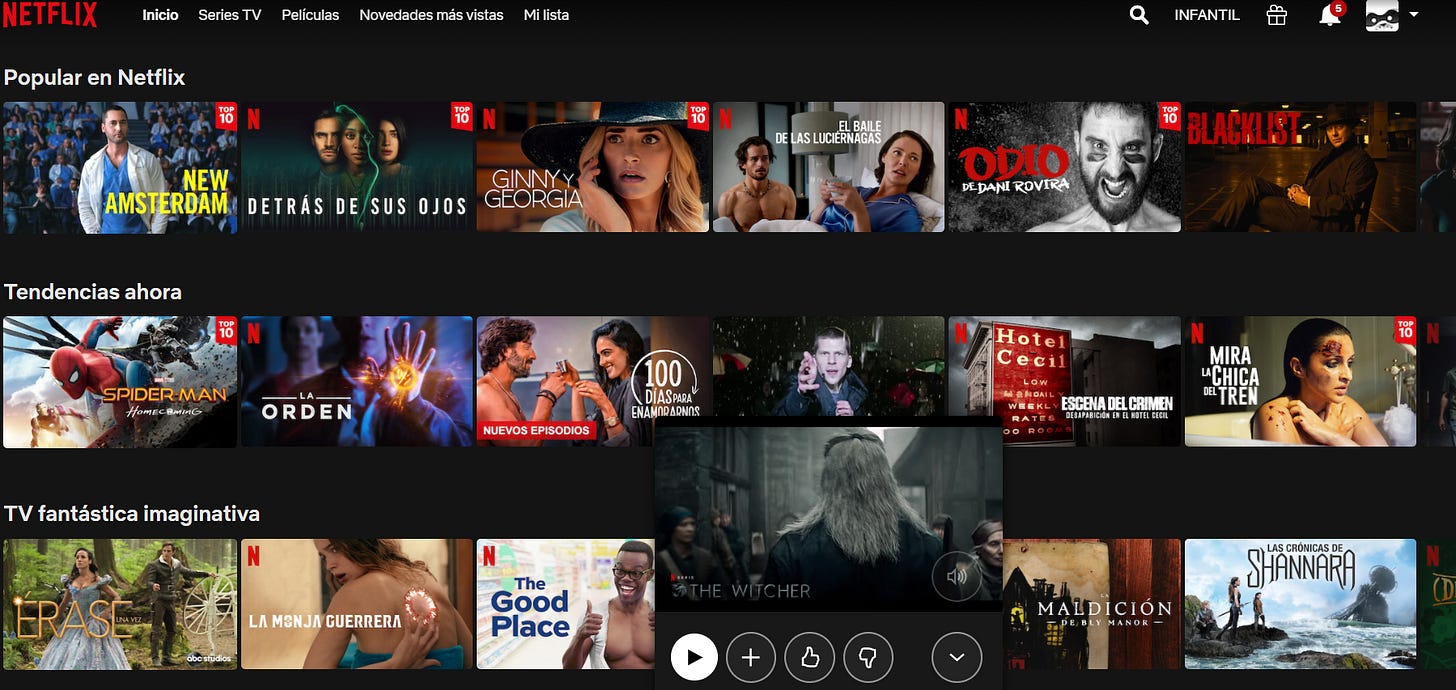

Every cluster of users has a series of stimuli that they respond best to. To explain the degree of customization among clusters, I have attached pictures of 2 different Netflix users.

While their recommendations are vastly different (new series, featured movie, and upcoming titles) the user experience has evolved to the point that the terror fan is shown a frightening clip of "The Witcher" that can be more appealing to him.

Curation is one of the most important features of the service otherwise, titles would "get lost" on the platform and wouldn´t be properly targeted towards the specific clusters that may find them appealing. Customer experience is maximized when any given user finds the most relevant content given their tastes and preferences, therefore a deep content library becomes as important as a great recommendation engine and UI, and competitors investments risk being unprofitable without adequate targeting capabilities; this is why some competitors are going after splashy big-budget titles with marquee names attached, allowing Netflix to obtain a higher ROI on their local productions.

V. Pricing power

"Our job is to invest in providing our members incredible experiences, more great content, and great product experiences. And when we do that and we do it well, we earn the right to increase the price a bit, and then we take that new revenue and invest it back into the model. And that sort of continuous positive cycle, we get to keep going. And we foresee that that will keep going for many years in the future"

Gregory Peters Q3 2018

This beautiful paragraph describes how Netflix thinks about its pricing power in the market. Netflix is not extracting rents from its customers and to "earn the right" to increase their monthly subscription prices they have to enhance the value proposition of the service. This cycle allows Netflix to raise membership fees in order to invest in greater content, further improving the value proposition for the customer. Netflix's pricing policy is totally decentralized and based on local metrics like member growth, retention, or engagement, and only if those metrics are on a healthy track (indicating Netflix provides outstanding value) they will adjust pricing.

Despite hiking its global monthly prices at a 6% CAGR since 2015 Netflix has managed to steadily deliver more value to its subscribers. For every dollar customers paid Netflix in 2020 they received $96M worth of content, nearly two times the 2015 figure. While this metric may appear simplistic it does at least underline how much consumer surplus Netflix provides to the subscriber relative to the value it captures via pricing.

In the USA where Netflix value proposition is comparatively weaker and new "competitors" have recently entered the market, Netflix has risen its subscription price at a 7,6% CAGR since 2013, price hikes have been more aggressive over the past 5 years at a 10% annual clip and at the end of 2020, Netflix announced another price hike for their US subscribers, increasing its standard plan to $14 a month and its premium tier to $18 a month.

These recurrent price hikes and subsequent improvement of the customer experience while maintaining best-in-class churn metrics (figure bellow) highlight how severely underpriced is the service for their customers. Netflix will keep increasing its prices over the next decade while improving the customer value proposition by providing an incredible slate of global and highly curated content. Content is not a commodity and consumers are willing to pay hundreds of dollars to get access to highly curated and fresh stories ( books or videogames are not a race to the bottom).

To sum up, Netflix is a hyper-focused company on a mission to entertain the world by producing local content on a global scale. Netflix delivers an outstanding user experience which entails strong pricing power that allows the company to further invest in new content, widening its competitive advantage and improving the customer´s value proposition.

Netflix content strategy

Netflix is trying to entertain the world by providing the most relevant content for every single subscriber and in order to accomplish this titanic goal, they need to release a big array of titles in every single category. In Reed´s words " we’re doing more quantity, and that’s helping with the quality". Given that quality is highly subjective it is imperative to produce in quantity to achieve quality.

Netflix used to license content from other companies but in 2012, they started to transition towards producing its own content. In 2018 Ted Sarandos announced that 85% of new content spending was going towards "originals" and in the Q3 2018 shareholder letter, Netflix disclosed that its own studio was already the single largest supplier of content on a cash basis.

The transition towards producing original content is a lengthy process but Netflix is already dominating the original streaming rankings in the USA and despite licensed series still representing a big portion of the catalog, Netflix has more than 500 upcoming titles and is leading the pack in terms of original content production. Moreover, the recent success of original shows like Queen's Gambit, Lupin, or Bridgerton underpins this transition.

The total number of titles available on Netflix today is significantly lower than what it was a couple of years ago when they were licensing in bulk despite that, the value proposition has improved (reflected in the aggressive price increases) and the quality of the slate has radically improved with hundreds of new original titles.

To support this transition, Netflix is signing exclusive deals(an extended practice in the industry) with directors, studios, and creators. These deals started to get traction around 2017 and have increased at a fast pace over the last years. By signing exclusive deals with creators Netflix reduces its dependence on external studios, locks talent, and decreases the hefty markups imposed by third parties.

Studios used to have a great influence on the type of content that was produced (content is expensive and the stakes are high); Netflix on the other hand, aims to be a creator-driven company( the brand becomes a collection of great minds) and they try to help producers to create the shows they want to make instead of imposing centralized policies. Filmmakers value the degree of creative freedom and risk-taking (on top of the generous paychecks) that Netflix allows in its productions, and the streaming company has signed exclusive deals with Ryan Murphy, Shonda Rhimes, Guillermo del Toro, or Nancy Karter among others. Netflix is building its company as a creator-friendly environment that encourages new ideas and great talent, therefore bolstering the possibilities of working with the next George Lucas or building great franchises over the next decade.

Netflix distribution capabilities and their ability to work with foreign production studios are unmatched. They launched in Korea in 2016 and " in an effort to restrain Netflix from entering the domestic market, major terrestrial networks ― MBC, SBS, and KBS ― made an informal agreement not to sell newly aired TV series. The arrangement ended when one of the networks sold the streaming rights for "Hymn of Death" as advertising revenue for the three-part miniseries was hard to generate." Akin to Korean networks many local channels around the globe have signed first-look deals with Netflix. Once Netflix has a bigger presence in the country, they sign exclusive deals directly with the "showrunners" disintermediating the TV networks (Money Heist premiered on Antena 3 a Spanish channel but Netflix has now signed an exclusive deal with the "showrunner" Alejandro Pina).

There are three major categories of content among Netflix library and Netflix uses the term "original" to delineate between movies and series that are exclusive to its platform and those that are aggregated from other studios after first being made available elsewhere. Original titles may belong to several categories across its lifespan (Designated survivor).

1. Licensed non-first-window content such as Shameless, The Office or Friends ( both titles left Netflix to other streaming platforms) where Netflix "rents" the show for a period of time.

2. Original first-window content such as Orange is the New Black (owned and developed by Lionsgate), Narcos, or House of Cards where Netflix has to pay a premium above production cost to the studio. Netflix may later sign exclusively with original first-window content creators, effectively disintermediating studios(Jenji Kohan who is behind Orange is the new black).

3. Owned original first-window content from the Netflix studio, such as Stranger Things, The Irishman, or Bridgerton. These are titles where Netflix owns all IP rights and only has to cover the production costs. (besides exclusive agreements costs)

Netflix is focused on organically building the company and has only made three acquisitions, two of them were small companies acquired to develop its IP. In 2017 they bought Millarworld, the comic-book publishing firm founded by Mark Millar, and in 2019 Storybots, to create ‘the next generation of Sesame Street’

Movies and animation are two content verticals where Netflix has redoubled its efforts and I think they are worth mentioning:

Movies

Netflix content investments had always been weighted towards shows and just a few years ago their entire movie slate was built on Adam Sandler movies and licensing from other studios. Followed by an aggressive increase in content spent Netflix will deliver a minimum of 70 original films this year (more than one movie per week).

In just 5 years Netflix has gone from barely having any original movies to having a huge pipeline of original content announced by Dwayne Johnson, Gal Gadot, and Ryan Reynolds. The sheer pace of improvement is mind-blowing, and it seems plausible to believe that in a few years' time some of the biggest "blockbusters" will premiere on Netflix, included in the price of your subscription.

Animation

Netflix's boundless ambition in regard to their animation slate are well known. A couple of months ago management stated their desire to eventually catch up with Disney in family animation, and even though there´s still a long road ahead, this may be achievable in the long term.

Netflix animation efforts came to life with Klaus, this was the first animated movie financed by Netflix. The film, directed by Spanish animator Sergio Pablos (Despicable me creator) marked a turning point for the Spanish animation industry. The film was initially perceived as too risky and was rejected by many studios, including Netflix(Sergio Pablos had to pitch them the project three times) who at the time didn't make animated movies. Netflix eventually acquired the rights in 2017 and 2 and a half years later Klaus became the second Spanish animated movie that earned an Oscar nomination, proving that there´s a lot of local talent waiting to be unleashed.

Quoting Sergio Pablos " Klaus is the spearhead of a monster that comes behind, with great creators and a lot of risky projects". Netflix has created an animation studio with more than 30 projects in the backlog that plans to release 6 animated features per year, which no major studio has ever done. The company is now deep into their '21, '22, '23 animation slate, and in the years to come Netflix will release high-quality animation movies included in the price of a 15$ monthly subscription. The amount of consumer surplus being created is undeniable.

In order to accomplish these bold objectives, Netflix has taken some decisive steps over the past few years, signing exclusive deals with industry heavyweights like Chris Nee, Nancy Karter, Darla Anderson, or Alexx Woo among others. According to a report in TheRealDeal, the streaming giant has just signed a lease for 171,000 square feet of office space in Burbank where they plan to set up their first dedicated animation studio. Netflix productions are also being animated at studios around the world, which promotes cross-team collaboration (James Baxter traveled to Madrid to help with the animation of Klaus).

Animated production is a long process but some of these efforts are already paying off and in 2021 Netflix led with 40 Annie nominations across an array of projects.

Netflix's ability to disrupt the space to the point that they no longer require big established IP is unprecedented, and they are leading original content production working with many third parties as well as hiring in-house talent. The consumer´s value proposition keeps increasing at a rapid pace fostered by original content and new verticals like movies or animation.

Management and culture

Underpinned by its famous mantra of freedom and responsibility, Netflix is a decentralized and nimble organization with local decision-making, from greenlighting content to price increases. The business model and culture are designed to be adaptative and flexible (DVD and originals transitions). This is often an underappreciated trait but it is complicated for incumbents to reshape their organization to create a nimble and decentralized company.

In order to build a global streaming service, able to produce content across many verticals and countries, it is necessary to build local executive teams around the world and grant them a great level of autonomy in order to avoid bottlenecks in decision-making.

Quoting a recent interview: "Sarandos misses the days when he would read every draft of every script and watch every cut before it went online, but now there are shows on Netflix that he sees for the first time alongside subscribers. In his view, it’s a necessary step. I do think that that’s just something that would be untenable for some creative executives. But I think it’s the only way we could do what we’ve done".

These cultural traits have had a profound impact on the creation process; Netflix doesn't coerce creators to make a certain type of content and an increasing number of creators value this creative (and budgetary) freedom, which also allows for a higher degree of risk-taking in their productions instead of making "what works". Directors are not hired to create branded content and titles are produced in line with content creators’ overall vision. Netflix is therefore creating projects that otherwise would not exist

The company is led by its co-founder, Reed Hastings (60 years) along with co-Ceo Ted Sarandos(56 years old) who joined Netflix in 2000. This talented duo has led the company for over two decades, disrupting the media landscape and building tremendous value for both the consumer and shareholders. They have a long-term vision for the business and I hope they will stick around for the next decade.

Executives are paid handsomely, with a mix of cash and 10-year stock options depending on their preferences. Despite receiving most of his pay in stock options Reed Hastings only owns 2% of the company since he has been selling shares over the last decade; insiders now own 3,4% of the business.

Quantitative metrics

Netflix has been able to rapidly increase its global subscriber base at a +20% annual clip, reaching 204M subscribers in 2020 while rising its global ARPU 5% annually.

In the UCAN region (Canada is included since 2019) the ARPU has increased at a 7,61% annual pace since 2013 while the subscriber base has almost doubled. The international subscriber base has exploded and now represents 64% of the total subscribers but due to more muted monthly pricing it still represents 54% of the total revenues.

The business has beautifully scaled with the subsequent increase in margins. UCAN contribution margin (Gross profit-Marketing) has risen to 35% in 2019, (a higher gross margin improvement has been masked by an increase in marketing) while achieving positive contribution margins in the international business since 2017. These contribution profit improvements have translated to the bottom line and EBIT margins reached 18% in 2020(the company benefited from COVID-related production delays and the 2020 margin profile is somewhat elevated) and management is targeting an average annual increase of 300 basis points per year an 20% operating margins for 2021.

In order to fulfill its ambitious goals, the company has aggressively invested in new content which has partially been funded with debt. The company has a favorable debt maturity profile up to 2030 and management has recently stated that they will no longer require external financing in order to grow the business.

Despite boasting near 20% GAAP EBITmargins Netflix has historically been FCF negative(excluding 2020 COVID one-off); due to a wide discrepancy between cash content expense and amortization of streaming content assets.

Cash content expense differs from content amortization because the vast majority of content spend now goes towards Netflix originals and self-produced content where the cash spending is more front end loaded given that Netflix must fund content that will be released over the next one to three years. If we adjust cash content expense for this peculiarity (by taking into account "released content expense") we come with a number that closely tracks amortization expense.

The more Netflix invests to increase its consumer value proposition the higher this discrepancy will be and as Reed says "in some senses, negative free cash flow will be an indicator of enormous success" Netflix is therefore planning for and investing in a future that is much bigger than its present.

4. Streaming landscape

Streaming is often pictured as a fiercely competitive market, but I argue Netflix has no direct competition in streaming, mainly because no other company is trying to play the same game. The company has been benefited from the COVID-19 pandemic but this has been a long-term negative event for Netflix because it has accelerated secular trends and incumbents felt compelled to further invest in their streaming services.

Netflix is trying to play the aggregator role and seeks to become the default source of premium entertainment content (excluding sports and news). Incumbents are not willing to play this game and they are following different strategies. Tech companies are using video streaming as a loss leader trying to produce high quality or splashy big-budget productions and lack the focus required to represent a threat to Netflix ambitions. On top of this filmmaking is a lengthy process that takes a few years, so in order to build a global service in the future companies need to start investing years in advance across many categories and countries. This is a titanic task that requires a decentralized organization and a complete focus on streaming.

The media and financial press like to portray the industry as” the streaming wars”, and even though the different companies involved in the industry compete for talent and customer attention, this is a war against pay-TV and there will not be a single winner. As you can see in the picture below streaming services are winning the battle benefited from the consumer shift to the internet away from linear. Netflix leads the pack, closely followed by Prime Video and Disney.

Despite the copious supply of new streaming services, some of the new entrants have a dubious value proposition which is translated into their churn metrics. Netflix best in class churn in the USA despite aggressive price increases reflect the tremendous amount of customer surplus created by the company. Netflix's value proposition abroad is multiple times higher, given their so-called "competitors" barely have an international presence and are years behind in terms of local content production.

Worldwide spending on non-sports content was estimated by Ampere Analysis to be over $123 billion in 2018 and mimicking consumer trends it is shifting towards streaming. The picture below is a 2021 content budget estimate among different US companies and given management objectives Netflix will probably be closer to $20B. What goes unappreciated is that Netflix will only spend their budget on global non-sports programming while other companies bid for sports rights and spend on box office content.

Akin to high-budget productions I do not think it is possible to build sustainable competitive advantages by bundling sports content given that any given company can simply outbid you, viewership is heavily concentrated among a few sports and there are barely any emerging categories. By contrast, Netflix is building local teams that greenlight new titles and figure out what works best in their community, has spent years creating and fine-tuning their UI, produces a great array of titles among thousands of clusters, it is signing new talent across a great number of categories and it is radically changing the content creation process.

Amazon

Amazon is uninterested in winning the streaming wars and it is using video content as a loss leader in order to make the Prime bundle more appealing, therefore generating more online e-commerce revenue. As Jeff used to say "we want Prime to be such a good value, you'd be irresponsible not to be a member"

With an eye on making the service more appealing to its members, Amazon is bidding on sports rights and has been aggressive in landing splashy, broader, and more mainstream projects(Lord of the Rings, NFL, Borat, "The tomorrow War", Wheel of time Novels) effectively creating another reason to shop on Amazon. It is therefore expected that Amazon will keep increasing its estimated 8,5B$ content budget.

Prime membership has been widely successful with more than 150M members around the world and despite that, the differential between Netflix budget and Amazon has widened. Moreover, Amazon´s lack of focus is reflected in their poor user experience (almost inexistent curation on top of a huge title count) and overall strategy. Besides India, where Amazon and Flipkart are neck-to-neck in the e-commerce wars, Amazon barely produces local original content, and their global original output is multiples behind Netflix.

Amazon is not likely to represent a threat to Netflix whose lead will only get wider over time as local content expenses increase and superior targeting capabilities prove to be decisive. It is unrealistic to think that big tech would wreck Netflix given their "war chest" of cash when they haven´t been able to make a dent in Spotify's growth prospects. In the long term, Netflix "moat" will get stronger with an increasing number of content verticals and local teams across the globe which will propel tech companies into mainstream/marquee name titles and sports.

Apple

Akin to Amazon, Apple seeks to build a compelling add-on in order to make their ecosystem more appealing to their users. Apple's strategy is therefore focused on making a few high-profile titles per year. Streaming is just another tool to attract and retain users to their ecosystem and Apple shouldn't be considered as a true contender. Despite this, Apple´s war chest shouldn´t be overlooked and it´s giving birth to "big budget inflation" that particularly harms US companies focused on high profile titles (HBO).

The company has no interest in pursuing a volume strategy and lacks the focus required to be a long-term threat (music is at the core of the iPhone and Spotify is still hugely popular among IOS users) and the majority of its users are on free promotional offers that Apple extended to buyers of its hardware devices.

Both Amazon and Apple are using content as a loss-leader and despite that, Netflix has been able to keep steadily growing, mainly because it offers a compelling value proposition with superior content and curation.

HBO

HBO (AT&T owned) released their streaming offer in 2010, but cannibalization fears along with an archaic culture allowed Netflix " to become HBO faster than HBO can become us" and the Albanian army is now taking over the world.

By the end of 2020, according to WarnerMedia parent AT&T, HBO Max had 17.2 million subscriber activations (many customers who already pay for HBO have access to HBO Max as part of their package but haven’t yet activated that subscription and started watching); and 61M global subscribers. AT&T makes direct comparisons with streaming rivals more difficult, given the fuzzy disclosures given and they now expect 120 to 150M global subscribers by the end of 2025.

HBO is focused on developing high-quality original content and their output volume is quite low, Antony Root, head of Original Production at WarnerMedia EMEA recently underlined the fact that" HBO doesn’t focus on volume, but rather on truly premium-level and well-curated content". Even though this may look like a good strategy, quality is subjective and hard to build if you are not focused on volume (or you are Disney and have the backing of a huge fandom across a great portfolio of properties on top of a well-oiled machine that can cultivate and further monetize those franchises). That's why Netflix's strategy is doing more quantity, and that’s helping with the quality, on top of that, it is unclear how they plan to build highly curated content without a focus on content volume.

HBO's value proposition remains fuzzy, but despite that, I think their service will do OK by riding on their rich IP (DC Comics, Game of Thrones, Harry Potter). The company is planning to roll out their service across Europe in 2021 but the incumbent has traditionally been a laggard in terms of execution, and they have existing distribution and content licensing agreements that may slow down their growth prospects.

Due to the COVID pandemic, Warner Bros decided to release their entire movie slate on HBO Max including films like Dune, or Godzilla vs Kong for international markets it will be on a "case by case" basis) and will release an ad-supported tier in 2021.

HBO´s strategy is not without risk, given that the majority of its content budget will be directed towards big franchises and AT&T lacks Disney´s ecosystem and expertise for cultivating and monetizing franchises. Netflix’s content spend has grown by HBO’s entire budget during the past years and while HBO has legacy profit pools that need to protect Netflix is completely focused on its streaming service and it is years ahead of the incumbent.

Disney

Disney D2C strategy is a mere reflection of the company´s mission statement, Disney is focused on building and monetizing franchises across their ecosystem.

Disney who has been depicted as "an oil company that can put the oil back in the ground after it is done drilling so it can drill it again" is not interested in cluster maximization or producing local content; instead, it is focused on building and cultivating brands by leveraging its rich IP and company´s assets(parks, cruises, box office, experiences, and products). This wonderful playbook has given birth to dedicated fandom across many of its properties.

Disney is therefore insulated from building local teams or having a great curation engine given that they do not pretend to go after a big portion of streaming minutes and they use their portfolio of assets to generate expectation (Disney weekly releases Wandavision in Disney+, fans then visit the Avengers campus and buy merchandising that they wear to Black Panther 2 box office premiere) and build a dedicated audience that is willing to spend hundreds of dollars on the Disney ecosystem.

After blowing out of the water street expectations and recently surpassing 100M subscribers on Disney + ( this is an impressive feat given they have only released Mandalorian and Wandavision so far) the company is guiding towards 245M subscribers on Disney+ by the end of 2024 and a global subscriber output across all of its properties ( Hulu and Espn+) of 300 to 350M with a D2C content budget of 14 to 16B ( the majority of the budget will go towards Disney +).

Even though the company has non-Disney content (Hulu/Star and Espn) that will be bundled along with other Disney properties, the bulk of its efforts will always be focused on their beloved franchises that are the core of Disney´s flywheel. As Bob Iger states "the emphasis will always be on quality, not volume. Quality holds its value, and that has been our mantra for as long as we've been telling stories"

I believe that there are more than 200M households willing to pay more than 15-20 USD$(with great pricing power) per month in order to get access to a part of the Disney ecosystem, therefore D2C will become the main gear unit of Disney´s machinery and one of the most valuable businesses inside the company.

Despite my bullishness regarding Disney´s prospects(I think they will emerge as one of the long term winners of the streaming industry), and even though both Disney and Netflix are competing for US talented storytellers(Disney´s leaking animation heavyweights) and actors, both companies will coexist in the long term given that they have completely different strategies and objectives.

Disney is therefore cultivating and monetizing franchises while Netflix is trying to build premium TV, those objectives require different strategies, budgets, and procedures. Most of Disney´s output is carefully produced and polished in order to retain tight control of the final output; on the other hand, the Netflix brand becomes a decentralized collection of great minds and comparations with aggregators like YouTube are more suitable.

There are some subscale streaming services like Peacock, CBS All Access, or Discovery+ that operate under AVOD/SVOD models. These services, that barely have new original content will offer a comparatively worse value proposition in the future as the biggest players keep scaling. They may eventually sell their content to CTV companies like Roku(supported by the acquisition of Quibi library) fully transition to an AVOD model.

Over time SVOD will consolidate around a few companies led by Netflix, Disney, and Amazon while the Pay-TV ecosystem will emerge as the clear loser. As I previously mentioned content is not a commodity and the winners of this transition will enjoy lasting pricing power and significant growth in customer viewing hours.

5. Risks and opportunities

Opportunities

Netflix may eventually build a substantial revenue stream by merchandising and further monetizing its content, on top of this and given Netflix’s reach, product expertise, and predilection for creative experimentation, the company will likely produce new forms of storytelling(Black Mirror: Bandersnatch) but its most promising opportunity lies in the Indian market.

With a 1,3B population that may overtake China, there will be 1 billion Indian internet users by 2030, driven in large part by Jio, which has reduced data prices by 95% since 2014, therefore the biggest streaming services (Netflix, Amazon, and Disney) are pouring millions of dollars into producing India-specific original content( Hindi language content accounts for >50% of the overall streaming). In 2020 these companies spent near $530M to create Indian content and over the past two years Netflix spent $400M in the country.

Indian domestic creative landscape has radically shifted and every single Indian show nominated in the 2020 Emmy awards was created by either Netflix or Amazon, the latter is set to win e-commerce in India and has called the country a "priority market" where the company will produce over a dozen originals. As stated before Amazon is interested in winning e-commerce and it is therefore using its streaming video platform in order to conquer the market.

Meanwhile, with more than 40 titles scheduled for 2021, Netflix is expanding its slate by nearly three times as compared to 2020 across languages and genres. As stated by Monika Shergill “We’re getting very, very big on India,” Shergill said. She declined to give a specific figure but added: “This slate is nearly three times that [of 2019 and 2020], so I think you can make an educated guess about how much we’re leaning into programming in India. As a proxy for Netflix's Indian content popularity, the Netflix India Youtube channel is blowing up and receives half the visits of its American counterpart.

Netflix is targeting its next 100 million subscribers from India, and although ARPUS would be low in the near future, Netflix is poised to achieve a significant presence in the country by leveraging its global content production. APAC subscribers, subsidized by its American counterparts will represent an increasingly bigger share of the pie.

The Indian landscape entails some risks like political scrutiny. Streaming shows are facing the wrath of Hindu nationalists and Tandav(Prime video series) scenes have caused police complaints. These platforms remain in the public spotlight in a country where the government has licensing and content censorship powers in mediums like cinema and television.

On top of these opportunities owning a +200M subscribers entertainment platforms comes with a great amount of optionality and at some point in the next decade, Netflix may expand towards other categories in order to further grow its share of the entertainment pie. Management doesn't think about Netflix as a streaming service “We compete with (and lose to) Fortnite more than HBO", but rather as a global entertainment platform.

Risks

Netflix constantly competes for consumer attention and a change in consumer behavior (short-form video content is very appealing to young demographics) or more immersive ways of entertainment such as videogames could harm Netflix´s watching in the long term; I think it is likely that many forms of entertainment will coexist in the future and Netflix will adapt its storytelling to new technologies like VR.

Aggregation theory

“There are two ways to make money in business: You can unbundle, or you can bundle.” — Jim Barksdale

Based on Ampere data, the average U.S. household uses four SVOD platforms while European households average two. Despite representing a smaller percentage of streaming viewership Netflix has managed to capture an increasing amount of TV time and in the US(based on Nielsen data) Netflix's total viewership has gone from 5,9% in 2019 to 8,5% in 2020.

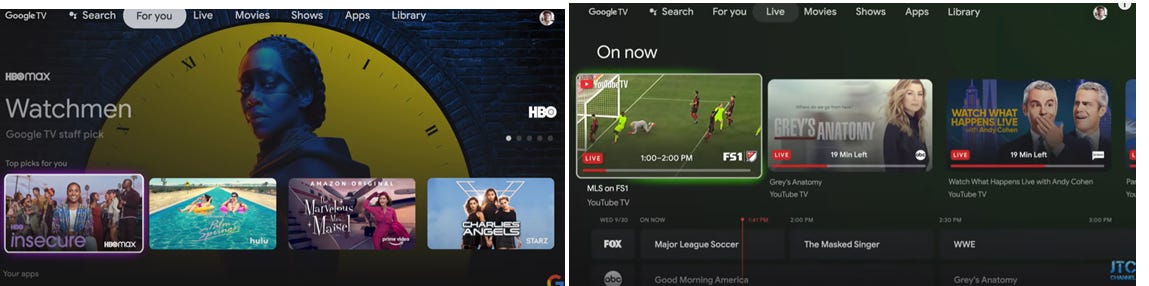

Most of SVOD watching time happens on a TV and consumers are increasingly turning to TVs to watch OTT video content (120 million people in the United States streamed YouTube on their TV sets up from 100 million people in March 2020). In the new D2C world, consumers access their favorite content through a combination of add-on hardware like Firestick, Roku, or Chromecast and pre-installed software on smart TVs (Google TV, Fire TV, Roku). These operating systems are becoming increasingly important to the consumer since they provide a better user experience.

The lion share of connected TVs are powered by either Roku, Google, or Amazon and the landscape will further consolidate due to the “winner takes all” dynamics of these platforms. Roku is currently leading the pack with 51M active accounts (averaging 3,8 hours of watching time per day) closely followed by Amazon with 50M users and Google in the third place( who shouldn´t be overlooked given their relationship with TV manufacturers who risk losing access to Google services smartphones).

We are witnessing the creation of a new TV ecosystem that is still in its infancy. The first version of these platforms displayed an array of D2C apps on the home screen on top of an AVOD channel that aggregated content from different sources. (Roku has more than 10,000 apps in its Channel Store, both free and paid and recently acquired Quibi´s original programming in order to bolster its "Roku Channel" content offering)

These platforms are trying to replace the linear TV experience and they make most of their profits by selling ads in AVOD content or getting a cut of subscription revenues. The new TV gateways allow content publishers to distribute and monetize their content to a large audience through SVOD and AVOD(Roku states that it displays a lower add load than traditional TV with 8 minutes per hour).

Similarly, to what Youtube has accomplished with user-generated content, these companies pretend to aggregate TV by accommodating a mix of AVOD and SVOD content.

The recent Google and Fire TV updates give us a preview of what´s to come to the streaming industry. By displaying SVOD content on the home screen these platforms become the new interface allowing you to watch some content without the need to enter SVOD apps. The aggregation experience is still in its infancy and bundling multiples premium services into packages seems like the next logical step. These platforms directly compete with Netflix, given that the latter is trying to aggregate premium TV entertainment (this excludes mostly news and sports).

The aggregation thesis suggests that these content gateways would reap the lion´s share of profits, therefore commoditizing content providers by bundling SVOD into a monthly subscription (on top of aggregating AVOD content). Given that no company can own all the media content in the world and consumers would want a way to filter through the world's content, aggregators would earn a big share of SVOD subscription dollars and advertising (in AVOD content). Under those assumptions, high-quality IP would hold its value (Disney wins) while distribution would be more of a commodity.

Several aspects lead me to believe that this theory would not take place as stated on premium content. The winning model will be able to deliver the most relevant content to every single consumer, therefore maximizing the user experience.

1) User experience: UX is maximized when any given user watches the most relevant content based on their tastes and preferences. In order to do this, it is necessary to build a deep pipeline of new titles across genres and curate/target the content based on consumer preferences, improving discoverability and reducing friction. As I previously explained, 80% of Netflix viewing time comes from the first page of recommendations; Netflix's business model relies on effectively curating content and while much of Netflix’s tech can and will be replicated, they will continue making technological and experiential gains.

The biggest aggregators still have 1/4 of Netflix´s scale and it seems likely that the big 3 (Amazon, Roku, and Google) will share the market for the years to come, these are not true global aggregators yet but mere interfaces that allow for a better TV experience. On top of this, given that aggregators are not vertically integrated (they don't own their own supply) discoverability would likely be worse (Netflix displays different clips and pictures to different users and this would be hard to replicate by these platforms).

2) Content: to win consumer´s attention the key is having content that consumers seek to watch, and these platforms would need to aggregate more compelling content than Netflix. However, economies of scale allow for a higher degree of risk-taking (blockbuster movies, animation efforts, etc.) that would be harder to replicate for smaller companies. Netflix is creating content that had never been produced before because they have a 200M subscriber base that allows them to experiment and fail. An aggregator would likely work with many smaller partners around the world (given that there are high barriers of entry to long-form scripted content creation) who would stick to producing content that "works" and would prioritize viewing hours over quality. Netflix is incentivized to produce the best possible content for its members and it's not afraid of failure (given that they have 500 upcoming titles) which gives them leeway to produce new content.

Netflix is directly working with creators, therefore disintermediating linear networks and offers content producers a new place for freely producing content; this creative freedom would be difficult to replicate for linear channels or studios around the world. The landscape will likely change in the future, but content takes time to produce and it will take a few years till aggregators hit mass adoption. This leads me to believe that when any given platform reaches a significant user base, Netflix would be at a 30B content expense run-rate, offering a superior value proposition for the consumer.

Furthermore, local TV networks around the world are feeding Netflix content library and therefore digging its own grave. Netflix works with many content producers that cannot resist big upfront payments and after a few successful shows start directly working with content creators.

No company can certainly own all the media content in the world but it looks like Netflix is positioned to become the most compelling premium bundle of the next decade (I'm not counting Disney here given they are following a completely different playbook). Distribution platforms would probably become an aggregator to small publishers and AVOD prone content.

3) Supply economics and customer´s value proposition: unlike user-generated content (Youtube, Tik Tok), producing scripted media is quite expensive (story rights, screenplay, directors, cast, production costs, etc.) requires a lot of time (1 to 3 years on average) and the collaboration of hundreds of people. But contrary to videogames where the users are immersed in the gameplay for dozens of hours, streaming is a tricky business that commands strong economies of scale.

Users expect to watch hundreds of millions of dollars worth of content per week by paying a monthly subscription that includes most of these titles (Netflix subscribers can access a global array of new titles for the same price as Paramount+).

These dynamics where the biggest content providers can offer a better value proposition to their customers than subscale services should drive concentration in the long term in premium content while news and AVOD (similar to user-generated content) will desperately seek aggregators in order to reach a global audience.

Netflix wants to become the most compelling premium TV service for the end-user, and it is not standing still. They are rapidly increasing their content expense and as a result, the customer´s value proposition has improved (which translates to price increases). The company is generating a huge customer surplus and it will be difficult for an upstart to catch up. It seems unrealistic to think that a bundle of low-tier US content could harm Netflix prospects in the long run.

Even though I think Netflix has great prospects for the next decade, these platforms act as a toll road and shouldn´t be overlooked because they represent the biggest risk that Netflix will face over the next decade. Roku is the only "pure-play" aggregator and despite its reduced international presence the recent Quibi acquisition leads me to believe that they will further try to bolster the Roku channel value proposition in the future.

Management execution, Netflix viewership time and aggregation initiatives are important areas to monitor in the years to come.

6. Valuation

Over the next decade, Netflix will keep investing in content spend, therefore improving its value proposition. As the service gets even more appealing to its potential users, monthly subscription prices would increase over time at a 5% CAGR reaching 25$ per month in the UCAN and 16$ in international markets. Despite recurrent price increases, consumers would receive nearly $200M worth of content for every subscription dollar they pay as Netflix "earns" the right to increase prices when the value proposition gets better.

Subscriber base will keep growing by reaching 500M in 2030 and most of the subscription growth would come from international markets where penetration is lower than in the UCAN region. Given that there are currently more than 750M Pay Tv homes excluding China (600M excluding both India and China) I think this is a realistic target for the next decade.

As Netflix grows, the user experience would drastically improve further widening its competitive advantage as content quality/volume as well as targeting capabilities improve. The business has a very high incremental margin, given that content investments will grow slower than revenues, and costs of revenues mainly consist of amortization of streaming content assets.

Under these assumptions, as content investments are amortized over a bigger subscription base, Netflix would expand its operating margins to 45% while offsetting dilution and buying back a small percentage of shares outstanding. Customer growth, viewing hours, and pricing power will all trend higher for a long time to come, and given the nature of the business 20-25 FCF maturity multiples are not unreasonable, which gets us to a 15% implied IRR over the decade.

This is a phenomenal article. Appreciate your intellectual rigour. Great job.

Fantastic write-up! Would love it if you could provide and update given recent slowdown in subscribers and massive share price decline.