Roku: Trojan Horse

"I think the addressable market is every TV household, we're #1, and our lead is growing"

Anthony Wood

Share price: 430USD($ROKU)

Market Capitalization: $57B

1. Elevator pitch

With the vision to become the streaming platform that connects the entire TV ecosystem Roku is one of the leading TV operating systems in the world and is poised to benefit from a multidecade shift towards streaming TV while trying to become a global TV aggregator.

2. Industry

The global TV industry is huge, with around 1,4B TV households ex-China and 750M+ pay-tv subscriptions. "Linear/ Live TV is the traditional mean of watching TV, in which a viewer watches a TV program on the channel it’s presented on at its scheduled time" while OTT television does not require users to subscribe to a traditional cable or satellite pay-tv service (like Comcast or Time Warner Cable) and delivers content over the Internet.

OTT video consumption represents a superior value proposition and users will eventually make the transition due to cost, convenience, and selection reasons (US Pay-TV households stood at 74 million in 2021 down from the 2014 peak of 100M). Consumers have begun to change their TV viewing behavior, and someday all TV content will be available through streaming.

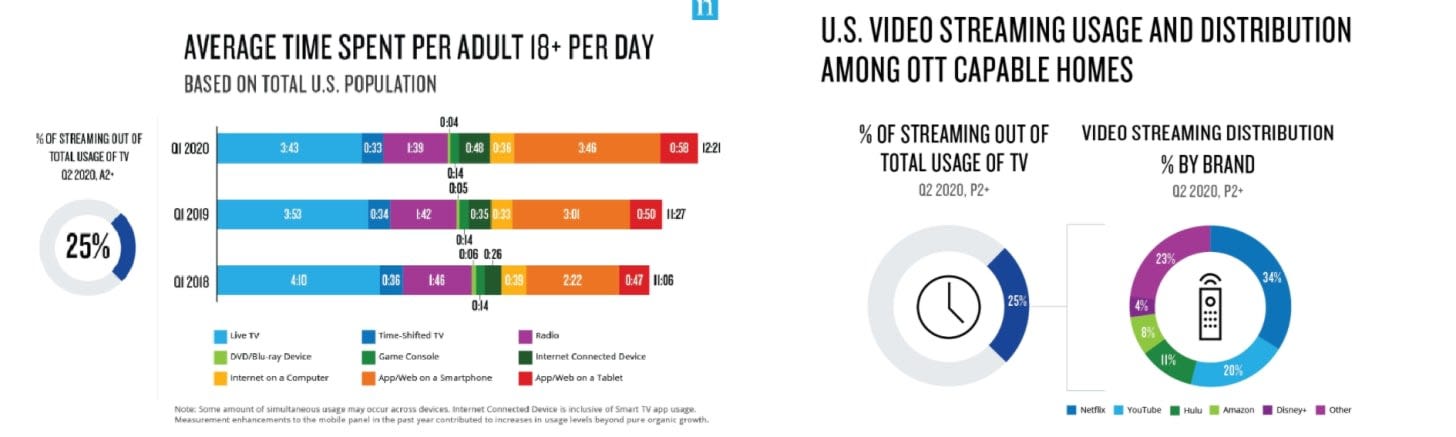

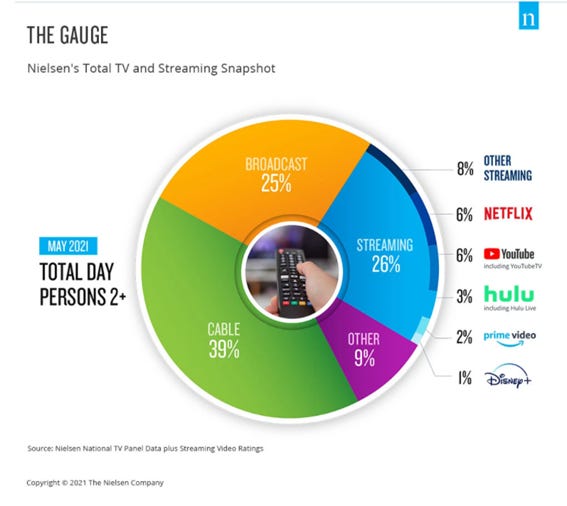

There are about 120M TV households in the USA, and while most households own a connected TV ( a TV that can be connected to the internet and access OTT content), linear TV still represented 75% of total TV time while streaming accounts for a mere 26% ( in May 2021 up from 19% in 2019), this trend towards OTT video consumption represents a multidecade tailwind for companies like Roku.

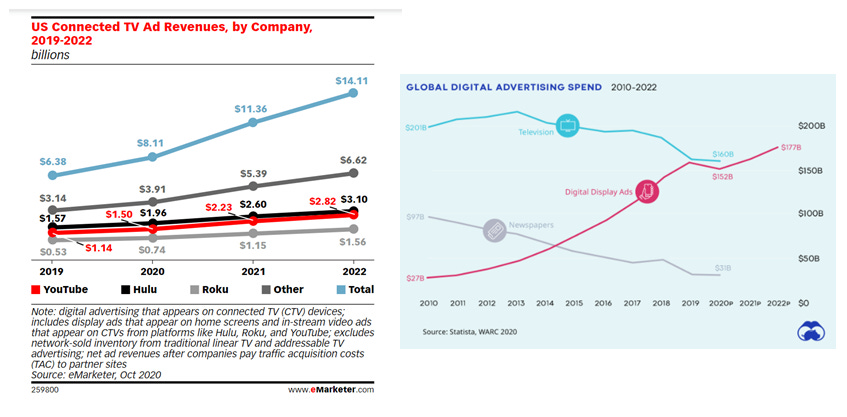

Moreover, the US TV advertising budget represents $70B which is equivalent to 580 USD per household; the majority of this budget is still spent on linear TV but it will eventually shift towards streaming as "money follows eyeballs".

The OTT long-form video consumption landscape has evolved over the years:

OTT 1.0

OTT 1.0 was bolstered by SVOD streaming companies such as Netflix. During the first wave of OTT video consumption, users watched video content on their laptops or PCs and most people bought their first smart TVs to access a limited catalog of streaming content across few providers. Streaming companies such as Netflix began building their own streaming devices (Project Griffin made by Roku).

OTT 2.0

The proliferation of OTT video content gave birth to TV sticks and set-top boxes that allowed consumers to transform regular televisions into smart TVs. The smart TV, also known as connected TV (CTV) is a traditional TV set with integrated internet that became the dominant form of television by the late 2010s.

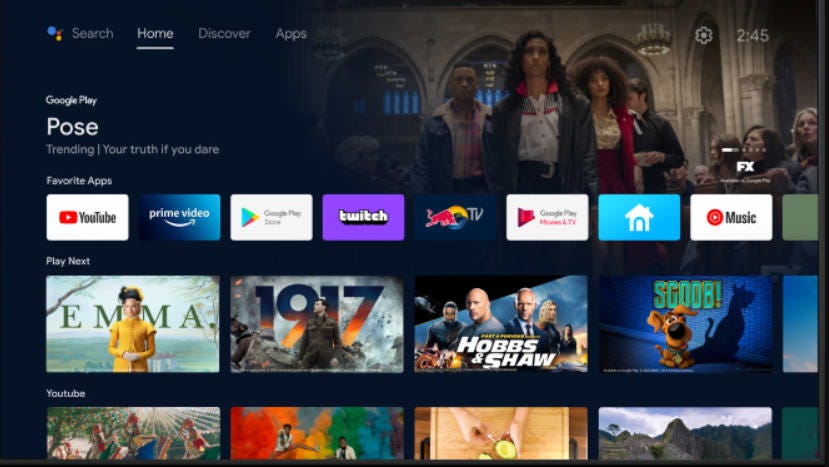

OTT 3.0

OTT 3.0 will be marked by a content-first UI (user interface) that will propel streaming usage time and will strike a killing blow to linear TV. The content-first UI aggregates hundreds of channels and premium content on the home screen, offering a more convenient and overall better user experience. Consumers do not want to switch between apps to watch their favorite content and akin to e-commerce aggregators, content-first Uis will become the default option over time.

A content-first UI is a huge endeavor that will require great curation and discovery capabilities and will aggregate the long tail of TV content available, based on user preferences (unlike current content-first Uis such as Fire TV that barely displays any content that is neither promoted nor belongs to the Prime Video offering).

The winners of this transition will be "destination apps" such as Netflix and YouTube and platforms focused on a best-of-breed user experience that manage to aggregate the long tail of AVOD content.

3. Business

Roku was founded in October 2002 by Anthony Wood ( still leading the company) who after pitching the product to Reed Hastings become VP of Internet TV at Netflix. In 2008 Roku (called Project Griffin) was spun off from Netflix because "if Netflix released its own hardware, it would be seen as a competitor to the very companies with which it hoped to partner.

"As CNBC states "Wood received an unfinished device, patents, 20 to 30 Netflix employees (more than doubling the size of Roku) and some cash and in return, Netflix received about 15% of Roku’s equity". A few years later Netflix sold its stake in Roku but it wasn´t until 2018 when Roku moved to its new headquarters in San Jose (Roku was previously subleasing office space from Netflix in Los Gatos).

Roku was approached by both Intel and Amazon but it finally IPOed in September 2017, and the stock has been a wonderful investment as the share price has increased by more than 17 times (the company began trading at $24 and now trades at more than $430).

Roku believes that all television will be streamed and that every TV will one day run a streaming OS (operating system). The company wants to become as ubiquitous as Android is in mobile phones and Roku´s mission is to become "the streaming platform that connects the entire TV ecosystem of viewers, content publishers, and advertisers".

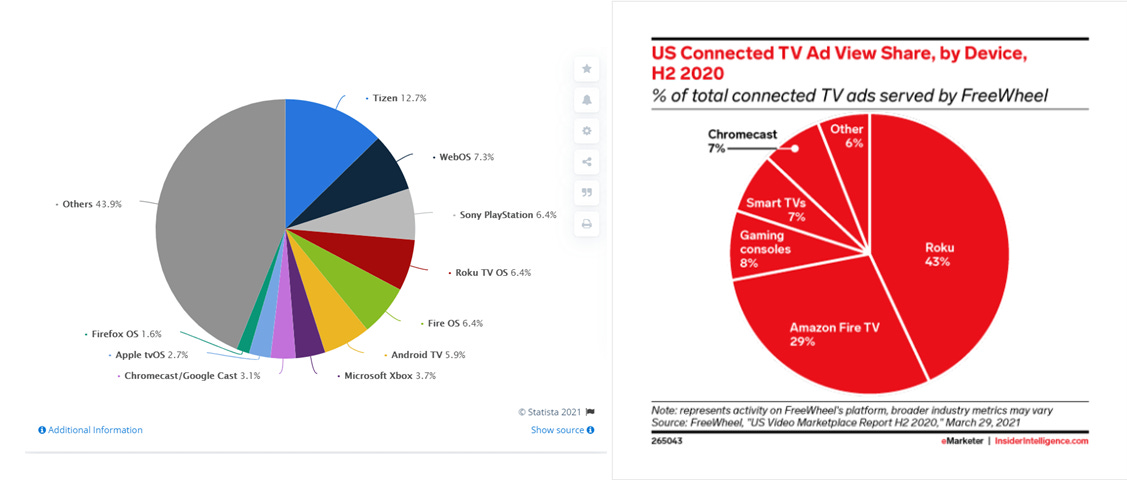

Central to the platform is the Roku operating system which is the number 1 OS in the US and powers nearly 40% of smart TVs sold.

The company is present in over 20 countries and distributes its players in the US, Canada, UK, France, Ireland, Mexico, Brazil, and several other Latin American countries, however, the bulk of its users come from the USA as Roku is the No.1 TV streaming platform in the US and the bestselling connected TV operating system in Canada. While Roku has been selling media players for many years, the company began licensing its OS in 2014 when they released their first Smart TV.

Roku has two revenue sources: platform (software) and player (hardware):

Player revenue is generated from the sale of streaming payers that connect your TV to the internet allowing you to stream content. Roku sells a plethora of streaming players at razor-thin margins (Roku´s cheapest streaming stick sells for $29. ) in order to increase scale and makes money from user interactions on its platform which has great margins and defensive competitive advantages (unlike a streaming player that is a commoditized piece of hardware). Streaming players and Roku´s licensed TVs are sold through brick-and-mortar retailers or online webs.

Platform revenue is generated from the sale of digital advertising and related services on the Roku operating system as well as license revenues. In order to reach scale, Roku licenses its OS to TV OEMs (original equipment manufacturer) such as Hisense or TCL.

"Roku gets a share of that revenue when you sign up on Roku. And if the channel has ads in it, then Roku generally gets access to some of that ad inventory. If you’re familiar with the cable ad model, the cable system distributes national networks. They get two minutes on the hour to sell. It’s the same idea. We get inventory from our channels. Then we aggregate all that ad inventory and sell it to our advertisers"

Ad revenue (2/3 of platform revenue): Roku monetizes content with video ads which are sold as 15 or 30-second spots within channels on the Roku platform where the company has video inventory access (third party inventory "one of the ways to secure video ad insertion rights from content publishers is via distribution deals") and on the Roku channel (first-party inventory). Advertising revenue represents the bulk of the platform´s revenue as full screen not skippable video ads are amongst the most sought ad formats.

The minority of ad revenue is what Roku calls, "audience development", this revenue is comprised of high margin display ads on the home screen or the screensaver, ad banners or branded buttons on its TV controllers, reserved for content publishers such as Netflix or recently Apple, that seek to "reduce friction and drive incremental usage by allowing users to launch straight into the channel"

Distribution revenue (1/3 of platform revenue): when any given publisher ( HBO example) wants to distribute its content on Roku, it has to sign a distribution agreement. Video publishers want to reach as many consumers as possible and Roku gets a piece of the economics ( if it's a subscription based publisher, Roku will get a percentage of SVOD or subscription video-on-demand revenue) and if it is a advertising funded publisher, Roku will get access to a share of the ad inventory.

The company also obtains revenues from licensing its OS to OEMs and Roku´s TVs are present in the US, Canada, Mexico, Brazil, and the UK.

In its quest to power TV, Roku interacts with different parties:

OEMs

Roku licenses its OS to OEMs such as Hisense, Hitachi, Philips, or TCL. The company has several partners that benefit from an OS purpose-built for TV and designed to run in low-cost hardware.

Instead of using a recycled Android operating system, Roku built its OS from scratch and OEMs can therefore use less powerful chips and a smaller memory footprint that allows them to build a cheaper TV which is very important in a low margin hardware business, moreover Roku has an intuitive user interface that causes lower return rates and works hand in hand with their partners to ensure proper software integration (Android barely helps OEMs with software updates and certification work)

Besides licensing agreements Roku also manufactures streaming players to enable consumers to use their Roku OS, however licensing arrangements with Roku TV brand partners accounted for 62% of new accounts in 2020 up from 56% in 2019, and will account for the majority of new users going forward.

The company has recently launched Roku TVs in Brazil and UK; in 2019, Roku passed Samsung as the #1 Smart TV operating system in the U.S, and in 2020 Roku was the number 1 OS in the USA (38% unit share), Canada(31% share), and the No.2 for smart TVs sold in Mexico where it has increased the number of Roku TV brands (from 2 to 9)

In 2021 Roku announced an international expansion of its deal with TCL (Europe and South America) and on June 17th, 2021, the company announced the launch of a new TCL TV in the UK (TCL increased its market share to the #2 spot for U.S. smart TV sales in 2017, up from #19 in 2014 while using Roku OS).

By leveraging the global distribution and manufacturing capabilities of its North American partners, (these companies such as TCL are eager to work with Roku abroad as the company allows them to increase their market share) Roku may achieve an international footprint, given that it went from no market share in the USA to over 38% of unit market share of smart TVs sold. However, Roku´s international expansion efforts have been slow, and most of the company´s users are still from North America.

Some OEMs such as Samsung or LG are still using their own operating systems. Samsung has kept using its own proprietary operating system and has lost significant market share in the USA as a consequence( 5 years ago Samsung had over 33% market share and now is below 25%, LG has also lost a significant market share). "According to Omdia, the market share by sales volume of TCL is around 11% in 2020, ranking No. 3 in the world with more than 23 million units sold"

However, these partnerships are not exclusive and some OEMs work with many OS (they have a lot of stock keeping units) and "TCL has announced that it will roll out a TCL Google TV™ series in 2021 starting in the United States and later in other parts of the world".

Publishers

Roku enables content publishers to build audiences and monetize their content on its platform. Publishers can distribute their content to a large and relevant audience on a platform that possesses better discoverability and monetization capabilities. Moreover, Roku is a neutral third party that does not seek to profit from having its own content.

As traditional linear audiences shrink, OTT video platforms will become more important over time. Content publishers can promote their offerings on the platform and they can either publish an app or syndicate that content, directly into The Roku Channel which will become increasingly popular as it offers better discovery and user experience. Small and independent publishers won´t need to invest in a D2C( direct to consumer) offering

Roku´s first-party payment data will be determinant for AVOD models as targeted advertising is much more effective and any given consumer will only subscribe to a few providers (subscale AVOD offerings would lack first-party data).

Roku´s position as a connected TV gatekeeper has allowed the company to achieve partnerships with several publishers including HBO (a deal was announced at the end of 2020, and even no financial terms are usually revealed I think this deal took longer than usual because Warner Media just released an ad-supported version of HBO Max, and Roku likely achieved a share of the inventory).

As the WSJ states "a primary sticking point in Roku’s negotiations with WarnerMedia and others has been programming for The Roku Channel, which sits alongside competing TV apps in Roku’s service. WarnerMedia didn't want to share any content for The Roku Channel, said a person familiar with the matter".

While big publishers are reluctant to share their best programming with Roku, the platform is a trojan horse that will keep aggregating AVOD content until premium publishers that have not managed to become destination apps (HBO) decide to license some titles on TRC to increase awareness and achieve higher visibility.

In May 2021 Roku had a dispute with YouTube as the so-called "unchecked monopoly" tried to negotiate better terms for its YouTube TV app. Google is supposedly trying to use carriage negotiations to change how Roku´s products are built and demanding consumer data.

"Google is apparently pushing the AV1 codec during negotiations forcing Roku to increase the price of its hardware products, which competes directly with Google Chromecast, however content providers and consumers would have lower bandwidth requirements". The dispute ended as Google added a YouTube TV function within the YouTube app as a workaround.

These types of issues were very common a few years ago between distributors and content networks and are a risk to Roku´s long-term prospects as a few providers (Netflix and YouTube) hold huge power positions.

While this discussion was unusual as it was not oriented around economic terms, Roku has already had several "carriage disputes" ("carriage disputes first occurred between broadcasters and cable companies). In 2020 it had a dispute with Peacock (NBC Universal) and HBO Max was not available on Roku until December.

According to CNBC "Roku has become more aggressive with its carriage agreement demands, including asking for more advertising inventory, higher app store fees, and better content for The Roku Channel. That’s led to delays in reaching agreements with both HBO Max and Peacock"

Advertisers

"We serve every ad dynamically, it's targeted one-to-one. It has interactive capabilities and then it has the measurements. And the trick is because we're the platform owner and we have account information, we know who's watching. And because we know who's watching, that allows us with the help of some partners to actually follow that person either off the platform, if it's, says, visiting like an advertisers' website, if it's doing purchase data, we can actually get credit card purchase data. And so we're not guessing at that, we actually can provide -- we've run say 80 tests for, let's say, a soda company, where we can show the actual list between the control group and the exposed group for the ads and follow that based on actual purchase information. And so it's super powerful."

Steve Louden, Roku CFO

CTV advertising is much more effective than linear TV ads; by collecting first-party user information such as registration data, Roku can effectively target consumers with relevant advertising. This valuable first-party data is supported with third-party data to track consumers off-platform creating a "closed-loop attribution to measure campaign performance across the Roku platform".Advertisers can properly measure the ROI of its ads and Roku employs technology such as content recognition in order to avoid duplicated advertising.

Roku claims that its ad load is half that linear TV at 8 min per hour and despite this, CTV CPMS (cost per thousand impressions) trade at a hefty premium due to better targeting and attribution capabilities. "Money follows eyeballs" and CTV platforms will benefit from the ongoing shift towards OTT video consumption as long as they are able to monetize the inventory (most of the inventory is currently owned by SVOD companies or YouTube).

According to e-marketer the CTV industry will reach $18B in 2024:

Users

“I do think the trend is we are going to see more aggregation towards these destination apps, and Netflix obviously is the original destination apps. But I think that is what TRC is as well, consumers want better value and free AVOD is very popular but there was not a great experience. Over time we will be another destination app”

Anthony Wood

CTV users can access their favorite content more conveniently as Roku offers its users a better TV experience with a polished UI that has aggregation tools, unified billing, and thousands of free titles on The Roku Channel which will eventually become the main appeal of the platform.

Connected TV provides an overall superior consumer experience as advertising is now targeted and Roku´s ad load is around 8 minutes per hour (half of linear TV ad load). AVOD content is growing faster than other segments and 70% of Roku´s customers watch AVOD on the platform.

"For example, I use The Roku Channel. Last week, I went in and watched an episode of Chernobyl on HBO. And then I saw that Die Hard was there, so I ended up watching Die Hard as well. So it's very complementary. People come in for 1 reason, and maybe end up watching something else"

Anthony Wood

The Roku Channel (TRC)

"The Roku Channel is our sort of sandbox for building a next-generation, content-first user interface. And someday, when we think it’s ready and good enough and has enough content in it, it’ll probably become the home screen.”

Anthony Wood

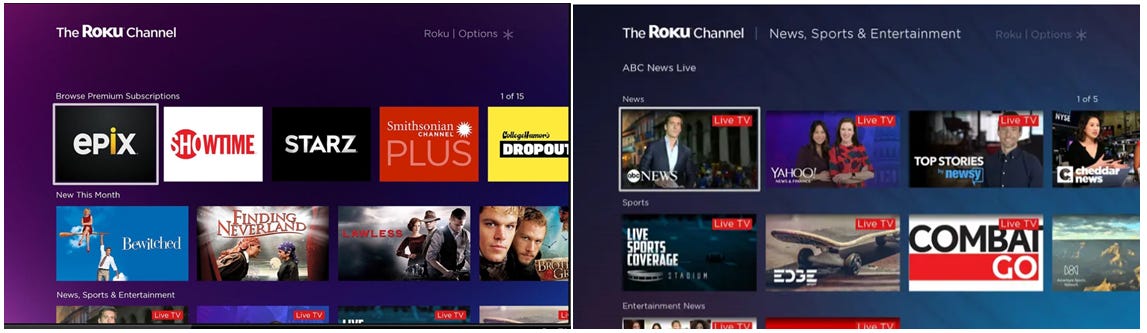

In September 2017, Roku launched The Roku Channel "an ad-supported streaming channel on the Roku platform that gives users free access to AVOD content, premium subscriptions, personalized content selection, one-click subscriptions, and unified billing( a single monthly bill for your premium subscriptions)”.

TRC has a mobile app for both Android and iPhone and in October 2020 it launched on Amazon Fire TV (it hasn´t gotten meaningful traction as awareness outside of Roku´s platform is limited). The channel allows Roku to increase the amount of monetizable inventory on the platform as the company is in control of the inventory that is shown on TRC and it gets a 50% take rate on the advertising revenues generated.

When TRC launched, it was a top 20 channel on the platform by hours streamed "and the channel already offers access to more than 50,000 titles. As I previously explained consumers still access content from dedicated apps such as HBO app Disney or CNBC; but this entails serious friction points and I believe the future of video consumption will be marked by aggregators such as The Roku Channel(TRC).

Content on TRC has dramatically increased over the years and in 2020 TRC was a top 5 channel on the platform (in 2017 was a top 20 channel) while streamed hours more than doubled.

In Q1 2021 TRC reached US households with approximately 70 million people. Based on US Census Bureau there is an average of 2,6 people per US household which equates to 27M active accounts reached (70/2,6) implying a 50% penetration (up from a 35% penetration in Q1 2020). While awareness of TRC is still limited and its library is filled with back-end content, it has been rapidly growing and ongoing content investments will increase penetration in the future as more users watch monetizable inventory on the aggregator.

“I used to interview [Netflix Co-CEO] Ted Sarandos at conferences 10 years ago, and he’d say, ‘Oh, we’re happy with just one or two original shows.’ Meanwhile, they’d be laddering up into better content. I’d argue companies giving Roku content are digging their own grave.”

Michael Nathanson , media analyst

I think while Micahel´s quote is directionally right, akin to Nike in e-commerce some content providers will manage to establish dedicated audiences, but the majority of publishers will struggle with discovery and monetization by employing an app-centric approach (Roku has thousands of apps and the average user only installs a handful of these).

Moreover building a D2C service requires investing in a great user interface while managing churn and engagement. It is obvious to me that the long tail of content will choose to publish its offering on TRC instead of creating its own service. While disaggregating publisher´s user interfaces into TRC can create tension as publishers want to build dedicated audiences, the consumer is always right and many providers will get better economics and viewership by working with Roku.

TRC aggregates a plethora of content (thousands of titles) across many categories such as news, kids, or movies and it is monetized with advertising while users watch the content. Roku licenses some content to its channel(Matrix Trilogy) and in 2021 the company acquired Quibi´s content and "This Old House"(America´s number one Home Improvement program).

Many shareholders and media commentators have criticized Roku´s content acquisitions and I think the “originals” content strategy is vastly misunderstood. Roku´s menu still displays a channel-first UI but I think Roku will follow Google or Amazon (the tech behemoths released their content-first UI in late 2020) and TRC will eventually become the default home screen instead of another channel. Both Google and Amazon were “late to the party” while Roku launched TRC in 2017 and has been aggregating AVOD content ever since.

As Scott Rosemberg (SVP Platform Business) states, increased scale allows Roku to reinvest its profits into new content for TRC.

"As our scale grows, we can buy more expensive content, which usually means better, more brand name actors or more recent and that on a cost per streamed hour basis, it can end up being cheaper if we pick the right content because it gets you by more people, because maybe it's just more appealing or maybe it hasn't been seen before"

While every single operating system offers some free content in addition to linear channels and premium content, Roku has been working to increase its depth and content variety for a few years while its competitors mainly display SVOD premium content from a handful of providers (Disney or Netflix).

Only a few streaming services will get away without contributing content to TRC and while this aggregator is not widely known amongst international consumers, Roku´s end goal is to become the "YouTube of TV". By aggregating long-form video content, Roku is creating a global business powered by strong network effects that will transform the connected TV OS industry into a "winner takes all" (the platform with the biggest number of users will be able to offer lower ad loads to the consumers while making a better ROI for the content publishers).

A couple of months ago I wrote the following paragraph in my Netflix thesis :

"Curation is one of the most important features of the service otherwise, titles would "get lost" on the platform and wouldn´t be properly targeted towards the specific clusters that may find them appealing. Customer experience is maximized when any given user finds the most relevant content given their tastes and preferences, therefore a deep content library becomes as important as a great recommendation engine and UI, and competitors investments risk being unprofitable without adequate targeting capabilities; this is why some competitors are going after splashy big-budget titles with marquee names attached, allowing Netflix to obtain a higher ROI on their local productions".

Nowadays consumers seek to have access to a few streaming apps and the TV operating system, user interfaces or aggregation tools are not among the main reasons for consumers to buy a new TV (Vizio or Samsung have achieved meaningful scale while having dubious value propositions).

Roku´s competitive advantage currently lies in having a better user experience, with a simple and easy to use interface and cheap hardware/software offerings. However, these are weak "moats" and Roku´s future will be powered by global network effects powered by its Roku channel.

Only a handful of providers will manage to become destination apps( aggregators inside the TV platform) such as Netflix in premium content or YouTube in user-generated content and OS awareness amongst consumers will radically increase as the aggregator will become a frictionless way of finding curated and engaging content.

Even though network effects are theoretically global, most of AVOD-content tends to be local,(talk shows, news) but Roku can invest in titles that appeal to a global audience (Quibi´s content) in order to build bridges to international customers. It remains to be seen if publishers find in TRC a profitable channel to release original content (the majority of scripted content found on the channel is recycled old content that was previously monetized through the box office or premium subscriptions).

While I initially thought that subscale streaming service companies were poised to fail, and while I still think that will be the case as standalone offerings, these services will be valuable when integrated into aggregators such as TRC or as a part of a bigger bundle. For example, Roku recently disclosed that "more active accounts streamed a Roku Original in the first two weeks on the Roku Channel than the number of Quibi accounts did on Quibi over the brief nine months of the app’s lifetime."

"Content publishers on the platform are getting much more traffic because we can monetize it at a higher rate, they're probably getting even with the rev share roughly the same or slightly better revenue than they could off any hour. And if they give up their app completely, we've also eliminated app development cost, maintenance, marketing to try to drive traffic. So we are great value proposition over time"

Steve Louden

In order to kickstart the channel´s network effects (the more users the channel has, the more views any given title gets increasing TRC´s appeal for content publishers and increasing the inventory which leads to higher engagement )Roku, recently released its first original series (Cypher premiered exclusively on TRC and was the No.1 show in its first weakened) and will keep licensing and investing into original content such as Quibi and This Old House (content acquisitions).

The company recently signed its first-ever pay-one window rights deal with Saban Films and has greenlighted a second season of Kevin Hart’s ‘Die Hart’ series. Next TV disclosed that Roku is looking to hire new employees to oversee its original content expansion.

Roku has also launched Roku Recommends ”a new fifteen-minute weekly entertainment program that uses exclusive Roku data to highlight best bets and hidden gems across the Roku platform" that will improve discovery and awareness and I think Roku is in a great position to bundle subscale content (in the future Roku could release subscriptions for users that do not want to watch ads in TRC resembling YouTube Premium).

TRC take rate is high (50%), on par with platforms such as YouTube that aggregate user-generated content, and while management claims that TRC is a great value proposition for publishers given they no longer need to invest in D2C capabilities, take rates could decrease if costly productions are directly published on the platform.

New Roku´s content investments are launched on TRC, branded as Roku Originals; the strategy is already paying off as "In the two weeks following the launch of Roku Originals, May 20 to June 3, a record number of unique accounts streamed The Roku Channel. Furthermore, the top ten most-watched programs on The Roku Channel were all Roku Originals in this two-week period and more than one in three users of The Roku Channel streamed a Roku Originals series - with users streaming over nine episodes on average".

While I think this is a great strategy in order to enhance the awareness of the platform, it is important to bear in mind that Roku does not want to enter the content business and they are only investing in originals to increase the appeal of the aggregator. TRC´s long-term prospects require that publishers upload new content to the platform

Acquisitions

Dataxu DSP: on November 8, 2019, the Company acquired Dataxu for $150M, a demand-side platform (“DSP”) that enables marketers to plan and buy video ad campaigns in an automated manner. Dataxu rebranded Oneview provides a platform that enables advertisers to buy ad inventory by integrating Roku´s valuable first-party data and "anonymized behavioral information" with third-party data such as Kroger´s In 2021 the company acquired Nielsen’s Advanced Video Advertising business in order to improve its advertising platform.

AVOD is a tricky business if you do not have first-party data (which Roku has) because, in order to maximize traffic, AVOD companies do not require a sign-in with credit card information making their monetization capabilities much weaker.

As the management team claims

"the right to win as a DSP really comes down, especially in this world of cookie challenges, device ID challenges to first-party customer relationship, a platform at scale, advanced targeting and measurement, unique ad products. These are all the things that we think make OneView strongly appealing to our clients".

Quibi/ This old House: In 2021 Roku acquired most of Quibi´s content library for around $100M to bolster the attractiveness of TRC and hired Former Quibi exec Brian Tannenbaum to Oversee Unscripted strategy (Quibi was a failed mobile-focused streaming service that launched in April 2020).

In March 2021, Roku acquired the top-rated home improvement program in America which is available on TRC. It seems obvious to me that Roku is getting ready to implement a content-first UI.

Management and culture

Akin to Netflix, Roku does not pay its employees performance bonuses, and as Anthony claims "working at Roku is like being part of a professional sports team:

"We pay well and at “market” rates for top talent, and review compensation quarterly to proactively ensure employees stay paid at market. Pay is not tied to performance reviews; it is tied to “market” for a particular individual. Other than a few sales-oriented jobs, Roku does not use bonuses tied to “MBOs” (objectives). We have objectives and goals, but they often change in our dynamic market. And the type of employees that work at Roku wants to do a great job, regardless of a bonus"

Moreover, management compensation is heavily oriented towards stock options which I think is great for long-term shareholders.

Anthony Wood (55, founder and CEO): Roku means six in Japanese as is the sixth company that Anthony has ever started.

Mr. Wood is an entrepreneur who began programming computers when he was 13 years old and sold his first software program while studying in college. Anthony started in business when he was a child by finding lost golf balls and selling it to the golfers making 25 cents per ball.

Before starting Roku Anthony graduated as an electrical engineer and found a few companies. In 2002 he founded Roku with its own money; this Trojan Horse has now become the de facto CTV OS in the US. Anthony is a visionary that will propel Roku´s growth over the next years.

Throughout the years Mr. Wood has sold a portion of his shares and an in April 2021 he held 19M Class B shares/options (Roku has a dual-class share structure and Class B common stock has 10 votes per share while Class A has one vote per share) which amount to 62% of the voting power. Anthony is heavily incentivized to create long-term value as the majority of his wealth is tied to Roku´s future.

As detailed in the proxy statements" Mr. Wood elected to forego $400,000 and $500,000 of this fixed salary amount during 2020 and 2019, respectively, in exchange for monthly grants of vested stock options at an intended valuation equal to the amount of such foregone salary".

Steve Louden (48, CFO): Steve has served as Roku´s CFO since 2015. Before joining Roku he was employed by Expedia, McKinsey, and Disney. In December 2019 the company was looking for a new CFO as Steve wanted to relocate to Seattle with his family; after working remotely for a few months during the COVID pandemic Steve decided that he will work remotely from Seattle and the company ended the search for his successor.

Steve has tremendous knowledge of the media industry and he has done a great job at Roku where the management team has executed flawlessly over the last years.

Colin Davis (who was previously working at Quibi) is now leading the scripted content division at Roku along with his colleague, Brian Tannenbaum who is at the front of alternative content; I will be paying close attention to the new content hires as they will be fundamental to propel TRC awareness.

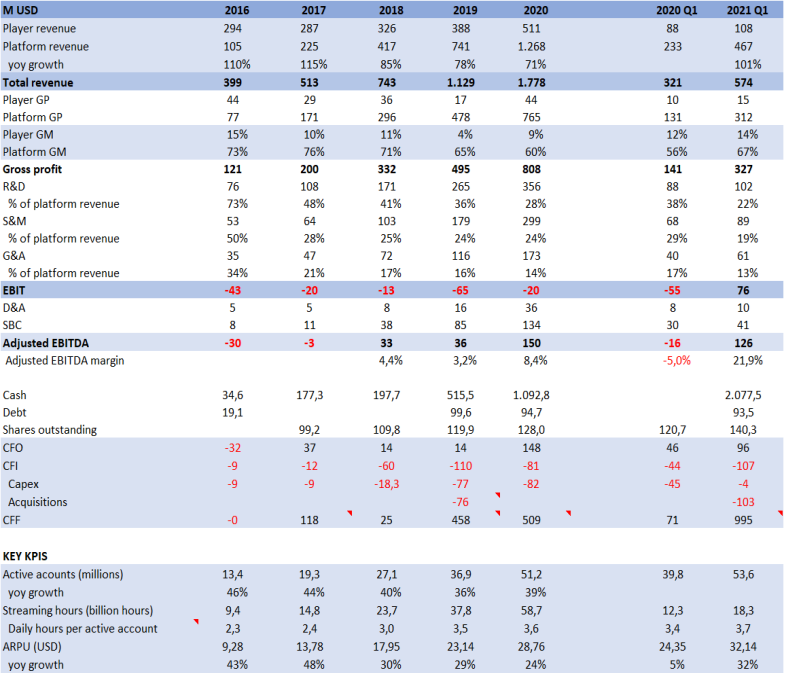

Quantitative metrics

Roku player is run at breakeven in order to increase platform revenues, the company has rapidly grown its user base and active accounts ( a proxy for households that are measured as "the number of distinct user accounts that have streamed content on the platform within the last 30 days of the period") reached 54M in 2021.

The rapid increase in active accounts along with an increasing number of hours streamed per account has propelled Roku´s ARPU ("measured as platform revenue during the preceding four quarters divided by the average of the number of active accounts at the end of that period" ) and in 2020 platform revenue surpassed $1B in revenue while representing the lion's share of the company's gross profit.

Advertising revenue is recognized on a gross basis and represents the bulk of platform revenue. TRC take rate hovers around 50% and platform gross margins have been trending down and will settle around the high 50s as ad revenue now represents a bigger portion of the mix.

After its IPO in late 2017 and a few share issues( In march 2021 the company raised $1B at $379 per share), the company is debt-free with a cash position over $2B. The company has outstanding unit economics as it outsources the hardware manufacturing and barely requires any additional capital to increase its platform revenues. However further original content investments will likely consume more capital going forward as the company will selectively invest into new content to increase TRC awareness.

Management has stated that the company will be run at an EBITDA breakeven as Roku further invests in new content, international expansion, better platform capabilities, and sales teams to build platform awareness among publishers and advertisers.

In order to capitalize on the gigantic OTT video consumption opportunity, Roku´s growth strategy has three main pillars:

Grow active accounts

The majority of Roku´s users are from the USA and while at 120M TV households the US still represents a growth opportunity the bulk of new TV households will come from abroad. While international expansion represents a large opportunity to grow active accounts, Roku´s efforts have traditionally been slow and its competitors are rapidly growing outside of America.

While launching Roku OS internationally seems like an easy task, management claims that they have to fine-tune their software to adhere to regional tuner standards and country-specific requirements, however, Roku will leverage the international footprint of its NA OEM partners and will eventually release Roku´s license TVs all over the world (UK TCL TVs).

Roku´s international expansion has lagged Google´s efforts as I think management h was previously focused on winning the valuable NA market( the US is the biggest TV advertising market and agglutinates close to $70B out of a global $160B TV ad budget and is, therefore, the most valuable market in the world ) and they have now redirected their attention to the international landscape.

Grow monetizable hours

Roku defines hours streamed as "the aggregate amount of time users streamed content on our platform in a given period" and while Roku´s users are dedicated streaming users and watch near 4 daily hours per account, the company does not monetize the majority of this watching time (Roku benefits from media fragmentation and if consumer´s watching time is concentrated between a few destination apps, the platform would not be able to monetize watching time) growing monetizable streaming hours will therefore be a priority (to do this Roku will need to increase TRC´s appeal ). In the meantime, Roku´s connected TV usage will keep gaining share over linear TV until daily hours per active account reach 6 hours (management estimates).

Grow ARPU

Instead of increasing the ad load, Roku plans to increase monetization of AVOD content by "expanding its advertising capabilities both on and off the Roku platform and it will continue to increase sales teams in order to raise the platform´s awareness for advertisers".

The COVID pandemic accelerated the shift towards streaming resulting in the fast growth of active accounts and streaming hours over 2020 and while ARPU growth was more muted during the first half of the year Roku managed to increase their platform ARPU by 24% in 2020.

4. Risks

Competition

"We are much more focused, all we do is we come to work every day and we think about how to make TV better, those companies yes they are great companies but they come to work thinking how can I sell more shoes how can I sell more phones , how can I do better search , TV is on their list but is at their bottom of their list"

Anthony Wood

While Roku works with more than 15 brands, the TV industry is huge and in 2020 over 220M TVs(40M in the USA and around 160M smart TVs globally) were shipped to consumers. Smart TVs now account for over 70% of the number of TVs sold which highlights the importance of licensing agreements as consumers are currently unlikely to switch providers if their current operating system is good enough.

A great portion of these TVs is sold by Samsung and LG who have their own OS ( Tizen and WebOS). Tom Forchetta VP of Ad Sales and Operations at Samsung Ads disclosed that "five years ago, over 90% of viewing done on Samsung TVs was linear and just 10% was OTT. In the midst of the recent pandemic, Samsung viewers started watching more OTT than linear, with 63% of viewing time now in streaming ".

The CTV ecosystem is in its early innings and OEMs with no technological background and inferior OS have achieved meaningful traction in the market as consumer’s awareness of CTV OS is limited. This can lead to revenue share agreements as OEMs will not forego this profitable revenue stream.

Vizio ($VZIO) is a great example of the state of the industry, the company was founded in 2002 by William Wang and is known for selling low-cost HDTVs.

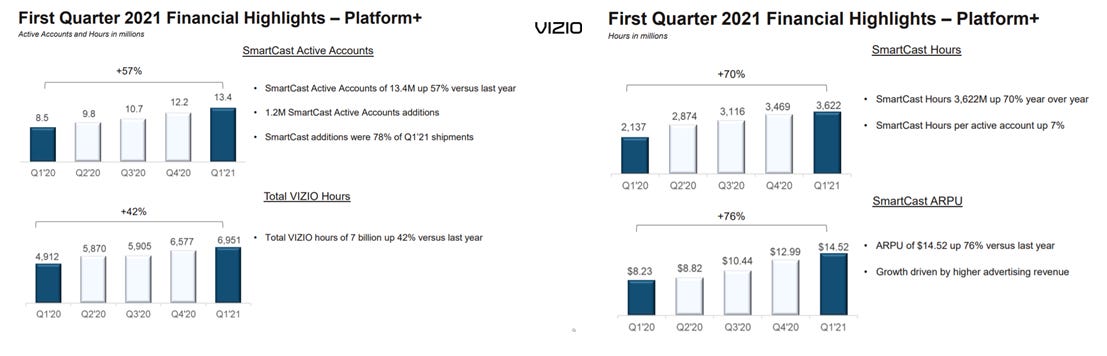

In 2006 the company´s revenue was around $700M, in 2016 the company launched SmartCasts OS, and in 2018 Vizio released Watch Free powered by Pluto TV that offers free AVOD content. Fast forward to 2021, Vizio has recently IPOed and the company has more than 13M active accounts and is currently generating a $15 ARPU (roughly half of Roku´s ARPU) which translates to a +$200M platform revenue run rate while holding a $4B market capitalization.

A pig with lipstick is still a pig and Vizio relies on "third parties for the research and development behind the technologies underlying its devices". OEMs such as Vizio without a software background will not be a meaningful threat but Vizio´s scale underlines that consumers are currently looking for a "good enough" OS that allows them to watch their favorite destination apps while recurring to linear when they want to watch the news or AVOD programming. Aggregators such as TRC have powerful network effects but limited awareness and that is why Roku is running its business at an EBITDA breakeven by reinvesting its platform revenue into media content that has fixed costs and allows Roku to leverage its scale advantages.

Google and Amazon will remain the biggest competitors in the CTV OS landscape:

Focus is a superpower, and while Google TV was first to market Roku has been able to capture meaningful market share due to a purpose-built OS and great partnerships. While this could theoretically be replicated the difference will widen over time as TRC becomes a "destination app".

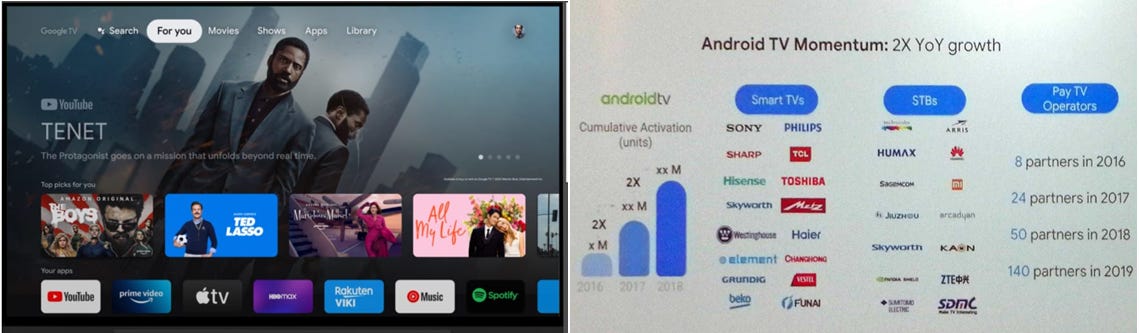

Google is working with many OEMs worldwide that use Android TV ( some OEMs such as Hisense or TCL work with different OS across many SKUs). In late 2020 the company transitioned towards a content-first UI and the new Android TV OS now powers more than 80M monthly active devices with over 80% growth in the US ( announced during the Google I/O event)

However, Google´s figures cannot be compared with Roku´s active accounts number because any given user with multiple Android TV devices could have those devices counted separately. Third parties estimate that Android TV has over 50M accounts.

"In this golden age of entertainment, there is so much good content to choose from that it can actually become difficult to decide what to watch next. If you think about what Google does, our mission is to organize the world’s information and make it easily accessible, we should be able to do that for media.”

Shalini Govilpai, VP&GM of TV platforms at Google

Google offers more than 8,000 apps (vs Roku´s 25,000), integrations with your phone (cast connect features ), and best in class voice search.

Google is the most problematic competitor as it has previous experience aggregating an advertising video on demand long tail of content(YouTube) and both search features and a great recommendation engine are at the core of its business. Moreover, Google could remove YouTube from Roku´s OS or work on best-of-breed integrations that would only work on their Google TV software.

While Google could theoretically win in CTV, Roku has a purpose-built OS and its sole focus is winning CTV. Google will probably not develop a new OS from scratch in order to be cost-competitive and its focus on featuring Youtube on its operating system could lead to Roku´s success according to “The Innovators Dilemma” concept as Google is incentivized to preserve and increase their existing revenue streams (Youtube ad revenue) and they are not focused on aggregating the long tail of TV content.

Amazon

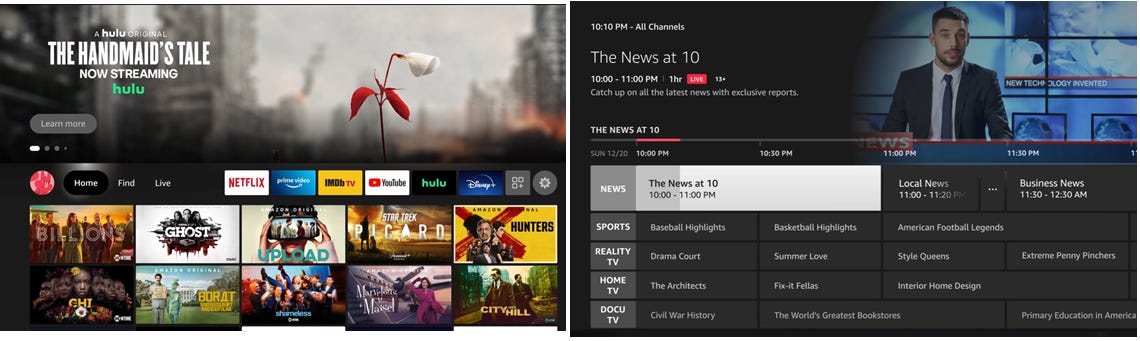

In late 2020 Amazon disclosed that Fire TV had reached over 50M monthly active accounts which represent a 25% increase since January 2020 ( Roku had just over 51M active accounts at the end of 2020). This number is particularly impressive given that Amazon has struggled to license its Fire TV OS and the bulk of its active accounts come from the sale of Fire TV sticks which highlights its distribution power. (Amazon heavily promotes its Fire TV sticks on Amazon.com).

The company has recently rolled out a new software update ( content-first UI) which includes user profiles, improved content discovery, and Alexa voice navigation.

Competition should not be overlooked; unlike smartphone OS TV operating systems are not widely known amongst consumers who usually choose the cheapest device ( Firestick) or an operating system that allows them to watch their favorite SVOD content ( Fire TV did not have HBO untill November 2020, which was a major drawback for consumers). A "good enough" OS should do the trick until aggregators’ awareness increases.

However, Fire TV is not interested in aggregating the long tail of AVOD content and Amazon heavily promotes its own content (Prime Video) as it is interested in getting users to subscribe and watch their Prime video titles that reinforce their e-commerce business; Roku is a neutral third party that will provide a better discovery experience.

While Google and Amazon have achieved meaningful scale Roku has higher streaming hours per user than any other platform:

"We have more serious streamers. I think we have more cord-cutters. Basically, if you're an Apple fan, you're probably going to get an Apple TV, but that doesn't mean you're going use it. But if you want to cut the cord, and get great content for a lower cost, you look at reviews. We get the best reviews, and you buy a Roku. I think active streamers self-select into Roku. Also, our user interface being very simple results in more streaming as well"

Anthony Wood

As I previously said AVOD is more oriented towards local content and if one of their competitors manages to aggregate relevant local programming(such as news and talk shows) while offering access to SVOD inventory, consumers will probably stick with their default OS.

Media concentration

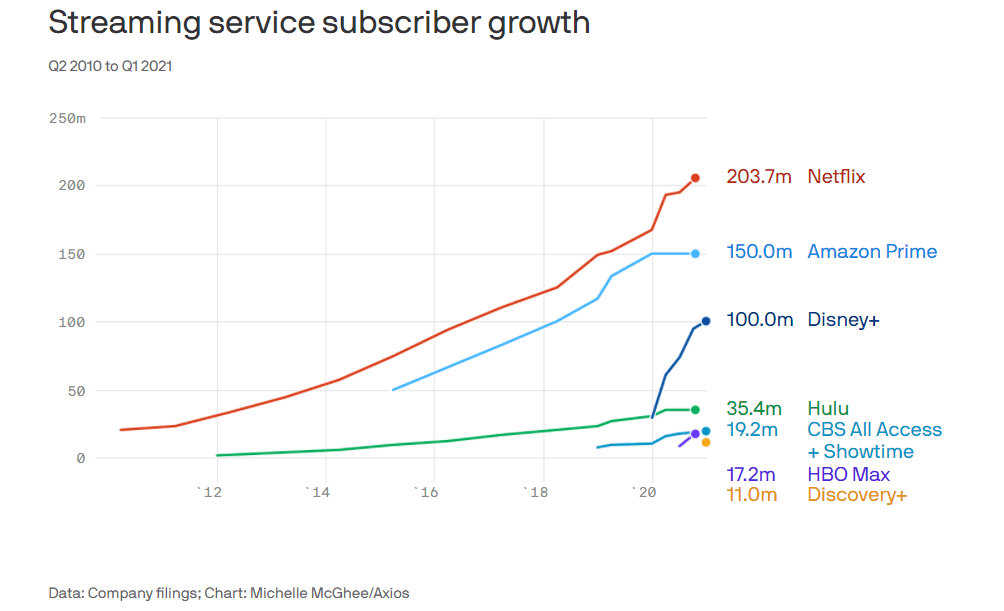

Unlike user-generated content, long-form video content has tremendous barriers of entry, and producing scripted media is quite expensive (story rights, screenplay, directors, cast, production costs, etc.) requires a lot of time (1 to 3 years on average), and the collaboration of hundreds of people. This has given birth to media behemoths such as Netflix, Disney, Amazon, or Warner/discovery(the deal was announced in May 2021 and it is expected to close mid-2022)

According to CNBC “Zaslav said he has a goal for his new company to reach up to 400 million streaming subscribers across the world, up from the 100 million subscribers the two separate companies have today”.

Moreover, tech companies are using media content as a loss leader which further propels the ongoing industry consolidation (Amazon recently bought MGM to bolster its Prime Video content offerings).

Historically, a small number of content publishers have accounted for the majority of the hours streamed on the Roku platform. In 2008 Netflix accounted for 100% of streaming hours, In 2016 content streamed from the top five streaming channels accounted for approximately 70% of the total hours streamed while Netflix alone represented one-third of hours streamed.

Publisher concentration is still a big issue and in the quarter ended March 2021, the top three streaming services represented over 50% of all hours streamed in the period. While Netflix is still the number 1 app on the platform, it now represents less than 30% of the hours streamed (down from 50% of hours streamed a couple of years ago).

Netflix and YouTube are the biggest channels on Roku but the company does not get a meaningful revenue contribution from any of these companies(as these providers have tremendous leverage).

Media consolidation is not great for Roku as the platform will struggle to monetize the increasing amount of hours streamed. While management often mentions the $70B TV US ad revenue opportunity, the reality is that Roku´s long term revenues will depend on the amount of time that the company is able to monetize, and if TV watching time is concentrated amongst a few companies Roku will not be able to capitalize on this tremendous shift.

Roku may struggle to secure original content on its channel and its success over the long run will be determined by the appeal of its channel content. Local networks around the world are feeding the streamers with original content but the increased scale may propel Roku´s content supply, as publishers will seek to own their success instead of licensing their biggest shows.

Moreover, there is a long tail of non-scripted shows, talk shows, or news that usually have lower budgets and have a higher chance of being aggregated due to higher fragmentation and lower barriers of entry.

Nielsen recently published a new monthly total TV and streaming snapshot (picture above) that is particularly interesting:

First of all, we can conclude that streaming is slowly taking share from linear TV (26% watch time vs 19% in 2019), the top 3 streaming platforms by watch time are Netflix, YouTube, and Hulu that agglutinate 58% of streaming minutes and 15% of total TV time. However, while usage time is heavily concentrated amongst few companies, the audience is fragmenting as other streaming providers account for 8% of watching time, up from 5,3% in 2019 ( Nielsen data).

The "other" part of the pie includes several platforms such as HBO, subscale companies such as Peacock or the WWE($WWE), and a long tail of content its success is remarkably important for Roku´s long term growth prospects as Roku is not able to monetize time spent in destination apps such as Netflix or YouTube.

In order to better understand the industry, it is important to understand a concept that is closely tied to barriers of entry. According to Dan Hockenmaier,

"creative intensity is the rate at which products or services go stale and new ones must be created. It is the key factor in predicting the future of marketplaces"

While marketplaces such as Home Advisor or Instacart resemble big suppliers with lower creative intensity (lower quality businesses with less defensive competitive advantages), aggregators such as Steam or YouTube are on the higher end of the spectrum.

Media content is a creative endeavor that can produce uncertain outcomes, and that is why relatively unknown producers such as the Duffer brothers can create Stranger Things, or a five people studio created Valheim ( a videogame that has sold over 7M copies).

Dan hits the nail:

"Steam could theoretically get good enough at figuring out which indie developers to finance, almost as a VC would. However the video game industry has one of the highest levels of creativity intensity possible, as evidenced by the breadth and rate of turnover of games on Steam. While the market for high budget, blockbuster games may continue to consolidate, it’s unlikely that something similar happens in the indie games space. A marketplace is the most effective model".

While media has different industry dynamics than video games (barriers of entry are higher, requires more coordination amongst many people, and consumption patterns are wildly different (as consumers expect to watch millions of dollars worth of content per week) premium content will likely continue to be owned by big suppliers such as Netflix.

The companies benefit from tremendous scale benefits (can spread the cost of failure of these unpredictable productions amongst a huge subscriber base) while they are years ahead of the rest of the industry and have inked multiyear partnerships with creators such as Steven Spielberg; besides that, consumer´s experience could be disrupted if they are shown ads while watching more engaging content while it can be tolerated while watching YouTube or AVOD-prone content.

Moreover, premium content providers (SVOD) do not seek to maximize time watched on any given title, Netflix seeks to maximize engagement on the platform rather than time spent on a specific title (the value of any title is calculated by taking into account the title value for every single subscriber, the ability to drive new subscribers or retain previous cohorts etc.) while AVOD publishers are paid based on time watched and therefore seek to maximize cost per minute on every single title.

Great content such as The Witcher would not be feasible on an AVOD model. I recommend you to read my Netflix article to better understand the industry dynamics and why I think Netflix will remain a destination app.

"There are a lot of church apps on Roku. The Mormon church app is popular. International content, like Indian language programming, Korean language programming. Nichey content is very popular. Music is very popular, both Spotify, as well as music videos [and] Vevo. The anime channel Crunchyroll is very popular. Fitness. There's a long, long tail"

Anthony Wood

While every industry participant is mostly focused on scripted TV, there is a long tail of AVOD prone content that has lower barriers of entry (talk shows, news, unscripted TV, documentaries, lower budget productions such as Sitcoms, programs like Kitchen Nightmares, Pawn Stars or reality TV) and will likely be aggregated as consumers would want to filter through the world´s creativity (the average household now subscribes to 4 streaming services).

It seems plausible to believe, that emerging companies and independent studios would leverage Roku´s scale to publish new content on the platform, therefore owning their outcomes. While NA is the most profitable market in terms of advertising, Europe is much more fragmented and according to Bloomberg there are “more than 11,000 television channels, most of which still depend on the advertising-based economics of linear broadcasting”

The high degree of creative intensity has given birth to companies such as AMC focused on niche streaming services.

In this interview with The Hollywood Reporter, Josh Sapan(AMC CEO) “likened AMC’s approach to owning a series of specialty boutiques rather than the streaming equivalent of a department store”

Emerging companies such as Curiosity stream have achieved a great level of success by serving passionate niche audiences( Curiosity stream is a factual entertainment SVOD company that recently reached 16M subscribers up from 1M in 2018 ).

Kurzgesagt is among my favorite YouTube channels that “focuses on minimalistic animated educational content, using the flat design style and discusses scientific, technological, political, philosophical, and psychological subjects”. The company has over 40 employees that publish one monthly (10 to 15 min) video and while the channel is supported by Patreon contributors and their own merchandising, longer and more ellaborated content on a TV aggregator seems like the next obvious step.

While a supplier approach is great for consumers on scripted TV, (fostering bold productions and risk-taking instead of sticking to a format that “works” ) a platform that puts no limits on creativity (publishers around the world greenlight new content) will work well in AVOD as there is an infinite variety of niches around the world.

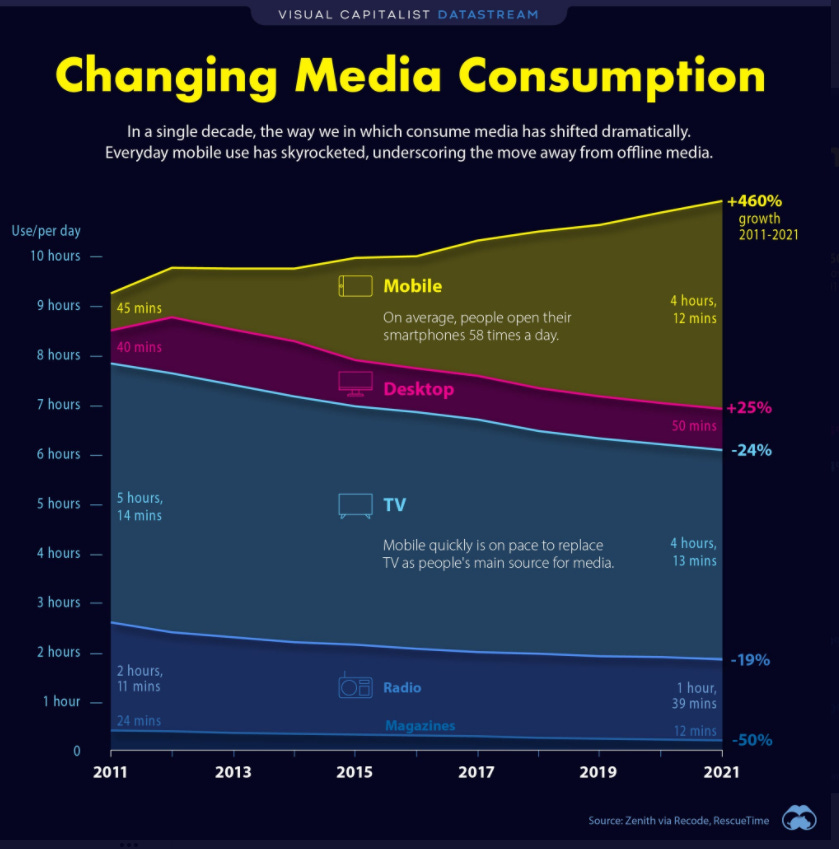

Media consumption

Over the last decade, mobile usage time has increased sharply as we witnessed the creation of global entertainment platforms such as Tik Tok that agglutinate a great portion of consumer´s attention. While I think TV content is still a great format for storytelling, social media, video platforms with user-generated content, videogames, and more immersive formats of storytelling such as VR (Virtual Reality) compete for the most valuable resource on earth, consumer´s attention.

It is only a matter of time before new computing platforms such as smartwatches or AR (augmented reality) get more traction and it remains to be seen if TV media consumption keeps decreasing over the next decade.

However, while mobile platforms have numerous use cases and support a fragmented ecosystem of applications, our interactions with TV are limited to video consumption and CTV OS (such as Roku) will be able to monetize consumer´s time to a greater extent than their mobile counterparts.

5. Valuation

“Sometimes being too conservative is just as harmful as being too optimistic. The goal should be having realistic forecasts, not conservative ones If I look back at some of the best investment opportunities I have missed, it strikes me that when I thought I was being conservative, I was in fact being inaccurate”

Roku has a great position in the U.S which is the biggest market in terms of ad revenue ( each US user is worth more than $500) and while the opportunity in the US is huge Roku will not be able to monetize most of the streaming time as media behemoths such as Netflix or YouTube will retain the majority of watching time. However, Roku is in a great position to participate in an enormous market that agglutinates more time spent than all major social media platforms combined.

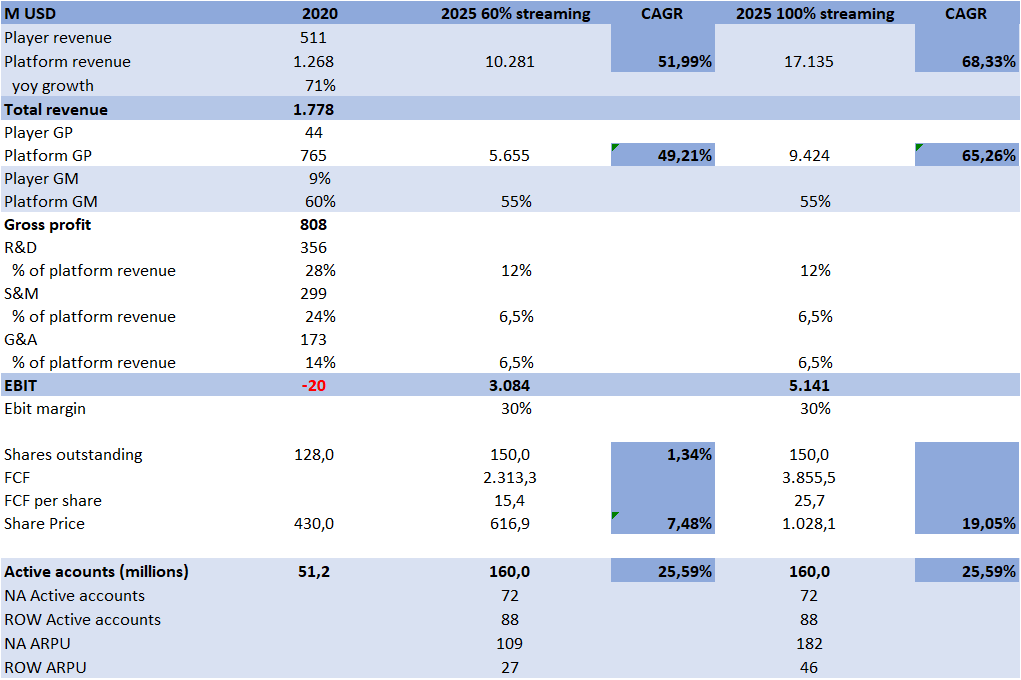

Roku´s hardware business will remain a loss leader for their platform ecosystem and I have estimated that will continue to be run at a breakeven. I have made the following assumptions for the next 5 years:

Global TV ad revenue is over $170B while the US stands at $70B. If Roku manages to compound its user number at a 25% rate over the next 5 years, it will reach 160M active accounts in 2025.

Let's say in 2025 streaming represents 60% of TV time and Roku gets to 72M accounts in the USA (60% of TV households); meanwhile, they invest in TRC AVOD content while aggregating more publishers and they are able to monetize 25% of total streaming time. 60% of the current $70B US TV budget will go towards streaming TV and Roku will achieve $6,3B in ad revenue ($70B*60% of streaming share* 60% of US households* 25% of monetizable inventory).

If advertising revenues represent 80% of platform revenues ( ad revenue currently represents 2/3 of revenues), USA could generate the bulk of platform revenues at a $100+ ARPUS. The rest of the accounts will achieve meaningfully lower ARPUS and I estimate it could hover around 25% of US ARPUS (FB usually discloses that NA ARPUS are around 3X Europe while the rest of the world has lower ARPUS).

Roku´s incremental gross margins have been trending down towards video advertising margins, in 2025 platform gross margins could hover around the mid-50s. The company will probably keep investing in its future (originals and OEM agreements) while presenting thin GAAP profit margins, however, I think the business could reach 30% to 35% EBIT margins at maturity state.

Scenario 1 (60% streaming penetration): under these assumptions, Roku will get to $10,3B platform revenues in 2025 (52% CAGR). At a 30% platform EBIT margin, Roku will achieve $3,1B in operating profits and given that the business won´t be anywhere close to maturity a 40X FCF multiple (2,5% FCF yield) is not unreasonable and get us to a $616 share price in 2025 or a paltry 7,5% CAGR over the period.

Scenario 2 (100% streaming penetration): if streaming time reaches 100% of TV time, Roku will generate $5,1B EBIT and $1028 share price in 2025 that equates to a healthy 19% CAGR. I think the shift towards streaming will take longer ( 10+ years ) and this scenario is highly unlikely.

Streaming penetration will likely trend towards the first scenario, Roku is is currently trading at a $55B EV (5X 2025 revenues) which leaves little margin for error. Moreover the company faces many risks that could harm these growth prospects.

An investment in Roku is betting on media fragmentation, while the industry has trended towards consolidation. However, media consolidation was a function of previous distribution alternatives and Roku stands a chance of becoming a global distribution platform for the long tail of content publishers around the world who will follow eyeballs. Premium scripted content will likely remain on SVOD platforms while AVOD would be aggregated.

Roku´s long-term revenue relies upon the percentage of inventory that the platform is able to monetize in the future( including future take rates which could certainly decrease in the future) and the number of households reached. While the company faces stiff competition on both fronts ( Google and media consolidation) Roku´s management team has proven everyone wrong and will likely keep executing over the next years.

Publisher adoption and relative scale vs competing operating systems and SVOD(subscription video on demand) services will go hand in hand and will dictate Roku´s success over the next decade. Roku´s growth prospects come with lots of risks and Google (both YouTube and Google TV) and Netflix will remain as the biggest competitors in the future, as becoming the global gatekeeper of 4+hours of video consumption is a sought position that entails a tremendous amount of optionality.

Wow. A great write up.

Nearly three years ago, ROKU had 20+ television Roku OS clients… today they have none.