Share price: 101USD($PTON)

Market Capitalization: $30B

“92% of fitness resolutions end within 6 weeks and our 12-month retention for our Peloton members is 93%”

Jill Woodworth, Peloton CFO

1. Elevator pitch

With the sole mission of helping people embrace fitness into their lives, Peloton is the leading connected fitness company in the world. A best-in-class user experience with aligned incentives, a visionary management team, and a multidecade transition towards connected fitness will help Peloton change the habits of millions of people over the next decade.

2. The fitness industry

Fitness is broken

According to the WHO, there has been no improvement in global levels of physical activity since 2001, and "insufficient activity increased by 5% (from 31.6% to 36.8%) in high-income countries between 2001 and 2016". Structural trends like videogames and passive content consumption along with remote working or food delivery will only exacerbate the lack of activity over the next decades.

Exercise is hard to maintain and with increasing levels of convenience, humans tend to inactivity and sedentary behaviors. According to the CDC (Centers for Disease Control and Prevention), roughly 53% of all U.S. adults met the Physical Activity Guidelines for aerobic activity while only 23% met both the aerobic and muscle-strengthening guidelines. Against this backdrop, caloric intake has steadily increased over the past decades from 2052 daily calories in 1965 to 2850 in 2015 ( developed countries), and “the average American consumes more than 3,600 calories daily – a 24% increase from 1961 when the average was just 2,880 calories", this has resulted into a new pandemic for which there is not a quick fix. Obesity levels have hit an all-time high and according to the CDC, more than 42% of adults aged over 20 and 1 out of 5 children are obese in the USA.

Fitness ("state of health and well-being and more specifically, the ability to perform aspects of sports, occupations and daily activities") is a fairly young category that emerged in the early 70s and has steadily grown since then. The fitness industry has gone through many fads and trends, from the jogging craze in the early 70s to the VHS workouts of American actress Jane Fonda that sold 17 million copies around the world over the 80s.

The home gym industry emerged in the 90s riddled with gimmicky products and misinformation, and a booming industry gave rise to the first gym chains like 24 Hour Fitness, LA fitness, and McFit in the late 90s.

Gym memberships have steadily increased since then and according to the IHRSA 2019 report, there were 62M gym members in the USA ( up from 33 million members in 2000). "Worldwide the industry is worth more than $94B, with more than 184M users and club count exceeding 210.000 facilities".

So, if the USA is one of the leading countries in terms of gym membership penetration and the number of users has increased throughout the years, why is the average American fatter than ever? Dietary habits play an obvious role but gym membership numbers are deceiving.

According to the IHRSA," in 2019 there were 27M core members or members that went to the gym more than 100 times per year and the average member has kept his membership for 4.7 years". A comprehensive Australian report with input from more than 1 million members states that around 48% of new club members give up their membership within 12 months.

Gym chains have built profitable business models around charging membership fees to people that barely show up. Low-cost chains such as Planet fitness have on average 7,600 members per facility and according to the WSJ " churn rate is over 25% in the first five months" The company has stated that 40% of their members have never been to a gym before and that monthly attrition rates hover around 2% after a membership has been active for a year.

Management claims that they have lots of clubs with over 10,000 members and they do not experiment capacity issues until 12,000 members because the majority of their members do not actually go very often, and the average facility holds around 5,000 workouts per week ( this equals to 21,400 workouts per month o 2,81 monthly workouts per member). As stated below, average members use the facilities a bit more often while many people do not even show up.

"The vast majority of cancellations are due to nonuse and the average member uses it about 5 to 6 times a month as opposed to the SoulCycle person that's working out 5, 6 days a week"

Chris Rondeau, Planet Fitness CEO

However Planet Fitness members have increased at a 19% CAGR ( 2015 - Early 2020) reaching 15.5 M in 2020 and the company has built a huge business with a marketing strategy focused around people who did not felt comfortable in a traditional gym, they celebrate "Pizza Mondays" once a month and black card membership penetration is around 60% ( benefits include massage chairs, drinks or tanning beds).

Gyms succeeded due to price and convenience ( despite not being a great experience for the majority of the population) but the business model is built around misaligned incentives and the most profitable customer is the one that barely shows up. The traditional "fitness" industry has miserably failed at getting people to work out frequently. It is obvious that for the majority of people, going to the gym is a chore, rather than a great experience.

Boutique fitness

As I previously explained, despite the rising number of gym memberships, most of its members are not having a great experience. Akin to e-commerce, the first wave of fitness was marked by price and convenience ( gym chains and low-cost options), and a couple of years ago, boutique fitness studios gave birth to the second wave that will be built around experiences.

According to the IHRSA, "40% of gym members enroll in a gym class such as Zumba or Yoga and 44% prefer working out with a partner", it is obvious that these offerings built around providing a great experience and sense of community will be more relevant over the next decade.

"A boutique fitness studio is generally viewed as a small gym (usually less than 5000 square feet) that focuses on group exercise and specializes in one or two fitness areas". These studios feature group classes led by motivating instructors while recreating an atmosphere that pushes people to work harder. "An estimated 42% of health club members (USA) in 2018 report having a membership with a boutique fitness studio and the average member use these facilities 104 times annually".

According to the IHRSA, in 2017, boutique fitness studios made up around 40% of the health club industry profit, the average class hovers around $20 to $30 per session and monthly unlimited memberships cost $110 to $300. The number of studios excluding Crossfit was around 7,000 in 2019( 5,000 were HIIT studios or High-Intensity Interval Training ). Some entrants include Barry´s Bootcamp (thread and circuit) Soulcycle (bike) or CorePower Yoga. Orange Theory which is one of the largest HIIT operators in the USA(treadmill, rowing, and floor/dumbbells)surpassed $1B system-wide sales in 2018 and now has over 1M members distributed among more than 1,200 locations.

Despite being significantly more expensive than traditional gym offerings, consumers are willing to pay a substantial premium as they enjoy the experience and stick to a given routine. Providing a better "fitness experience" is therefore crucial because it could mean the difference between frequently exercising or not.

Connected Fitness

At-home fitness is by no means a new category. In 1968 Keene Dimmick introduced the first electronic bicycle, in 1990 the thigh master revolutionized the industry ( has netted more than $200M in sales so far) and Billy Blanks and his Tae Bo became a cultural phenomenon in the late 90s.

However, the COVID pandemic marked a major turning point for the industry, and 2020 will be remembered as the year that brought the gym to our homes. Companies such as Gold´s Gym or 24-hour fitness and studios like Flywheel or Yoga Works filed for bankruptcy and according to the IHRSA, 15% of gyms have permanently closed. Fitness equipment revenue more than doubled and according to Sensor Tower "from January through November of 2020, approximately 2.5 billion health and fitness apps were downloaded worldwide, a 47 percent jump from the same period in 2019".

2020 saw an influx of capital into the "fitness technology" sector as the concern for the viability of high-tech home fitness equipment, quickly evaporated" home exercise startups raised $3.02 billion in venture capital globally last year, up from $1.79 billion in 2019".

Against this backdrop companies like Peloton experimented a great increase in sales and awareness. With studios closed, the combination of an immersive fitness boutique experience from the comfort of your home proved to be the winning recipe.

Walking and using cardiovascular equipment are amongst the most popular forms of exercise in the USA, at-home fitness was an old and stagnant category, and Nautilus Inc ($NLS), which is an at-home equipment manufacturer, claims that the 2019 US home fitness hardware market was worth around $3,6B.

Peloton management has disclosed that there are around 35M at-home treadmills in the U.S and several million stationary bikes while nearly 5 million threads and 1.6 million stationary bikes are sold every year in the USA.

As you can tell people clearly wants to exercise at home; the main issue is that akin to the gym experience, at-home fitness was a really bad experience for the majority of people and these pieces of equipment(treads and bikes) were effectively clothe hangers. For most people sticking to a fitness routine is complicated, we tend to get bored and we do not enjoy the experience as working out is hard.

Without discipline, motivation, and good habits it is difficult to overcome laziness. The main reason behind the boutique fitness "boom" is that it provides a better experience that encourages people to exercise, rather than a tedious chore.

Connected fitness combined the experience of a fitness boutique class with the convenience of at-home exercise. Video workouts and fitness apps became commonplace a couple of years ago but the category did not take off until the emergence of vertically integrated offerings that provide a better user experience. Seen from the outside, connected fitness may seem a fad; why would someone buy an expensive piece of equipment when they can use a cheap indoor bike while watching a spinning class on Youtube? But I think at-home fitness will follow the same steps as its outdoors counterparts (from convenience to experiences) and it will increase the TAM(4 out of 5 Peloton customers were not previously involved in the fitness equipment category ) as more people embrace exercise around the globe.

The first wave of at-home fitness was built DVD workouts (P90, Tae Bo, Jane Fonda) and cheap hardware equipment to exercise from your own home. In the next decades companies like Fitbit, MyFitnessPal or Runtastic attempted to combine fitness and technology by giving us better insights and measuring our activity (the measured-shelf), the second wave of fitness will be marked by content, community, and curation.

This second wave, led by companies like Peloton is structured around community and competition as these devices try to replicate the boutique experience and allow people to have access to great instructors while recreating a "community" atmosphere. Unlike anything we have ever witnessed in the fitness industry, user engagement is trending up over time as users get "addicted" to the experience. Connected fitness itself is not a fad, given that technology is now being used to enhance the training experience in an integrated approach. The majority of connected fitness equipment is replicating traditional cardio machines that have been around for decades like rowing machines or stationary bikes, but some companies like Mirror (picture above) have ventured into bolder areas whose popularity may be short-lived as the use cases are more limited.

Space limitations, personal preferences, and the overall at-home fitness experience will put a cap on the industry growth prospects. On the other hand, for the first time in decades, we are witnessing a new wave of innovation in fitness hardware equipment that will improve the at-home fitness experience. Tonal (picture above) is the first connected device that employs digital weights(these weights vasty reduce space requirements and I am confident it will be cheaper at some point over the next decade than a traditional home gym), it tracks and selects the weight for you, and accurately measures your output and range of motion. The early versions of these devices are expensive but technology will evolve, the hardware will get cheaper and both user experience and functionality will improve.

Jeff Bezos thinks that figuring out "what's not going to change in the next 10 years" is of crucial importance. I think over the next decades, consumers will want more convenience and a better user experience, and connected fitness will improve both and encourage millions of people to exercise for the first time in their lives.

It still amazes me that a category that has barely changed over the past 50 years, will experiment a tremendous transformation over the next decade. Subscription revenue will enable a better user experience as engagement is now a priority, the fitness category has been under-served by technology for many years and we are in the early innings of a multidecade trend that will get people off the couch.

3. Peloton

"It’s not about a good body, or sick pack abs is about being a good father or good professional or a better version of yourself because you have fitness in your life "

John foley

History

Peloton was founded in 2012 by John Foley and its former colleagues Tom Cortese, Hisao Kushi, Yony Fend, and Graham Stanton. Foley envisioned an indoor bike with a tablet attached to it that could stream spinning classes live or on-demand, making it easier for busy people to take indoor classes with the best instructors anytime, the bike would show output data allowing users to benchmark themselves by looking at the leaderboard.

John and his wife Jill were avid customers of boutique fitness studios like cycling and boot camp and he sought to recreate this experience from the comfort of his home by creating an internet-connected fitness bike.

"These classes left us feeling energized, refreshed, stronger, and ready to take on anything. However, with demanding jobs and two small children at home, just getting to the gym became harder and harder. Classes with our favorite instructors sold out quickly and were prohibitively expensive. We also had to accommodate someone else’s schedule at someone else’s location. And we were often left without time, without options. I figured that there must be a way to make these workouts more convenient, more affordable, and more accessible"

The early days were rough as nobody believed that the company could work. "In Peloton’s infancy, our lean founding team operated from a one-room headquarters with heavy black curtains that cordoned off a makeshift cycling studio, equipped with a modest six bikes and a used camcorder"

After raising $400,000 in seed money, the team built a prototype and by the end of 2013, the company raised more money and was forced to do a Kickstarter campaign.

As Inc magazine states "The prototype bike arrived in early June 2013. It was horrible. It wobbled, recalls Foley, a lot. For a Kickstarter video, you can fake it, so we faked it," says Foley. It was a high-anxiety time when you're trying to sell something that isn't ready to be sold. Eventually, the manufacturer fixed the production model by reinforcing the legs". After 7 years of crushing dilution Peloton IPOed in September 2019 at $29 per share, the offering raised $1.16B valuing the company at $8B.

In December 2019 the company experimented its first public scandal. A Peloton holiday commercial called "The Gift that Gives Back" where a man gives a woman a Peloton bike got viral and many social media users criticized the commercial for being sexist and classist. As the Guardian wrote, "Critics called it offensive and dumb, pointing out that the woman was already slim at the start and the implication that her partner thinks she needs to get fitter and lose weight was patronizing and damaging”. Ryan Reynolds quickly followed up with an ad called "The Gift that doesn´t give back" for its gin company (recently sold to Diageo for $610M).

I think the whole controversy around the Peloton ad encapsulates all of the preconceived notions about the fitness industry. Fitness is often associated with miraculous weight loss transformations, fads, and gimmicky products. It is therefore understandable that there is a great level of skepticism built around new fitness products but Peloton is a breath of fresh air that will become an antidote against traditional fitness.

Business model

"So we are the best cardio machine on the planet, who cares? . The bar is very low in fitness equipment. There is been almost no innovation in the fitness equipment category for 40 years "

John Foley

Peloton sells connected fitness products that include two stationary bikes and two treadmills that stream live and on-demand classes through a 22-32- inch touchscreen. The products run a custom Peloton operating system, built on top of Android.

Peloton Bike ($1895): this was the first product ever built by the company and it was launched in 2014. In September 2020 Peloton dropped the price of the original bike from $2245 to the current sum while releasing a higher-end model.

Peloton Bike+ ($2495): launched in September 2020 features a rotating display and a digitally controlled resistance allowing members to "Auto Follow" the instructor´s guidance.

Peloton Tread ($2495): announced in 2020 as a lower-cost option of the original treadmill, it has already been launched in Canada and the UK. Due to safety issues, the product has been voluntarily recalled and management hopes that it will be reintroduced in July 2021. (the product has not been launched in the USA yet).

Peloton Tread+ ($4295): launched in 2018 was rebranded as Tread+ when the lower cost treadmill was launched.

Moreover, Peloton sells its own apparel and partners with bigger brands such as Adidas.

To get access to the Peloton offering, members have to pay a monthly subscription fee that allows them to watch hundreds of new live and on-demand classes per month across many fitness verticals with numerous software features such as leaderboard, challenges, and real-time or historical metrics.

All-access membership/Connected Fitness subscription ($39 per month): available to hardware owners that will be able to have multiple accounts within the same subscription (if any given family has a bike and a treadmill they will only pay one membership). On average Peloton had 2.3 members per connected fitness subscription as of June 2020. All-access members can use a digital app to supplement their workout regimen whenever they are away from their bike/tread and as of June 2020, 67% of connected fitness members used the app.

Digital membership: ($12.99 per month): Peloton launched the digital app as a standalone product in June 2015 at an original price point of $19.5 per month and in December 2019 slashed the price of its digital offering. Peloton digital app is available for anyone regardless of whether they purchase a bike/tread or not and it is a standalone app that can be accessed through the phone/tablet/TV or web.

The cheaper digital offering for non-hardware owners only allows 1 user per subscription and provides an intentionally worse user experience ( not output tracking, or leaderboard) that helps Peloton attract new hardware buyers. The digital subscription has a 4.9-star rating and allows users with an existing treadmill or bike to try out the Peloton ecosystem.

Peloton´s content library includes a polished number of classes across many fitness verticals, class length, difficulty, music genre, or instructor along with several scenic rides. Peloton has launched the “artist series” and they are currently featuring 1 or 2 new artists per month, these are direct collaborations with artists where members will listen to several tunes from the artist throughout the workout. Integrations with Spotify or Apple music enable members to add new songs to their playlists.

Peloton´s curation capabilities will improve over the years to showcase the best type of classes for every member based on their tastes and preferences. Global community features such as tags or working out with friends, performance tracking, and a polished user experience make Peloton an addictive platform for its members that are increasingly turning to Peloton to exercise.

The company has made significant investments in its NYC and London studios($50M each) where the classes are filmed, Peloton fans occasionally travel across the country to meet their favorite instructors and participate in a live class. When Peloton launches in another country they hire local instructors (Germany or UK) and the company has recently hired its first Spanish instructor. In June 2020 the company had 33 instructors across different verticals while expanding its class offerings including concepts such as yoga and meditation and strength.

Peloton has a vertically integrated model, the company designs and manufactures the products, develops the software, hires the instructors, markets the equipment with more than 95 showrooms, delivers and assembles the final product to the customer.

"Whenever you order from Peloton a branded van pulls up and an athletic looking technician will come out of the van wearing Peloton apparel, he will introduce himself and the first thing he will ask is if you want him to remove his shoes before entering your home. The majority of technicians delivering Peloton´s products have their own bike at home as William Lynch lowered the price of the employee’s bike in order to ensure everybody could have their own"

Jamie Beck, VP Global Final Mile at Peloton

According to Jamie, delivery or repair surveys display a 4.92 out of 5 ratings amongst tens of thousands of surveys (some locations get up to 4.98), and in its relentless pursuit of 100 NPS (net promoter score) Peloton is striving to achieve perfect scores.

Litigation and Tread recall

In February 2020 Peloton settled a lawsuit filed by members of the U.S.’s music-publishing trade organization where the organization previously alleged Peloton was not paying for a significant amount of the music they were using.

In January 2020 the Company entered into a confidential settlement agreement with Flywheel and the cycling studio informed that they will no longer offer indoor cycling classes due to patent infringements. Some customers were eligible to trade their Flywheel Home Bike for a refurbished Peloton bike at no cost. (In September 2020 and as a result of the pandemic Flywheel Sports filed for bankruptcy and will permanently close its 42 studios) Peloton is currently involved in patent litigations with Icon Health and Echelon Fitness. Peloton does not rely on patent protection in order to sustain its advantages but they are legally defending their position against competitors who have released cheaper versions of their products and have blatantly copied many of its features( albeit their success has so far been muted).

In April 2021, the U.S. Consumer Product Safety Commission(CPSC) issued a warning for owners of the Peloton Tread+ exercise machine after multiple incidents. Peloton refuted the claims stating they were inaccurate and misleading. "According to the CPSC, many children became entrapped, pinned, and pulled under the rear roller of the product"

According to the Washington Post " There were an estimated 22,500 treadmill-related injuries treated at U.S. emergency departments in 2019 — including about 2,000 in children under 8 years old. The agency received reports of 17 deaths associated with treadmills from 2018 to 2020".

On May 5, 2021, Peloton and the CPSC announced the voluntary recall of both treadmills over safety concerns and the company decided to refund its customers. After 72 incidents and the tragic death of a 6 year old child, Peloton decided to stop the sale and distribution of both treadmills. The USA Tread launch was postponed until July (management estimates) and Tread+ could take longer as hardware modifications are required. Even though both treadmills are being recalled, the Tread+ requires hardware modifications( kids, objects, and pets pulled under the rear roller) while the lower cost tread has only had a handful of reports where screws loosen causing the console to detach from the unit. The latter involves a quicker fix that could be solved within a few months.

COVID-19

In April 2020 Peloton decided to temporarily pause live class production at their studios and resumed live programming from instructor´s homes on April 22. Peloton has been often depicted as a "COVID winner" as it has experimented a re-acceleration of its sales due to the pandemic. This spike in sales during the pandemic drove wait times for the delivery of some products at 2+months and in 2021 Peloton decided to invest $100M in air and ocean freight deliveries in order to alleviate supply concerns. OTD (order to delivery) times and supply capacity(has increased 700%) are now in much better shape and the company will ramp up marketing spend in the upcoming quarters ( marketing expenses had been more muted during the whole pandemic).

Acquisitions

Over the years Peloton has made several acquisitions in order to enhance its ecosystem; these are the most relevant so far:

2019: in October 2019 Peloton acquired Tonic Fitness Technology for $47M, a Taiwanese manufacturing company and they have built a second manufacturing plant. Tonic had been involved with Peloton since 2012 and they decided to acquire the company to invest and scale the supply chain while building differentiated manufacturing capabilities. Heavy R&D investments combined with vertically integrated manufacturing may yield outstanding results as Peloton will eventually introduce different hardware products.

2020: in December 2020, Peloton announced it had come to an agreement to purchase Precor, one of the world's largest commercial fitness equipment providers. The acquisition was completed on April 1, 2021, for $431M in cash. This is an opportunistic acquisition that will allow Peloton to establish a manufacturing base in the USA while bolstering its commercial channels(hospitality, corporate wellness, etc). Precor will operate as a business unit within Peloton and its president will be promoted to General Manager of Peloton commercial, the company expects to ramp up US-based production of Peloton bikes before the end of 2021.

2021: during the nine months ended March 31, 2021, the company completed three separate acquisitions.

Aiqudo Inc was acquired for a purchase price of approximately $58M, "Aiqudo had built an AI-powered digital voice assistant that lets developers add voice actions to apps and devices ". Prior to being acquired, Aiqudo was working on integrating its technology into head-mounted smart glasses worn by industry workers and Chinese electric carmaker, Byton had partnered with Aiqudo to power its "voice screen". David Patterson, former Aiqudo CTO is now working as Senior director of engineering.

Otari Studio was founded in 2019 by Chriss Kruger who currently works as an engineer in Peloton. The project started with an Indiegogo campaign and was trying "to build a smart exercise mat that used computer-vision algorithms to recognize how the body is moving in three-dimensional space, and then gives real-time feedback and improvement tips."

Atlas Wearables was working on fitness-oriented smartwatches, the company was founded in 2013 by Peter Li, who is now working in Peloton as the Director of AI and computing vision. This acquisition is fascinating as Peloton workouts "off the bike/tread" such as strength are heavily demanded. Peloton can not effectively track this type of workouts and a wearable device would enhance the overall experience. I was initially concerned about this acquisition as I feared Peloton would try to design a smartwatch, but after some research, I came to the conclusion that this is not a wearable you wear all day as it is designed to monitor training sessions, "watch sensors can track your motion and match it against a database of exercises to recognize the exercise you are doing", keep count of repetitions, rest times and remember last used weight. Recent updates such as the strive score can give us a hint about Peloton´s ambitions off the bike.

Otari and Atlas were acquired for an undisclosed sum (less than $78M as PeerFit intellectual property acquisition is also included).

“We’re going to make it irresponsible to not have a Peloton membership.”

John Foley

It seems obvious to me that both Otary and Atlas would be integrated into the Peloton offering (as Peloton already sells workout mats and a poor-designed heart rate monitor) to improve both Bootcamp and yoga experiences. In its quest to improve the fitness experience Peloton will keep adding hardware that interacts with its software offerings constantly enhancing the value proposition. Peloton´s ecosystem ambitions are very clear as Foley has stated numerous times that they want to be everything(fitness related) for its members for $39 per month.

TAM and Strategy

"Why wouldn't everyone want better fitness at a better location at a better value? Of course, there's a market for that. But they were saying, Show me the research report that says people want a $2,000 stationary bike."

John Foley

According to the IHRSA, the average monthly dues paid across all health club facilities were $51 and $90 amongst boutique studios. The average gym member spends around $550 per year but there is a long tail of spending that skews the average as 31% of health club members or 20M Americans pay more than $50 in monthly dues.

Moreover, Peloton management has stated that there are more than 35M households with treadmills at home and over 5 million treads and nearly 1.6 million stationary bikes were purchased annually (tread market is almost 3 times bigger and Peloton has not even released their mass-market tread in the USA yet). The bar for fitness equipment was very low and the experience was even worse than the gym so it is not unreasonable to expect the TAM for connected fitness will be much bigger than the at-home fitness market. According to a 2019 member survey "4 out of 5 Peloton members were not in the market for home fitness equipment prior to purchasing a Peloton Connected Fitness product".

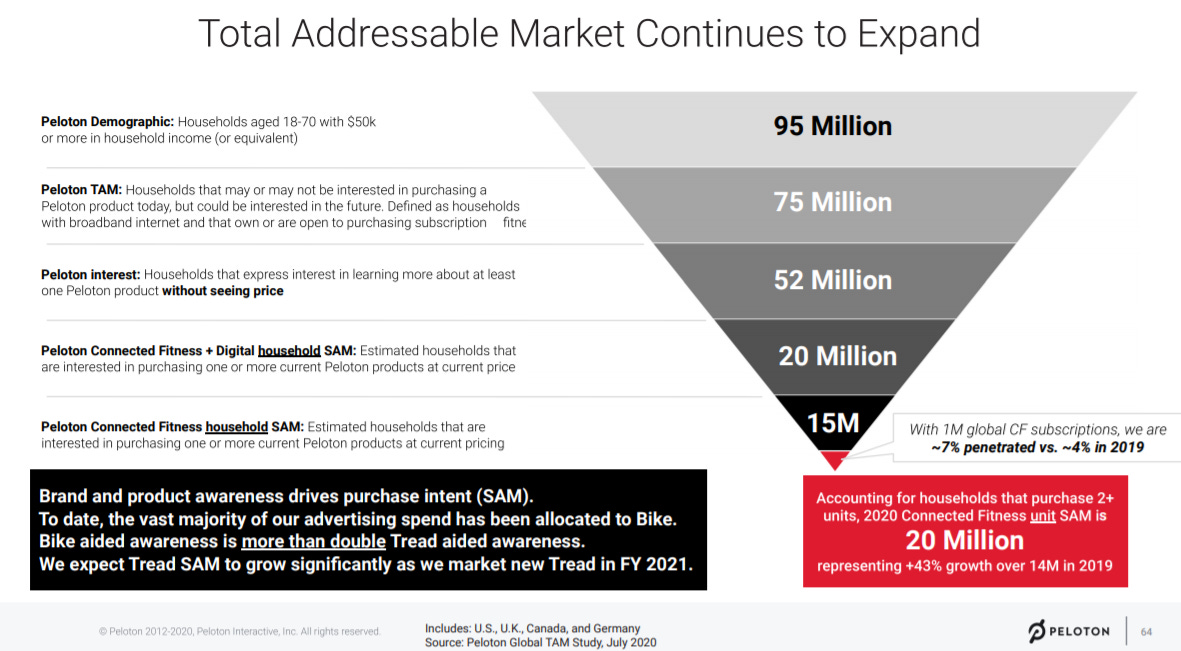

In its IPO filings, Peloton came up with a 14M SAM (serviceable addressable market) that was increased to 15M in 2020. Considering the tremendous growth of the fitness boutique industry, a stagnant but meaningful at-home fitness market, and an increasing willingness to pay for fitness I think a 15 to 20M SAM (with the current product offering )is quite reasonable. As they expand to more countries and launch new products while decreasing the price of its existing platforms I expect the SAM to meaningfully increase.

With the mission "to connect the world through fitness, empowering people to be the best version of themselves anywhere, anytime" Peloton does not want to remain a luxury product and as Alex Toussaint (Peloton senior instructor) frequently states "No one is getting left behind, Peloton is for anyone who wants it"

In the long term John Foley said he would be surprised if Peloton didn't have a rental option in place "it is not something you are going to see in the next year but I love moving in that direction, It´s all in the name of affordability for our members". I think Peloton will further reduce prices in the future in order to democratize access to its equipment (in the early days the bike used to cost $1200 and when prices increased sales went up as consumers perceived the product as a quality bike).

The $39 monthly fee has been described by Foley as "sacrosanct", as the company wants to improve its value proposition in order to ensure that people will not need a membership outside Peloton. The management has stated that the goal is to have 4 or 5 fitness platforms that are instructor-led, music, and socially driven. What initially started as a bike to democratize access to boutique fitness classes will transform into a multiplatform fitness ecosystem that will radically improve our approach towards fitness.

Foley has a clear vision of where the company is headed. “It’s called ‘fitness as a service.’ Everyone is going to pay $100 or $200 a month to have the best fitness equipment in their home. And whatever combination of devices you have, we’ll always be upgrading them. We’ll come in and swap out the latest bike or the latest treadmill or the latest something else to make sure you always have 10-out-of-10 equipment" in June 2020 only 2% of connected fitness subscribers owned both a Bike and a Tread but this could meaningfully increase in the future.

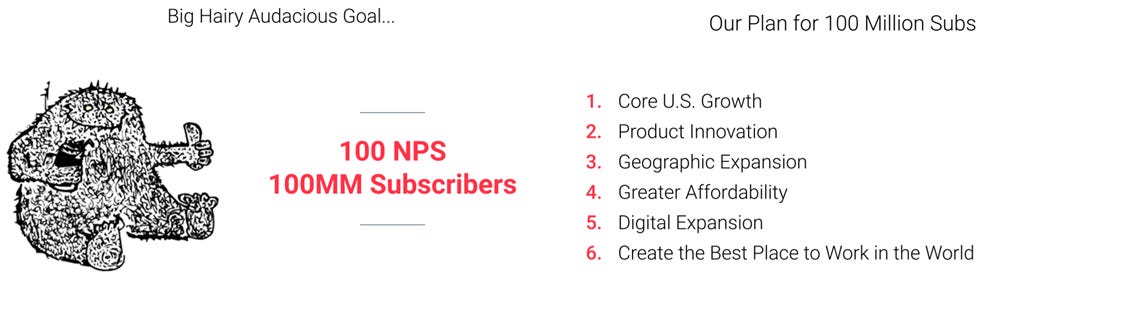

Peloton has audacious goals (100M subscribers) and in order to get there, they are focused on growing its core markets, internal expansion, and launching new fitness equipment.

"Now is just execution risk and now we are going to show people how we execute"

John Foley

Management expects to launch its lower price Tread into the US market in July 2021 and given that the Tread opportunity is multiples bigger than the bike platform ( and most of Peloton´s connected fitness subscribers are bike customers), I think the lower cost Tread will be the next leg of growth for the company. On the international landscape, Peloton announced its expansion to Germany in late 2019 and it will launch in Australia in the second half of 2021; current markets in NA(Canada and USA) and Europe(Germany and UK) represent nearly 50% of the gym memberships population and after hiring several British and German instructors in 2020 Peloton recently hired its first Spanish instructor in April 2021( Mariana Fernandez). I think that it is only a matter of time before Peloton announces its expansion to additional countries.

Peloton now has several R&D facilities and they are heavily investing in new products and the company has will be releasing new platforms over the next years.

"I think about 4 core ways of getting cardio: cycling, running, rowing and swimming. Those have been around for decades, if not centuries, right? We're not making a swimming machine"

John Foley

Besides cardiovascular exercise, muscle-strengthening activities are essential to stay healthy (WHO recommends 2 or more days a week of strength training involving all major muscle groups) and even though there are disciplines that barely require fitness equipment ( such as calisthenics) it seems to me that strength training will require dedicated hardware.

Strength content is Peloton´s fastest-growing vertical but current offerings are limited to bike/tread Bootcamp (alternating cardio intervals on the Bike/Tread with strength work on the floor) and floor content with dumbbells however, the company is committed to "win" strength even if that includes the development of new hardware and in August 2020, Peloton posted a job offering for a “VP of Product Marketing for Peloton Strength”, moreover Sam Bowen, who previously was hardware VP in Tonal (for over 2 years) is currently working for Peloton.

With more than 15,000 locations all over the world, Crossfit is one of the most popular fitness boutique strength concepts, and even though this experience may be hard to replicate at home, I think Peloton will be able to recreate the bike´s success over different platforms while enhancing the value proposition for its members.

Value proposition

"We want to make our products even more affordable than they are today. Right now our bike is just over $2,000. But it’s $58 a month [for a 39-month, interest-free loan that covers the cost of the bike]. $58 a month divided by two people who are going to use it. Maybe even three people in your home. If we can get those monthly payments down, we can really open it up. And we want everyone in every socioeconomic class to be able to afford Peloton. That’s a big focus for us in the coming years.”

John Foley May 2020

In order to enhance the accessibility of its products, Peloton has partnered with several financing companies such as Affirm and currently offers 39 months 0% interest financing (Peloton covers the costs). If members qualify for the financing program, they can pay the equipment in 39 payments due every month on top of the $39 monthly subscription fee (not included in the image below). After the bike price reductions in September 2020, the monthly payments for the 39 months loan are the following:

Around 50% of Peloton´s products are financed and the company offers a 30 day home trial period, ( customers can return the bike after that period if they don’t want to keep it) these two factors have enabled more people to buy the equipment and less affluent households represented 46% of bike customers in 2020 vs 29% in 2014.

The financing program changed the perception of consumers and instead of having to deploy nearly $2,000 on the bike, customers can pay it in equal monthly installments. Peloton´s offer is quite attractive for a big number of households as the all-access membership available with the fitness equipment allows customers to have up to 5 user accounts. In 2020 Peloton had an average of 2.3 users per household.

The $49 bike installments plus the $39 monthly subscription fee equals a $88 monthly payment that comes down to $39 after you pay for the equipment ( in 39 months) and for a multiuser household Peloton can be even cheaper than a gym membership. However, the fitness equipment is still quite pricy and I think the increased scale will help Peloton reduce prices in order to pass savings to the consumer, effectively broadening the addressable market.

As of June 30, 2020, 67% of the Connected Fitness Subscription members used Peloton Digital (the peloton app that members can use when they are away from the bike) to supplement their workout regimen, and in 2020 38% of workouts completed were across non-cycling fitness verticals. Digital workouts include indoor/outdoor running, walking, boot camp, strength, stretching, or yoga.

As members complete more non-cycling workouts, engagement has risen (and newer cohorts are working out more) every year, and in 2020 connected subscribers completed an average of 18 monthly workouts. While this number seems high there are 2.3 members per connected subscription and there is some workout inflation as new categories had been introduced( 20 min bike class followed by a 10min stretching and a 10 minutes yoga class count as 3 workouts). Nevertheless, it seems reasonable to conclude that members enjoy Peloton´s offering and the value proposition of the $39 monthly membership continues to improve( management has stated that the more content modalities any given member is engaged with, the stickier they are).

In 2020 Peloton disclosed that the number of members that had gym memberships have steadily decreased over the years(from 60% of the members a few years ago to 50% around two years ago, reaching a new low in early 2020 at 40%) and I think it´s safe to conclude that the company is not just a bike for its customers who are finding in Peloton a substitute to their gym memberships. As more content is added to every vertical, the value proposition of the subscription will keep rising for its customers until it will be foolish not to be a Peloton subscriber.

The charts above help me reach another important conclusion, customers are actually working out!!

Engagement is the most important factor to monitor in the future as Peloton helps people exercise and stick to any fitness routine. Unlike low-cost gym chains Peloton has achieved the impossible, beating lethargy and improving the life quality of its customers. User experience is the reason behind the rising engagement numbers and that is why alternatives like Playpulse (that lets you play games and watch Netflix while cycling) will never succeed as working out is hard and customers need to be encouraged to do their best work. Peloton wants their members to be fully immersed into their workouts and that is why the pause button feature took so long to be released ( I think this feature created an internal debate in the company).

For outdoor runners or people that consistently go to the gym several times per week, Peloton would seem like a pretty bad idea but if you have a great understanding of human nature and fitness history the perception of the business radically changes. So whenever we think about Peloton´s alternatives such as the gym or jogging, we must take into account both convenience(gyms have succeeded mostly due to convenience factors as most people dislike the experience) and user experience ( engagement follows user experience as most people get bored or do not stick to any given routine for a long period of time).

User experience

"If your Peloton bike becomes a clothes hanger, we have failed as much as you have”

John Foley

I deeply believe in the "premiumization" of experiences. Our day is composed of hundreds of experiences and if any given company is able to improve a relevant aspect of our life for a reasonable (but higher than other alternatives) price, we will eventually make the transition towards its products or services ( this is a broad description and usage and relative price points usually dictate the level of adoption). A couple of weeks ago, a friend of mine told me that Spotify made her a bit happier every day and that the $10 subscription fee was "money well spent" and while at $1895 for the bike on top of a $39 subscription fee Peloton is quite pricier, I think in both cases the user experience is the defining factor.

While watching yoga classes on YouTube and going for an outside run is certainly cheaper, the user experience in fitness is especially important because it could be the difference between consistently exercising or not (some users love the service so much that have gotten Peloton tattoos and there are several podcasts devoted to the brand). From this point of view Peloton´s price looks quite reasonable and if we only stick to rational arguments boutique fitness should not exist as they are an overpriced way to exercise, but the reality is that consumers love them (and the best way to lower CAC is love)

I think the founders of Club Intel (a consumer insight firm serving the fitness industry) accurately describe this trend, "the first storm was the arrival of the budget operators, with their low-price value proposition leaving an indelible mark on the industry. If that wasn´t enough, a second – equally destructive – storm then emerged: boutique fitness studios. The boutiques represented an entirely different innovative disruption – one that leveraged a very different capitalistic principle. Whereas budget clubs were an innovation that industry players could understand (all things being equal, the low price offering will win), boutique fitness studios were defying industry wisdom by saying you could get people to pay more for less". However I think consumers are not actually paying more for less because fitness boutiques make them want to exercise.

While other equipment manufacturers can create similar hardware, user experience is harder to replicate and will become better and more defensive as more products are released. As Ben Thompson describes in this great piece, "business buyers care about getting all the features they need at the lowest possible cost, consumers care about user experience, and how a product makes them feel". Moreover, users cannot easily compare user experiences( not quantifiable) and the experience can never be too good as engagement can keep increasing; so having a better user experience could mean that your service is cheaper for the consumer ( even though it costs more money) as people enjoy working out and become active; as the saying goes "the most effective workout is the one you do".

For the first time in history, incentives are aligned and there is a company whose sole focus is providing a better training experience so you want to exercise even more, as Thomas Cortese states "Our job is to build software that disappears and we are incentivized, as a business, to get you to work out more every single day, every single year"; Peloton is therefore in the game of delighting their customers.

Peloton stores all your historical workouts and reams of data, so you can easily track your progress. Members celebrate PR(personal records) or achievements such as their 100th ride and while you taking a class, the leaderboard allows you to filter by a number of variables (age, tags, gender, or people you follow). The company has steadily increased its content offerings across many verticals, difficulty levels, length, music genre, and instructor( in an IGTV live stream Selena Samuela hinted at the possibility of new classes such as boxing) and while new content offerings without dedicated hardware are somewhat limited, Peloton´s members are effectively working out across a diverse number of verticals.

With the motto of putting members first, Peloton listens to its members and is constantly asking them about new ways of improving its offering. The company has implemented a great number of suggestions from its FB group or Reddit members. Tailored content recommendations and an increasing number of personalized features will only improve the user experience in the long term. As the overall experience improves, customers work out more often and Peloton´s engaged community does the "heavy lifting" by telling the company new features to implement which reinforces the experience.

Unlike airlines or hotel chains where the experience is not as good, Peloton's experience is outstanding and instead of building loyalty, they focus on delighting its members. "The retention team helps curate goal-based challenges, awards digital badges for Member accomplishments, collects and responds to feedbacks about the platform in social platforms and sends Peloton-branded Century Club shirts after a Member’s 100th class". Peloton organizes several in-person events throughout the year including welcoming members for workouts, milestone celebrations, and instructor meet-and-greets at their production studios in New York City, and once a year the company celebrates "Peloton Homecoming" which is their flagship event.

Akin to Spotify´s year in review, Peloton created "The Cooldown for 2020 that allows members to create a personalized overview of their year, in the form of a 1-minute video, that can be shared across social media"; special live classes such as Turkey ride ( in thanksgiving) are taken by tens of thousands of members( the annual Thanksgiving Day Turkey Burn live rides led by Robin Arzon and Alex Toussaint had a combined live audience of over 88,000 members).

In 2020 Peloton teamed with the ESPN for an All-star ride and 16 pro athletes from various disciplines competed in two 20 minutes classes. After the event, the rides were made available to members in order to see how they compare against the pros. In May 2021 Peloton announced the champions collection that features 9 different pro athletes such as Usain Bolt or Allyson Felix and members were able to ride along with Usain Bolt in a 30 minute ride. Akin to Nike-sponsored athletes, this type of marketing benefits from scale advantages as there is a finite number of world-class athletes in the world and an upcoming competitor would struggle to secure these types of contracts. (the ability to occasionally race against Bolt would be a great marketing campaign for the USA launch of the new Tread).

Seasonally themed content, events, software updates such as target metrics and new features such as sessions (that allow members to take pre-recorded classes with a synchronized start time, providing them with a live leaderboard experience) artist series, or stacking classes are just a few examples of how Peloton is trying to improve their member´s experience.

Peloton´s software can and will be replicated but the company will continue making technological experiential gains as its competitors replicate their older achievements and as their Q1 2020 letter states, "we are just beginning to scratch the surface on both platform personalization and fully utilizing our substantial data assets to drive class recommendations and product development with the goal of deepening our Member engagement over time"

For example, the new programs revamp announced in the "Homecoming" 2021 event is leaning towards the democratization of personal training (collection of classes designed by instructors to help you reach a specific goal).

Community

"The level of emotional loyalty that our members have with the brand with our instructors, and with one another is so beyond what I’ve seen anywhere else in my career"

Brad Olson, Peloton Chief membership officer

Peloton´s cultish community counts with more than 424,000 members in their FB group that actively share their stories or suggest new features. After a few hours scrolling through the group posts, it is reasonable to claim that Peloton is a social experience with a deeply engaged community.

Peloton benefits from some sort of network effect as the community strengthens over time when more users join. Leaderboards, special events, tags, and the ability to simultaneously take a live class with a friend and race against him create some degree of interaction network effects that improve the overall user experience. Comparisons with social networks such as Instagram are misguided as Peloton has fewer and lightweight (so far) social interactions, however, the community plays an important role in the overall user experience and the purchase decision process ( you are more like to buy a Peloton if your friends also have one). As Robin Arzon once claimed during a live class, "if anyone ever doubts that this is more than a bike, I would invite them to look again".

There have been numerous companies such as Fitbit that have miserably failed to establish some sort of interaction network effects as their core value proposition was built around a "single-player tool" while other companies such as Strava have successfully pivoted towards social interactions.

As Chris Dixon beautifully explains: “A popular strategy for bootstrapping networks is what I like to call “come for the tool, stay for the network, the idea is to initially attract users with a single-player tool and then, over time, get them to participate in a network. The tool helps get to initial critical mass and the network creates the long term value for users and defensibility for the company".

Strava initially focused on analytics and performance measuring tools and eventually offered ways to compare performance and compete on certain rides.

Humans are by nature, social animals, and social interaction and the sense of community have always been a core aspect of the boutique fitness value proposition. Despite being an at-home fitness product, Peloton´s community closely emulates the boutique fitness experience since the value proposition was always thought of as a network instead of a "single-player tool". Tags allow the creation of smaller groups with similar goals( or similar age/gender etc) that encourage each other and while the social aspect of the platform is quite basic yet it does not seem unrealistic to believe that smaller communities will be created within Peloton given the importance of fitness in our lives.

Celebrities, athletes, and musicians that don’t want to be barraged at a studio class such as Beyoncé, Ellen DeGeneres, or Rory Mcllroy are avid users and amplify these network effects as millions of people would like to join them in a live class (the possibility to workout alongside professional golfer Justin Thomas would be invaluable for some people). Peloton is aware of this phenomenon and they intentionally cultivate their community (special guest filters).

Instructors

"Your responsibility on the bike way transcends dropping some pounds "

Alex Touissaint

Peloton instructors are heavily involved in the recruiting process of their colleagues (Cody Rigsby recruited Ben Alldis who is a former private equity investment analyst), and the audition process lasts more than six months. They get compensated with top-notch salaries( 3X or 4X times better than traditional studios that also include Peloton equity). Once a new Peloton instructor is announced, his social media followers skyrocket and Peloton tries to cultivate their profiles with special interviews ( Ally love recently interviewed Usher) while allowing them to pursue other ventures (Cody was recently featured in the new GM ad and Emma is an Under Armour model). Becoming a Peloton instructor is an aspirational goal for many people and while some of them agglutinate a big portion of the audience( Alex, Ally, or Cody) and losing any of these heavyweights would be a tough pill to swallow, Peloton does not depend on any given instructor in order to sustain its platform. Former instructors who are no longer in the spotlight, like Jennifer Jacobs have seen their followers stall after leaving Peloton (celebrity fades quickly when you are not in the public eye).

Unlike other "competitors", Peloton has a dedicated page for its instructors, and some of them have reached "celebrity status" having several fan pages. Instructors are treated like professional athletes and Peloton has hired around 40 instructors that appeal to a broad audience and attend to showroom openings or member-focused events. Unlike most fitness companies, Peloton instructors are at the center of the value proposition because they motivate members to work out.

Commoditization fears

Peloton has a very profitable business model (outstanding unit economics) and some people fear that competitors may replicate its success. While the hardware is easier to copy (a bike with a tablet attached) software and a vertically integrated user experience are harder to replicate.

Peloton´s competitive advantage does not consist in selling a bike with a tablet but rather in providing an addictive user experience to its customers. This user experience is vitally important and for many people, a marginally better experience could mean the difference between a sedentary lifestyle or embracing fitness. User experience can never become too good and it is constantly improving in line with member´s recommendations. While some argue the user experience could eventually be replicated, Peloton's advantage is not static and they are constantly improving its offerings so that potential competitors will eventually need to replicate a fitness ecosystem. (with new hardware additions such as wearables or yoga mats that closely interact with the software).

Given content is not particularly expensive to produce, scale advantages are not insurmountable (Peloton already has +60% subscription gross margins and has hired 40 instructors that produce content for millions of people), however not only competitors will need to invest in great content across many fitness verticals but also in personalized class recommendations(tailored to each member´s past workout activity) community features and special events. Moreover, all content is not equal, and marginally better classes could meaningfully improve the experience.

Echelon (a fitness equipment manufacturer) is playing copycat and they are selling cheaper versions of some fitness products (such as Mirror or Peloton bike) and while the equipment is certainly less expensive their offering provides a worse user experience and has not got meaningful traction. Other companies such as Nautilus ($NLS) are pretty desperate, having to advertise the fact that their bike can be hooked up to a Peloton subscription (on a tablet, because Peloton does not license its software)

It seems that it will be very difficult to catch up with Peloton on the software side, which will eventually give them advantages in hardware ( Peloton will have better equipment as they are investing more into R&D and they can afford to sell their equipment at a lower margin because they benefit from subscription revenue streams), as Peloton builds its ecosystem, and keeps releasing new content under the $39 subscription, their advantage will only increase.

Peloton has leveraged a profitable subscription business ( their $39 all-access subscription) in order to build their lower-cost digital offering ($12.99) as they are currently running the digital business on a break-even basis, allowing them to acquire new users that could eventually buy their fitness equipment and subscribe to their all-access membership that provides an intentionally better user experience than the digital app (more features and integrations).

In 2019 Citron published a bearish report on Peloton that can be summed up in two paragraphs

"It can be argued that competitors in the hardware space have used their second mover advantage to create better spin bikes that have swivel screens (e.g., allowing mat exercises), open platforms (e.g., allowing users to watch TV or Netflix while they are riding the bikes), and iPad attachments. None of these features are offered by Peloton"

"Although the person is not a fitness enthusiast, they choose to pay $12.99 a month instead of the plethora of free content on YouTube"

I think this encapsulates a lack of understanding of Peloton´s advantages because the main point of having a Peloton is having the experience, not the actual bike and the company only wants you to purchase their fitness equipment in order to be able to offer a better (integrated) user experience. By having Netflix on the bike Peloton would not only go against its own mission ( empowering people to exercise) but the user experience would certainly be worse given that consumers would not be engaged in its training and would perceive exercise as a chore.

While purchasing the fitness equipment will remain as an aspirational goal for some people, (at the current price point) the company allows non Peloton equipment users to enjoy the experience(slightly less engaging than the all-access subscription). Consumers (mainly non-fitness enthusiasts) not only will pay for a curated selection of polished training content but 10 to 20% (management estimates) of the Digital app users eventually buy the fitness equipment as they seek a better user experience.

Comparisons with hardware manufacturers such as Fitbit and GoPro are therefore misguided given that hardware is not that hard to build but integrations are what really make an engaging experience. Consumers, therefore, choose Peloton´s products for non-quantifiable factors (user experience) that eventually translate to quantifiable outputs (engagement or number of workouts).

As I tried to explain throughout the article, Peloton´s competitive advantage lies in a superior user experience formed by tight vertical integration, a constantly evolving software, and a deep community that makes a fitness ecosystem that will be hard to replicate.

Quantitative metrics

"Every person you talk to will say, what happens to Peloton after Covid, people think it’s dark clouds on the horizon for Peloton. That pessimism and disbelief in us fuels our fire and there are still so many naysayers that we are excited to prove wrong"

John Foley

Peloton ends its fiscal year in June and has two revenue streams, products, and subscriptions:

Connected fitness products revenue consists of sales of fitness equipment and apparel( $15M in 2019). Revenue is recognized net of returns, discounts, and third-party financing programs (such as Affirm).

Subscription revenue includes revenue generated from the $39.00 Connected Fitness Subscription and $12.99 digital subscription and as of March 31, 2021, nearly 100% of customers were paying month-to-month. Peloton´s digital app is a great offer to introduce new customers to the Peloton ecosystem and management has stated its desire to start marketing the standalone app. It is worth noting that more than 90% of Peloton´s connected subscribers are bike customers.

The digital subscription serves as a CAC (customer acquisition cost) channel and management has stated that 10% of the digital subscribers eventually became connected fitness purchases within a year or two. In February 2021 management claimed that the 10% conversion number had been increasing and they are now seeing that over 20% of Digital subscribers eventually upgrade to Connected Fitness. Given the rapid growth in Digital subscribers (from 177k to 891k in 2021)I think this is extremely positive.

Product gross margin has recently decreased due to higher shipping costs as a result of the pandemic (freight investments in order to reduce order to delivery times) and the original Bike price reduction, I expect them to pass along scale efficiencies to the customers(as they have done with the Bike) in order to increase the total TAM. Peloton unit economics are so good that the CAC ( S&M per net add) of acquiring a new customer is fully paid with the gross profit of the equipment sold ( this figure has turned negative in 2020 implying that Peloton earns money when acquiring customers without taking into account the profitable subscription revenues).

Subscription revenue earns a high margin given that costs associated with content creation such as studio rent or instructor costs benefit from great operating leverage. Music royalty fees are the largest subscription variable cost and subscription gross margins reached 62% in 2021. Subscription contribution margin which excludes D&A and stock-based compensation expenses reached 68% in Q3 2021 as the margins are burdened by two expensive and brand new studios ($50M each) in NYC and London and I think subscription gross margins can get up low-70s close to incremental margins an in line with management expectations of +70%.

Cash flow generation has remained muted as the company does not show profits under GAAP accounting metrics. The truth is that GAAP accounting should be interpreted as Peloton invests through the P&L statement. Razor-thin(or negative) EBITDA margins hide a tremendously profitable business as G&A benefits from significant operating leverage (this is a "quasi" fixed expense) and the (+70% contribution margin) subscription revenue stream will become a higher percentage of the total revenue. Moreover, GAAP accounting is not very useful when assessing subscription-oriented business models as the company has to make an upfront investment that has to be immediately expensed (customer acquisition cost) but will yield a +13 year revenue stream (subscription).

In 2021 Peloton closed a $1B 2026 0% convertible debt offering (conversion price around $240 which represented a 65% premium in February) and has a net cash position with over $2.5 B in cash while investing close to $200M in R&D in 2021, a figure that has increased at a rapid pace in order to sustain new products releases and software improvements and Peloton has stated that R&D expenses will reaccelerate reaching nearly 10% of revenue in Q4 ( around $90M). This sheer amount of investment is mind-blowing for an industry where big manufacturers such as Nautilus were previously spending $15M and it seems reasonable to underwrite that Peloton will be at the forefront of innovation in fitness equipment.

Peloton measures engagement as average monthly workouts per Connected Fitness Subscription to (a workout is measured as a Connected Fitness Subscription for Members either completing at least 50% of an instructor-led or scenic ride or run or ten or more minutes of “Just Ride” or “Just Run” mode and this definition has remained stable since the IPO).

Engagement, which is one of the most important metrics of the business has increased at a rapid pace and even taking into account the increased number of fitness verticals ( there is some workout inflation because 64% of 2020 connected fitness workouts were cycling workouts vs 94% in 2017 and subscribers are likely working out across more verticals while doing shorter workouts) it is safe to conclude that all access subscribers are working out more, which honestly is quite impressive. Peloton has managed to "crack the code" and it is positioned to become the antidote to laziness.

Usage drives value and loyalty, Peloton´s annual retention rate hovers around 92% (annual retention is an extrapolation of their reported average monthly churn (excludes data from the digital app subscription) and there is no lockup as the majority of users pay by the month. Unlike "measured shelf" devices such as Fitbit (which had awful user engagement figures), Peloton customers are fully immersed in the experience which translates into the best retention metrics of the fitness industry. Moreover, there are few units in the second-hand market with great residual values.

Peloton has a dual-class share structure and the management team holds shares of Class B common stock that are entitled to 20 votes per share, it is also worth mentioning that Peloton has around 56M stock options (around 20% of basic shares) with a blended strike price below 11 dollars and diluted share count is close to 360M shares.

Often portrayed as a "Covid stock", Peloton has been rapidly growing since 2017 and recently reached 2.1M connected fitness subscribers (averaging 2.3 members per subscription) and while Covid has certainly reaccelerated the growth rate of the business(the company could not make bikes fast enough as demand skyrocketed), and has massively improved the brand´s awareness, the company will keep growing when the pandemic abates as it was doing before Q3 2020. The USA launch of the lower cost recalled Tread will be an important event for the near-term growth prospects of the company.

Culture and management team

With a long-term oriented culture, Peloton is obsessed with improving member´s experience.

In December 2019 Business Insider got access to leaked corporate documents that outlined Peloton´s strategy and brand positioning. Peloton is focused on making hard work enjoyable, keeping people motivated and in-distractable (the protagonist of the ads is always fully engaged and immersed in the class ) making people feel part of a community, and describing the "afterglow moment post-workout (the positive feeling that Peloton provides you after exercising). Fitness has been an industry plagued by myths and misinformation and I find this approach refreshing.

John Foley (49): John is the founder and CEO of Peloton. Foley holds B.S. in Industrial Engineering from the Georgia Institute of Technology and an M.B.A. from Harvard Business school and has worked as a production shift manager in M&M/Mars, as the CEO of Pronto.com and Evite.com(IAC subsidiaries), and as the president of eCommerce at Barnes & Noble, Inc before founding Peloton in 2012.

"I think I’m an OK leader and I think I’m not a very good manager because I don’t like to manage. I like to hire fantastic, hardworking, self-managed people and get out of their way"

Despite becoming a billionaire, Foley has remained very humble and he is masterfully executing his long-term bold vision. He has a tremendous understanding of the fitness industry and consumer psychology and he seems extremely hungry and driven. Jill Foley is John´s wife and she remains the VP of apparel.

Willliam Lynch (50): is the president and director of the company and he was the former CEO of Barnes & Noble. In 2017 John recruited William in order to "steer the ship" and in a 2018 interview, Foley said the William was a more mature and measure leader and stated the following:

“There aren’t that many entrepreneurs who like running a 12-person startup out of a garage and also have the leadership and management capabilities to run a $100 billion company, I want to be both. I believe I can be both, but I care too much about Peloton to risk it.”

Jill Woodworth (48) is the CFO of the company and she is an industry heavyweight that has spent more than 20 years of her career in IB at Morgan Stanley and JP Morgan.

Despite Barnes & Noble failure both Jill and William are disciplined managers while Foley (and Thomas Cortese) provide the strategic vision, creating a terrific management team.

"Our CFO does 99% of finance. I engage because I want to know how we’re doing. But to say I don’t add value to her operation is an understatement"

John Foley

Relevant executives include Thomas Cortese who is one of Peloton´s co-founders and serves as the Head of Product Development, he is the soul behind the product and the product team has a lot of loyalty to him. Even though he does not give many interviews he is a very important piece of the company, Mariana Garavaglia is another seasoned executive that was hired as Chief People Officer in June 2019 after 11 years at Amazon where she held various roles. Sam Bowen serves as the hardware VP after 2 years at Tonal (the connected fitness company) and I am sure he will be fundamental in order to "win strength".

Dara Treseder, Peloton's SVP, Head of Global Marketing and Communications, and Brad Olson, Peloton's Chief Membership Officer were recently featured in a Forbes interview, where they discussed the importance of intentionally cultivating the community and Peloton´s approach towards marketing and building engagement. I think Peloton truly puts members first and I really like the company´s approach towards building engagement and loyalty.

As of September 30, 2020, Foley owned around 18M in class B stock ( 6.4M class B stock and 11.7M options; 3.5M shares are pledged as collateral). Despite some minor insider selling, his stake in the company is worth around $1.5B and he has near 30% of the voting power(which I am absolutely fine with). Foley is a great believer in insider ownership and executives receive a generous compensation that is heavily weighted towards stock ownership (long term stock options represent the majority of the compensation figure), executive officers and directors have near 60% voting power ( insiders own around 60M shares and the majority of their ownership is tied to class B common stock and options that have 20x voting rights).

Far from representing a downside, the dual-class share structure will allow the founder to take bold decisions in order to execute his long-term vision.

4. Competition

" We have biggest and most supportive community in fitness and if we can have lower prices over time, we believe that the idea of us having a true competitor is going to be a waning idea, and we're going to be pretty hard to compete with"

John Foley

There are two types of connected fitness competitors, those who have designed equipment built around tracking and measuring data such as Tonal, and companies that built their value proposition around community and user experience with ecosystem ambitions. I think there are various companies that belong to the first category while Peloton has no like-minded competition in the latter.

Single-player companies

These are companies that have built a better and more convenient version of pre-existing fitness equipment. The defensibility of these companies will depend on their ability to recreate an online community or integrations with other fitness equipment, therefore creating a "fitness ecosystem". While some of these companies greatly improve the user experience, they do not address the most important problem in the industry; motivation and eagerness to exercise as working out is hard, and if we are not properly incentivized we tend to lethargy.

Even though these companies have built great measuring tools with new and innovative hardware, I think they will become commoditized products over time or will be integrated into a broader ecosystem such as the one Peloton is trying to build. Some of these companies include strength-oriented equipment; as I previously said strength is going to be a tricky category given the difficulty of recreating a CrossFit-like experience at home and will probably be won as a part of a bigger ecosystem.

Every single company oriented towards this vertical is focused on the "measured shelf" and is a "single-player" company. Tonal (recently raised $250M at a $1.6B valuation) has the most promising tech (as the rest are probably 0s). Mirror is a similar concept to Vault or Tempo(without the weights) and was acquired by Lululemon for $500M in 2020 in a desperate move to enter the category.

Besides Tonal which could work amongst fitness enthusiast as an alternative to a home gym (mainly targeting people who were already working out as I think digital weights will eventually replace at-home gyms) I struggle to see how any of these devices could work as the use cases are quite limited and the subscription fee barely adds any value ( neither of these devices features an active and deeply engaged community and the classes feel like a personalized coaching training session).

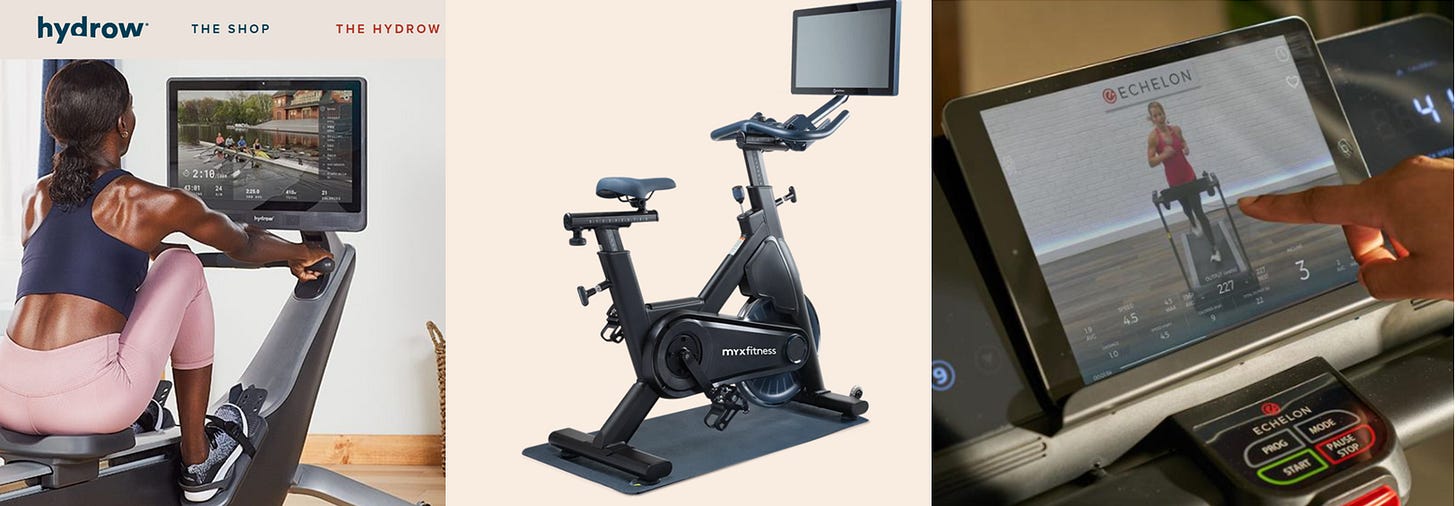

There are a handful of imitators that have tried to replicate Peloton´s success; Hydrow or the beautifully designed Ergata for rowing, Myx fitness that will go public via SPAC with the gimmicky Beachbody, or Echelon who has blatantly copied every single product in the market (from a rowing machine to the Mirror) and seems to believe that a connected Treadmill is a Tread with a tablet on top (image below). Companies such as Icon Health & Fitness (owner of Nordictrack and Ifit coaching service) have positioned their service as an online coaching offering (single-player offering) with a plethora of brands and devices which showcase a lack of attention to detail and user experience. Boutique fitness studios such as Flywheel (filed for bankruptcy in 2020) tried to replicate Peloton´s offerings but failed to do so.

As Peloton likes to say there is no like-minded competition in the market. None of these companies has a decent, community-oriented platform and they offer one or a handful of disciplines. While Peloton is trying to build a fitness ecosystem with several hardware platforms and a deeply engaged community, these companies are mostly oriented towards hardware that will become a mere commodity as traditional fitness equipment and cheaper users will probably buy a lower-cost hardware device while using Peloton´s digital app.

We have to understand that sticking to a fitness routine is not an easy feat for the majority of people and none of these companies seem to address this, while Peloton is obsessed with member engagement these companies think that having a screen is more than enough.

There are a handful of devices that I would consider buying such as Tonal or Ergata and while these devices address the fact that most people feel discouraged at a gym because they do not what to do, I think are mainly targeted towards the minority of people who previously enjoyed going to the gym (given they are mainly focused on tracking and convenience rather than motivation or community) and had no problem with sticking to a fitness routine as the majority of people will still find these exercises boring, tedious and repetitive.

Eventually, Peloton will provide a better experience, (even for these pragmatic individuals) due to an ecosystem of integrations formed by better hardware( a profitable subscription revenue stream allows them to heavily invest in R&D and lower prices over time) and a better user experience provided by its fitness subscription (with best of breed content and superior curation the value of their digital offerings will keep increasing).

Software offerings

Amongst the software offerings, Zwift is by far the most promising. Zwift was founded in 2014 by Eric Min and was initially built as an entertainment option for indoor cycling trainers. The company is currently valued at $1B dollars after a $450M round led by KKR.

Zwift is similar to a videogame that "immerses cyclists and runners in 3D-generated worlds". The company only sells an app that costs $15 per month and "in order to use the app Zwift’s biking adherents need to buy their own smart trainers, which can cost anywhere from $300 to $700 and are made by brands like Elite and Wahoo. Meanwhile, runners use Zwift’s app with their own treadmills". Zwift is now planning to make its own hardware in order to provide a better experience to its users

Akin to a videogame Zwift´s users race each other in 3D animated worlds and the offering is well suited for e-sports competitions ( top users can participate in e-championships and have the opportunity to get a pro contract )." Zwift takes the input from your bike either via a power meter, a smart trainer, or just a speed/cadence sensor using ANT+ or Bluetooth and uses an algorithm to translate your input data into your avatar’s speed on the virtual course" and you can use it on a computer, TV, smartphone or tablet. Users can customize the appearance of their avatars in an internal shop and the company celebrates various events that remind me of the online version of "The Tour de France".

In a recent podcast, Eric Min stated that the company was investing in hardware in order to reduce the amount of friction that customers face when considering to try out Zwift´s offering "You have to have your own bike. You have to have the trainer, and you have to get a device and then there's Bluetooth". While Zwift tries to emulate the outdoor riding experience, Peloton tries to replicate a fitness boutique class that has a much broader appeal.

Zwift is a great offering for outdoor and professional cyclists and has a deeply engaged (even much smaller) community. The company claims they want to target a broader audience but most people want to work out across a few disciplines (Peloton non-cycling workouts are rapidly increasing) and the music drivel, the instructor-led approach seems to appeal to a much broader audience as people need to be motivated in order to workout. While price and space limitations will put a cap on Peloton´s ecosystem ambitions, a leasing option and new hardware addons will improve the experience. Meanwhile, Zwift has not even released its own hardware.